Injective (INJ), the native token of the decentralized exchange protocol Injective Protocol, stands poised for a pivotal moment. On January 21st, a final tranche of 3.66 million INJ tokens will be unlocked, bringing the total circulating supply to a definitive 100 million.

Injective Token Unlock: Market Dynamics Shift

This marks the culmination of a phased release schedule outlined in Injective’s token distribution plan, and will see the remaining 16% of token supply flood the market.

Analysts remain divided on the potential impact of this event. Some anticipate increased selling pressure due to the sudden influx of tokens, potentially leading to a price dip. Others view the unlock as a positive catalyst for liquidity, making INJ easier to trade and potentially attracting new investors.

Final Cliff Unlocks Alert

Mark your calendars for January 21, 2024$INJ will be fully unlocked (100%)

Get ready for the massive cliff unlocks.

3.66 m tokens

132.4 m dollars

4.35% of cir. supply

Allocations:

– Advisors: $12.04 m

– Team: $120.37 m$INJ was… pic.twitter.com/EYCyv4hsuC— Token Unlocks (@Token_Unlocks) January 7, 2024

Regardless of the short-term price action, the full token unlock undeniably represents a turning point for Injective, marking the complete transition from initial distribution to sustained market dynamics.

It will be fascinating to observe how the community and market respond to this milestone event, and whether it paves the way for further growth and adoption of the Injective Protocol.

$INJ Bullish Flag Formation..!!

Seems lie Ready for Another Bullish Rally.#Crypto #InjectiveNetwork #INJ pic.twitter.com/OcPsNJ7laX

— Captain Faibik (@CryptoFaibik) January 6, 2024

Some market participants, such as analyst Captain Faibik, believe that Injective may be ready for another rally in anticipation of the impending event. According to Faibik, INJ has established a bullish flag and might see a rise beyond $60.

Faibik examines the chart and finds two rallies that are joined by a brief period of consolidation. These might potentially lead to a continuing upswing with higher highs and lowers.

However, given that the market crashed on January 3 and that INJ price originally dropped to $33.55, selling pressure could be imminent. The 4-hour chart shows rising volatility, and the Bollinger Bands point to overbought circumstances following INJ’s prior surge to $40.28.

INJ Price Analysis

The price of INJ has been trending downwards over the past 24 hours. It is currently trading at $37.412, down from a high of $37.875 earlier in the day.

- The Bollinger Bands (BB) are also trending downwards. This suggests that volatility is decreasing, as the price is staying closer to the moving average.

- The Chaikin Money Flow (CMF) is negative. This indicates that bears are currently in control of the market.

- The volume is relatively low. This suggests that the recent price decline is not due to a large amount of selling pressure.

Overall, the chart suggests that INJ is in a bearish trend. However, the low volume suggests that this trend may not be sustained. It is important to note that this is just a snapshot of the market and that conditions can change quickly.

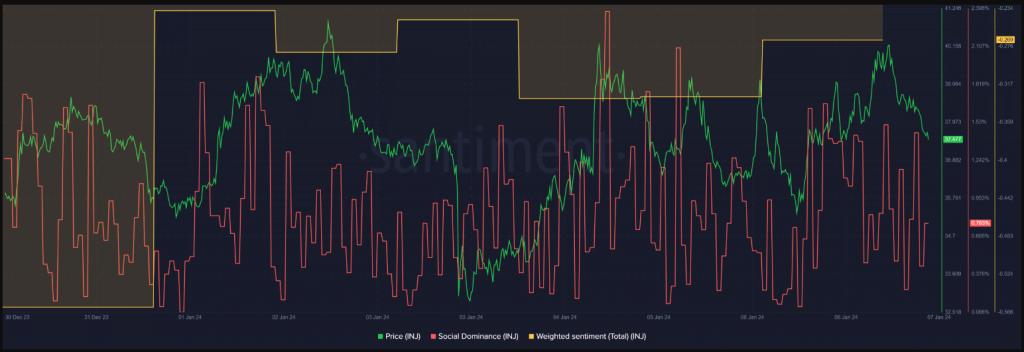

The ongoing unlocking of the token holds the promise of bolstering INJ’s social metrics, indirectly contributing to a positive influence on its price.

This is particularly crucial as increased community engagement often aligns with higher social metrics, reinforcing the token’s popularity. The sustained high Social Dominance of INJ signifies robust community support, a vital factor in navigating the unpredictable cryptocurrency market.

Simultaneously, the improvement in INJ’s Weighted Sentiment indicates a prevailing bullish sentiment within the market. This positive outlook among investors sets the stage for heightened trading activity, potentially triggering an uptrend in the token’s valuation.

Both Social Dominance and Weighted Sentiment serve as valuable indicators, providing insights into the token’s current state and the prevailing market sentiment.

Featured image from Shutterstock