According to a CryptoQuant Quicktake post published earlier today, Bitcoin (BTC) may be on the verge of a significant price rally. Since February 6, net flow across crypto exchanges has remained negative – a historically bullish signal for the digital asset.

Bitcoin To Benefit From Negative Exchange Net Flow

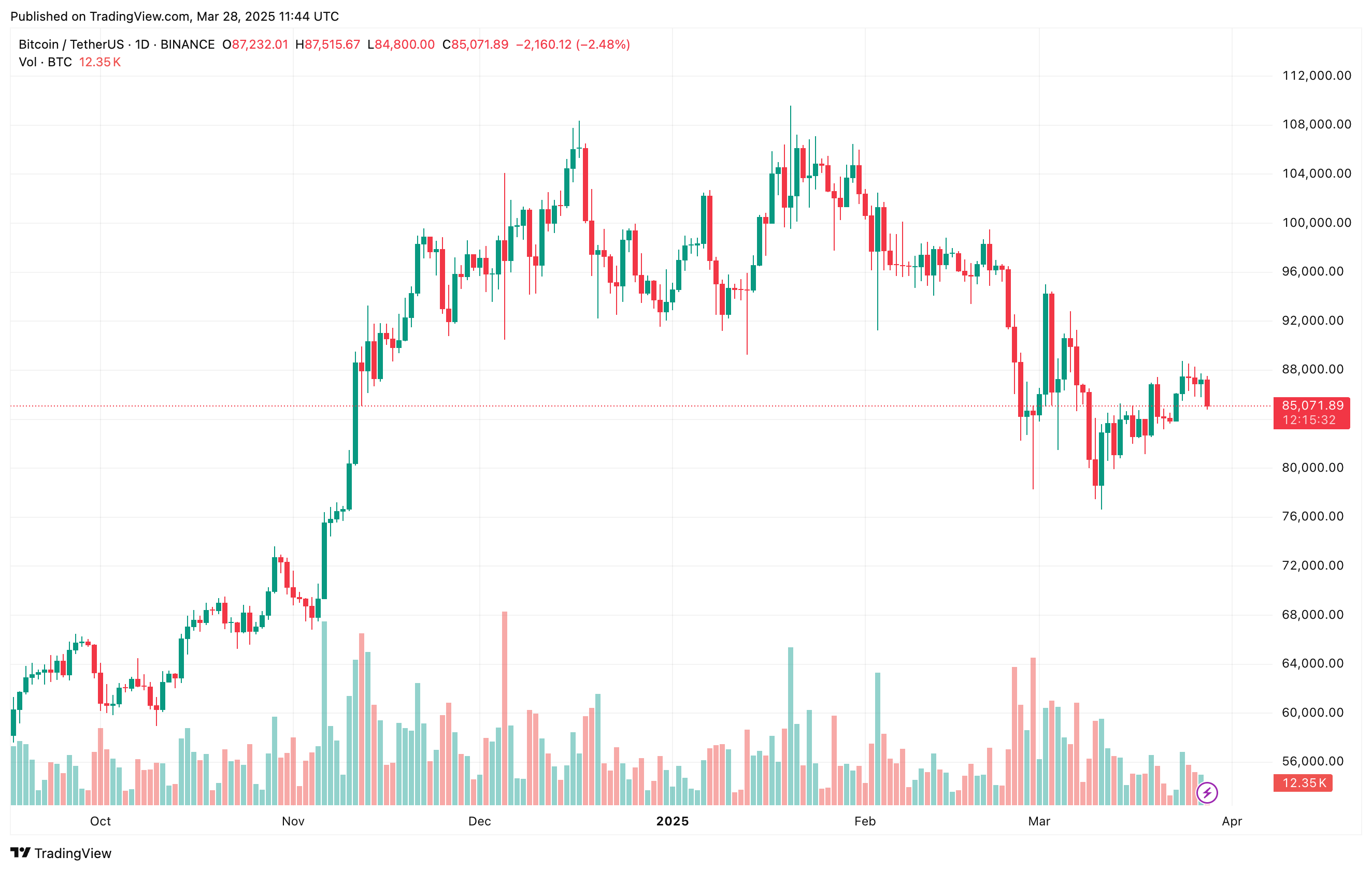

The past 24 hours have been highly volatile for the crypto market, with liquidations exceeding $360 million, the majority involving long positions. However, despite this market pullback, on-chain data remains bullish, suggesting that concerns may be overstated.

In a Quicktake post shared today, CryptoQuant analyst ibrahimcosar highlighted Bitcoin’s exchange flows. He noted that since February 6, BTC has experienced a persistent negative net flow across trading platforms.

To explain, when a large quantity of BTC is withdrawn from exchanges, it often indicates that investors – likely those who bought at lower prices – are expecting a price rally. These investors move their holdings to cold wallets, anticipating long-term gains and paying network fees to secure their assets. Over time, this behavior results in a negative net flow of BTC across exchanges, a bullish indicator.

Conversely, when a significant amount of BTC is deposited onto exchanges, it increases selling pressure, often signalling a bearish trend. Extended periods of high crypto deposits lead to positive net flows, typically preceding price declines.

The analyst stated that recent data – from February 6 onwards – suggests that a large amount of BTC is being withdrawn from crypto exchanges. The analyst added:

Historically, such high outflows have led to significant price increases in Bitcoin. This suggests that market volatility to the upside could be on the horizon.

Ibrahimcosar’s insights align with a recent analysis from CryptoQuant analyst ShayanBTC, who noted that BTC reserves on exchanges are rapidly decreasing. A sustained decline in exchange reserves could set the stage for a supply shock-driven price rally, reversing Bitcoin’s recent downtrend.

Momentum, Macroeconomic Factors Point Toward Bullish Trend

Beyond on-chain metrics, technical indicators like the Relative Strength Index (RSI) have also turned bullish. A recent analysis by Rekt Capital highlighted that BTC’s daily RSI has broken its multi-month downtrend, suggesting that a price rally may be imminent.

Additionally, macroeconomic factors appear to be fueling optimism. Reports suggest that US President Donald Trump may reconsider upcoming reciprocal tariffs set to take effect on April 2, potentially easing market concerns.

Meanwhile, Bitcoin whales – wallets with substantial BTC holdings – have resumed accumulation after a brief period of dormancy, further reinforcing a bullish sentiment. At press time, BTC trades at $85,071, down 2.1% in the past 24 hours.