Injective Protocol, a DeFi-centric platform using Cosmos tech, is gaining traction, looking at the gas fee revenue distributed to its validators in Q3 2024.

While INJ, the native currency of the protocol, is under pressure, cooling off after rallying to as high as $52 early this year, the recent development is a huge confidence boost. Looking at trends may signal that more users are flowing to Injective, a net positive for INJ in the coming sessions.

Injective Generates More Revenue Than The BNB Chain, Avalanche

According to CryptoRank data, Injective Protocol generated $4 million in revenue derived from gas fees. Every transfer or smart contract deployment attracts a gas fee like every other public ledger like Bitcoin or Solana. This fee is distributed to the winning validator or miner as an incentive to operate a node.

With $4 million in revenue, Injective created more than the BNB Chain, one of the largest blockchains by market cap, and Avalanche, a network in the top 20, according to CoinMarketCap. These platforms generated $3.4 million and $2.1 million, respectively.

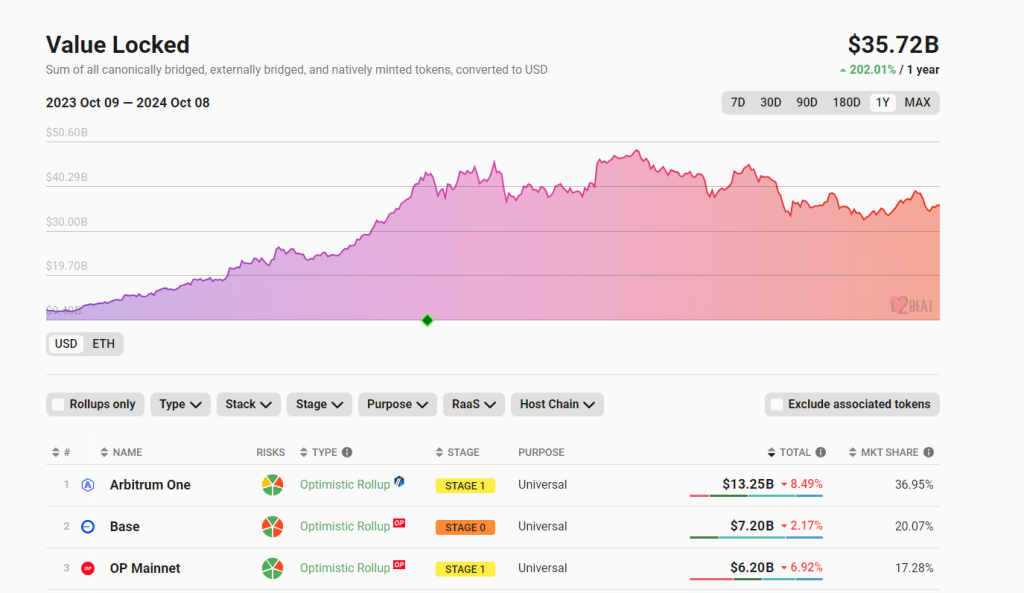

At this level, Injective also surpassed what some of the top Ethereum layer-2 solutions like Arbitrum, Optimism, and Blast generated over this period. For comparison, Arbitrum, despite being the largest and managing over $13.2 billion, according to L2Beat.

Ethereum, Tron, Solana, and Base churned more revenue than Injective. Ethereum funneled $159 million to its validators from July through September, while Tron and Solana cumulatively moved over $200 million.

The expansion of revenue, mostly from Tron, a scalable platform, is due to the meme coin activity on its network following the launch of SunPump in August. At the same time, Solana also benefited from meme coins and an uptick in decentralized exchange (DEX) volume over this period.

Will INJ Rise To $50?

It remains to be seen whether the recovery of DeFi activities while boosting Injective and its total value locked (TVL). As of October 8, the protocol manages over $40 million, looking at DeFiLlama data. At the same time, the platform has processed over 1 billion onchain transactions.

In early October, Injective announced the launch of Injective 3.0. This upgrade allows the protocol to change its tokenomics and make INJ deflationary. With this activation, a portion of INJ will be removed from circulation, making it more scarce.

Presently, INJ is inside a descending channel, finding support at $15. While buyers of Q1 2024 are still in the picture, the token is down 60% from March highs. A break above this descending channel could see the coin soar to 2024 highs of around $52.