The release of India’s Union Budget for 2024-25 has left a significant portion of the country’s population pondering its implications, particularly the cryptocurrency community, which finds itself at a standstill.

On July 23, the budget brought up by Finance Minister Nirmala Sitharaman left the digital currency industry unaddressed even after prior speculations and anticipation of potential regulatory clarifications or supportive measures.

This omission comes at a time when the global digital currency industry is seeing various levels of adoption and regulation, highlighting a stark contrast in India’s approach to handling these digital assets.

2022 Tax Status Quo Continues: Community Reactions

The budget outlined nine priorities for economic growth, such as agriculture and employment, but not virtual currencies. This absence is regarded as a failure to create an innovation-generating and investment-attracting legal framework in the rapidly developing field.

Apart from this, while there were important modifications proposed in the budget, like doing away with angel tax for startups and a tweak to the equalization levy, none of these changes were reflected in the case of digital currency assets, leaving the existing digital currency tax framework unchanged.

The absence of anything on the budget for digital currency has left the Indian digital currency community feeling shocked and worried. High-profile individuals such as developer Vijay Saran have recently taken to X to voice their concerns about the plan, which does not even mention digital currency.

Union Budget 2024 Update:

There is not even a single mention of Crypto in the #unionbudget2024

The Indian government did not mention anything related to cryptocurrencies in the union budget 2024-25

which means Tax on Crypto transactions and TDS is unchanged: 30% TAX and 1% TDS… pic.twitter.com/raBT1xWA6M— Vijay Saran (@imvijaysaran) July 23, 2024

According to Saran, the digital currency market left unaddressed in the budget suggests that the status quo from 2022 will continue, whereby crypto transactions are taxed at 30% with an additional 1% tax deducted at source (TDS).

Notably, these tax measures are among the strictest globally, significantly impacting the operational dynamics of digital currency exchanges and investors within the country.

Another budget session for India, and still NO mention of #Crypto. We need reduced crypto tax to encourage adoption of cryptocurrencies in India. #CryptoIndia

— Shubham Datta (@shubhamdat429) July 23, 2024

Impact of India’s Crypto Tax

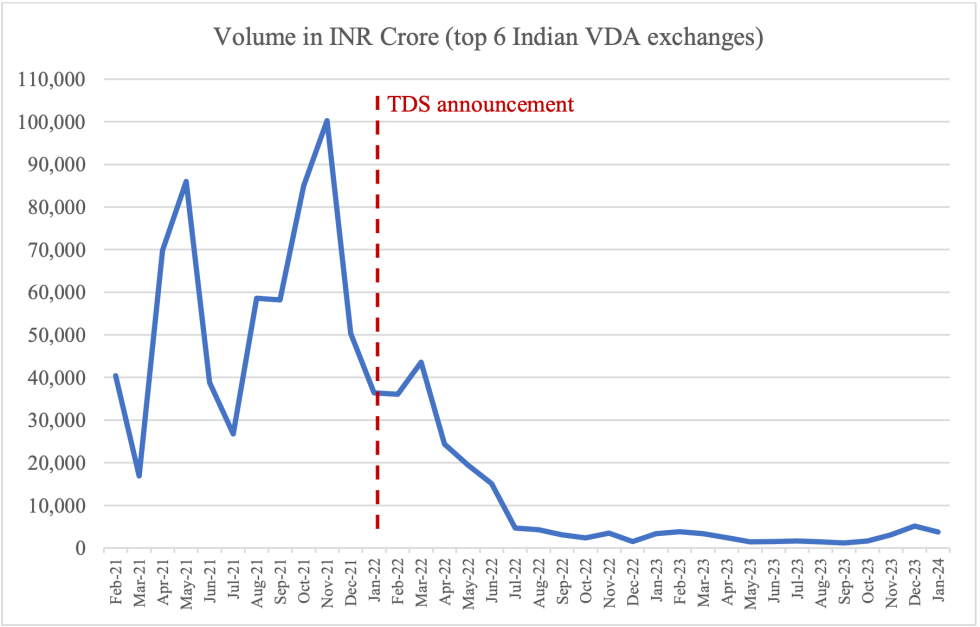

The stringent tax regime has already had a chilling effect on the digital currency market in India. According to the National Academy of Legal Studies and Research (NASLAR), since the implementation of these taxes, trading volumes on Indian exchanges have plummeted by 97%, and active user participation is down by 81%.

NASLAR found that these slumps damage the digital currency space and result in significant losses to the national treasury, estimated at 59 billion Indian rupees ($700 million) annually.

In contrast, a study published by NASLAR suggests that capping crypto TDS to 0.01% would see the government collect twice as much from the industry.

Featured image created with DALL-E, Chart from TradingView