Institutional investors have already shown how bullish they are on Bitcoin (BTC) and the broader cryptocurrency market, as they have continued to accumulate with USDT, especially during every dip. This bullish sentiment was again on display as this institutional investor sent $445 million USDT to exchanges to buy more crypto.

Cumberland Sends $445 Million USDT To Exchanges

The on-chain analytics platform Lookonchain revealed in an X (formerly Twitter) post that crypto trading firm Cumberland has deposited the $445 million it received from the Tether Treasury into different exchanges. Data from the on-chain analytics platform Arkham Intelligence shows that Cumberland used the USDT funds to buy more crypto, with Bitcoin accounting for most of the firm’s purchases in the last 24 hours.

During this period, Cumberland has withdrawn a significant amount of Bitcoin from various exchanges, including Coinbase, Robinhood, and OKX, among others. This development coincides with the flagship crypto’s recent break above $60,000, highlighting the increased buying pressure that Bitcoin has witnessed thanks to institutional investors like Cumberland.

The Spot Bitcoin ETF issuers have also bought a significant amount of Bitcoin in the last 24 hours, thanks to the net inflows recorded on August 8. Data from Farside Investors shows that these funds witnessed net inflows of $194.6 million that day. This was the second consecutive day of net inflows for these funds, having witnessed inflows of $45.1 million on August 7.

Some other investors, including retail investors, showed confidence in Bitcoin and the broader crypto market during this recent market crash. Lookonchain noted that Binance experienced a net inflow of $2.4 billion since the market drop on August 5. This includes a net inflow of $1.33 billion USDT and $519 million USDC, as these investors looked to buy more crypto and add to their positions.

What Next For Bitcoin?

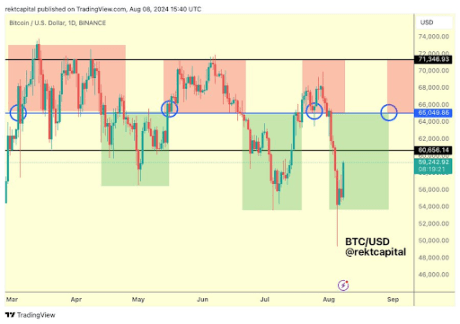

Bitcoin is back above $60,000 following its drop below $50,000 on August 5. Considering there are still concerns on the macro side, there are fears that this Bitcoin rebound might be a relief bounce rather than a bullish reversal. However, crypto analyst Mikybull Crypto is convinced that Bitcoin has found its bottom and is set to enjoy an uptrend from here on.

In a recent X post, he again alluded to the Volatility Index (VIX), which he noted gives all signs that the macro bottom is in. He remarked that the next markup phase will be “violent.” In the meantime, Bitcoin holding above $60,600 will be key to confirming this bullish reversal. Crypto analyst Rekt Capital stated that continued stability above this level would allow Bitcoin to revisit the $65,000 price level over time.

At the time of writing, Bitcoin is trading at around $60,900, up over 7% in the last 24 hours, according to data from CoinMarketCap.