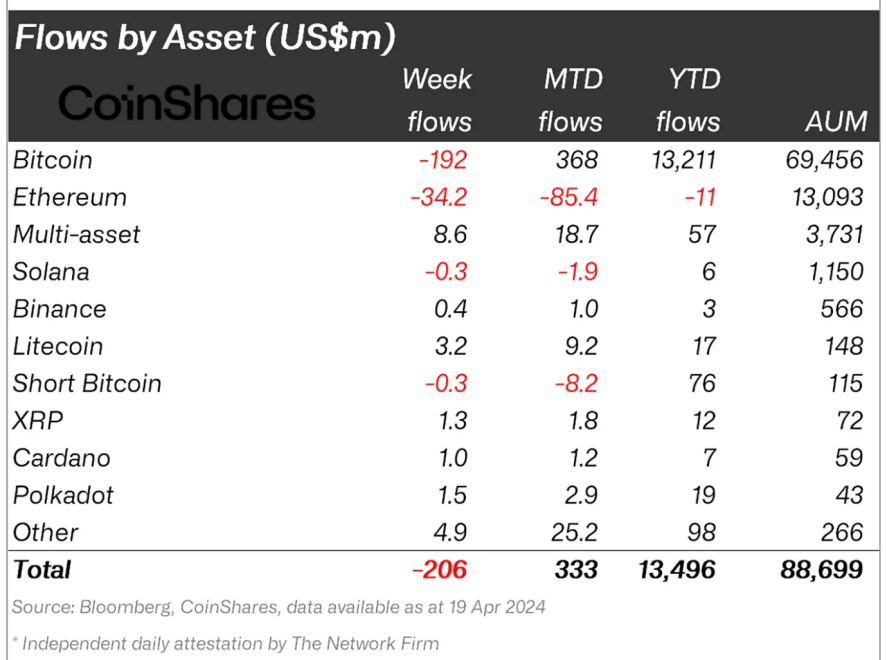

Global crypto investment products saw a net outflow of $206 million last week, reflecting investor concerns over the “potential impacts of Federal Reserve policy decisions on interest rates,” as reported by Coinshares.

Global Impact Of Crypto Outflows On Bitcoin ETFs And Market Volume

CoinShares revealed that the recorded net outflow of $206 million marks the second consecutive week of outflows, driven by expectations that the Federal Reserve will maintain high interest rates for an extended period.

The outflows were particularly notable in crypto investment products offered by asset managers such as Ark Invest, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares.

CoinShares Head of Research James Butterfill noted:

The data suggests appetite from ETP/ETF investors continues to wane, likely off the back of expectations that the FED is likely to keep interest rates at these high levels for longer than expected.

Interestingly, global exchange-traded products saw a slight decline in trading volume last week, totaling $18 billion, which accounted for 28% of the total Bitcoin trading volume. This figure marks a decrease from the 55% observed a month ago.

The net outflows in the US spot Bitcoin ETFs significantly contributed to the global weekly outflow, reaching $204.3 million.

However, amidst this trend, BlackRock’s IBIT emerged as the sole spot for Bitcoin ETFs to sustain weekly inflows. It garnered $165.4 million in inflows, prolonging its streak to 69 consecutive days before the Bitcoin Halving.

Waking up on 4/20 to see $IBIT took in cash for the 69th straight day, which was also the halving. It’s a little too perfect https://t.co/7Z8W3t9L7h

— Eric Balchunas (@EricBalchunas) April 20, 2024

Region-Based Crypto Fund Flows And Market Trends

According to the coinshares report, adding crypto futures products in the United States led to total net outflows of $244 million last week.

Conversely, Canada and Switzerland-based funds saw net inflows of $30 million and $8 million, respectively. Global Bitcoin funds accounted for $192 million of the total net weekly outflows.

Notably, short-Bitcoin products experienced minimal outflows of $300,000 despite the outflows, indicating that few investors saw this as an opportunity to short, according to Butterfill.

Furthermore, Ethereum-based investment vehicles carried on with their outflow streak for the sixth consecutive week, with $34 million in outflow. On the other hand, Litecoin and Chainlink products saw inflows of $3.2 million and $1.7 million, respectively.

Meanwhile, blockchain equities faced an eleventh consecutive week of outflows totaling $9 million. James Butterfill states this is so “as investors continue to worry over the consequences of the halving on mining companies.”

Amidst these fund flows, the overall crypto market has shown a slight uptick in the past 24 hours. Bitcoin, the largest crypto by market capitalization, recorded a 1.2% increase, while Ethereum, the second-largest, saw nearly 1% growth over the same period.

This price action coincided with Bitcoin’s fourth halving on April 20, reducing miners’ block subsidy rewards from 6.25 BTC to 3.125 BTC.

Featured image from Unsplash, Chart from TradingView