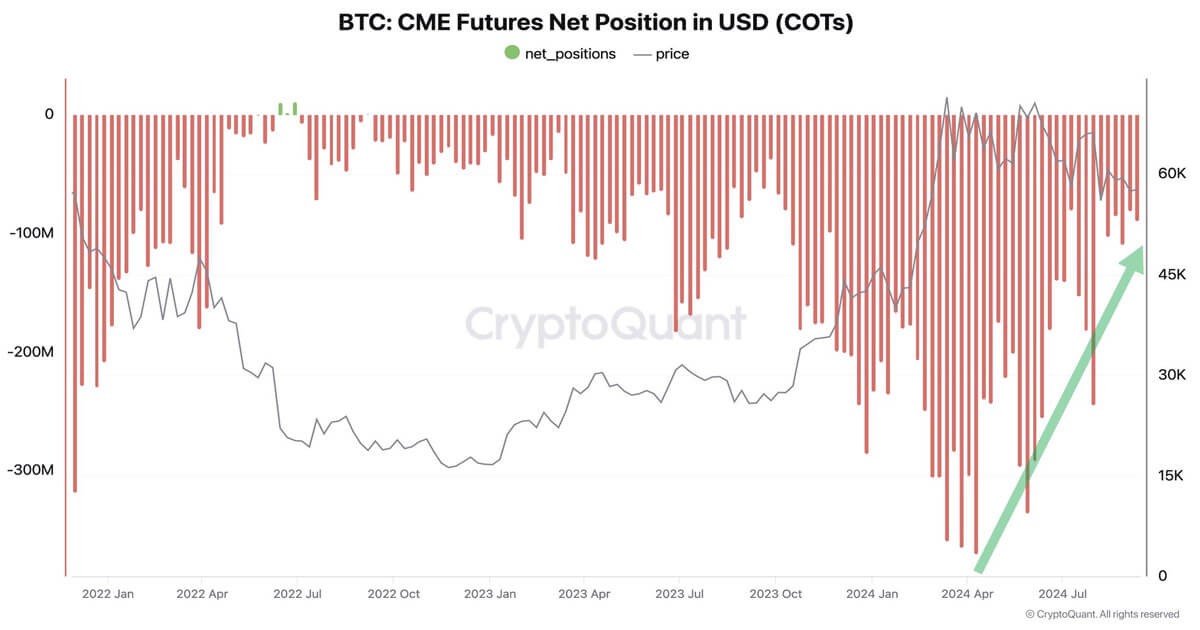

CME Bitcoin futures net short positions have declined significantly, dropping 75% over the past five months, as reported by CryptoQuant CEO Ki Young Ju.

This shift signals a notable change in institutional trading behavior, coinciding with a period of steady Bitcoin prices between $54,000 and $63,000. The data reflects a reduction in aggressive shorting by institutions from February to March, suggesting a shift in market sentiment from bearish to neutral or cautiously bullish.

Bitcoin’s price has remained stable during this period, showing limited downward pressure as institutions pull back from short positions. This aligns with the declining net short positions, indicating a strategic reassessment by institutional investors, potentially influenced by macroeconomic conditions or shifts in regulatory landscapes.

The reduction in net short positions implies institutions may be closing short positions or initiating long positions, signaling a more favorable market outlook for Bitcoin. This change could attract increased institutional and retail participation, contributing to a more stable or positive price trajectory. The period from April to September 2024 marks a pivotal moment where institutional sentiment appears to be shifting, providing a foundation for continued market stability or growth.

The post Institutions are no longer aggressively shorting Bitcoin – CryptoQuant appeared first on CryptoSlate.