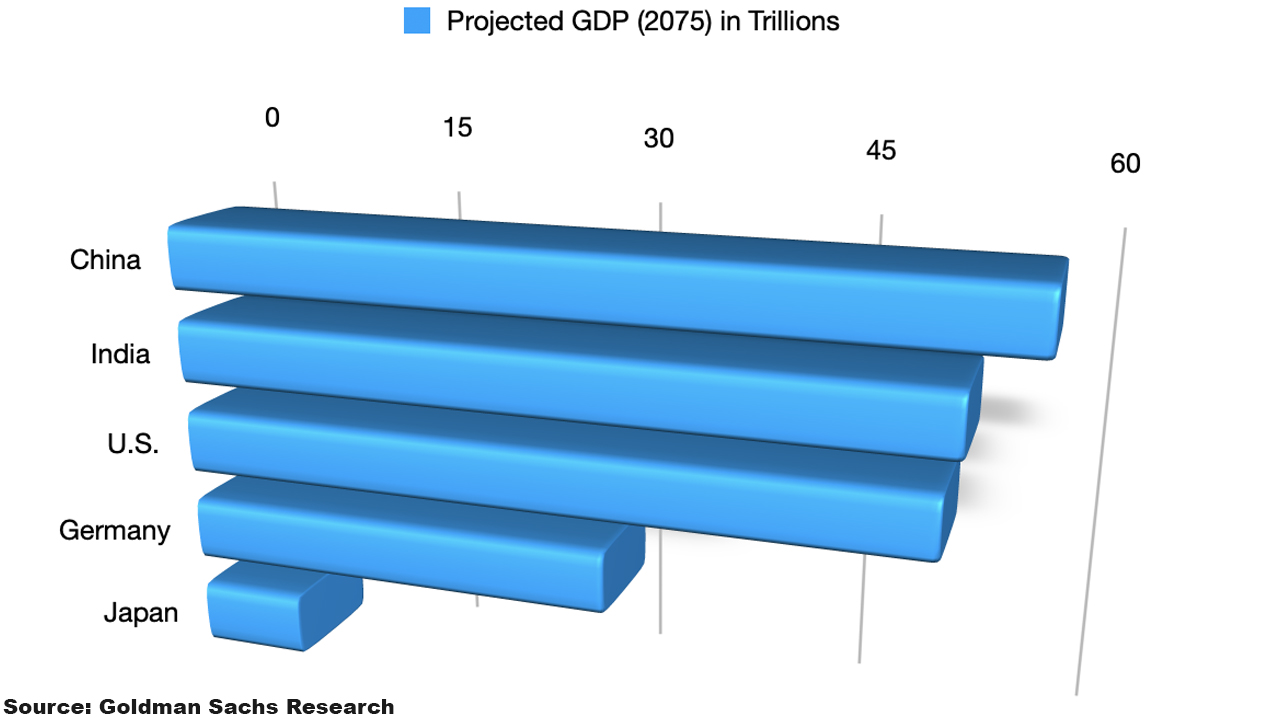

In a recent report, Goldman Sachs Research details that India is set to outpace Japan, Germany, and the U.S. to become the world’s second-largest economy by 2075. The financial institution’s researchers predict a dramatic expansion in India’s gross domestic product.

Economic Shift: Goldman Sachs Predicts India’s Ascent to World’s No. 2 Economy

In a report titled “How India Could Rise to the World’s Second-Biggest Economy,” Santanu Sengupta, an economist with Goldman Sachs Research, projects substantial expansion for India’s economy. The report forecasts a surge in India’s gross domestic product, making it the world’s second-largest economy by 2075.

This growth is largely credited to India’s advantageous demographic makeup, balancing its working-age population and those too young or old to work. The study indicates that the key for India is to boost labor force participation and offer ample training and skill development opportunities.

“Over the next two decades, the dependency ratio of India will be one of the lowest among regional economies,” Sengupta detailed. “India has made more progress in innovation and technology than some may realize,” the economist added.

The Goldman report asserts that India has seen significant growth in innovation, technology, and worker productivity. In economic terms, this suggests higher output for each labor and capital unit. The report also emphasizes that capital investment, driven by expected savings increases due to falling dependency ratios, rising incomes, and financial sector development, will be instrumental in fueling growth.

“Given healthy balance sheets of private corporates and banks in India, we believe that the conditions are conducive for a private sector capex cycle,” Sengupta notes.

The economist indicates that the primary challenge and risk to India’s economic growth forecast is productively engaging the labor force. Sengupta asserts that this involves creating job opportunities and enhancing job-related skills. The upside growth potential lies in digitizing the economy. The bank’s researcher cites Aadhaar, the world’s largest biometric ID system, which Sengupta claims has improved public service delivery and expanded access to credit.

Lastly, the report underscores India’s domestic demand-driven economy, the influence of global commodity prices, and the country’s energy needs as crucial factors in understanding its economic landscape. India currently holds the position of the world’s fifth-largest economy, and Goldman’s researchers posit that “India’s savings rate is likely to increase.”

Goldman’s examination of India follows commentary from British economist Lord Jim O’Neill, who conceived the acronym BRIC. O’Neill discussed de-dollarization and anticipates the Chinese yuan and the Indian rupee will become “much more important currencies for the world.”

What do you think about the Goldman Sachs Research report about India’s economy? Share your thoughts and opinions about this subject in the comments section below.