Bitcoin (BTC) is at a crucial level after a sharp 15% retrace from recent local highs. While traders and enthusiasts speculate about the causes of this downturn, the consensus is clear: demand is weakening.

CryptoQuant’s head of research, Julio Moreno, has provided an in-depth analysis of the situation, relying on key market indicators and data to explain the ongoing shift.

His analysis suggests that falling demand is a driving factor behind BTC’s recent price action. As the crypto market navigates this turbulent period, uncertainty is growing, making it difficult for investors to anticipate the next big move.

With indecision spreading among market participants, the upcoming days could prove pivotal for Bitcoin’s price trajectory as bulls and bears battle over critical levels. Will BTC recover, or is there further downside ahead? Investors are watching closely for signs of what’s to come.

Bitcoin Demand Is Declining Right Now

Bitcoin (BTC) is currently facing significant selling pressure, primarily due to a noticeable decline in demand growth. According to CryptoQuant’s head of research, Julio Moreno, this demand issue is reflected across various valuation metrics, which have been stuck in bearish territory.

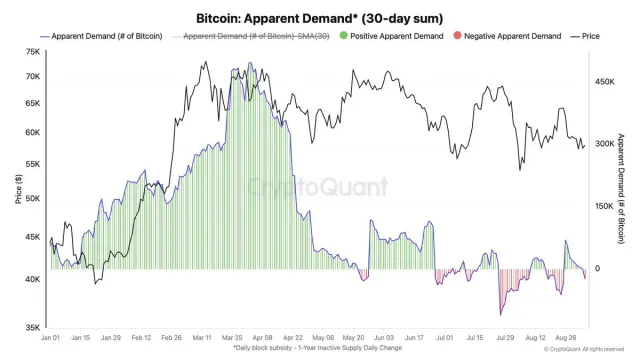

One of the most telling indicators is the apparent demand for BTC (30-day sum), which has entered a negative zone, highlighting weak buying interest. Moreno has shared his analysis on X, noting that the most severe signals have been flashing since July, when BTC’s demand began its steep decline.

This sluggish demand growth is the core reason Bitcoin’s price has been struggling to recover and start a fresh uptrend. While BTC managed to rally earlier in the year, the absence of new demand has kept it from sustaining higher levels.

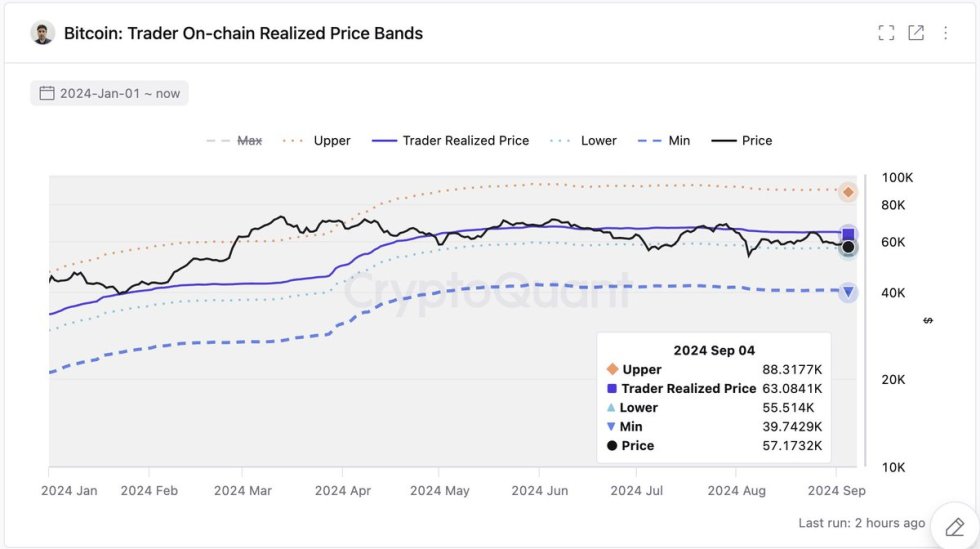

Moreno also pointed out that $55,500 is a key level to watch, representing traders’ on-chain lower realized price. The market may remain weak without reclaiming this level, as it signals broader challenges in attracting new buyers. Investors closely monitor these metrics to determine if the market can regain its footing or if further downside is ahead.

BTC Price Action

Bitcoin (BTC) is trading at $56,087, barely holding above the critical $55,000 level after several days of slow decline and lackluster price action. The recent BTC price stagnation suggests that it may test the lower demand zone at $54,500.

If Bitcoin manages to sustain its position above $55,000, bulls will need to reclaim the 4-hour 200 moving average, currently at $59,373, and push the price above the significant psychological barrier of $60,000. This level is crucial for establishing a renewed bullish trend and gaining momentum.

Conversely, if BTC fails to hold the $54,500 support, a more substantial decline could be on the horizon, potentially driving the price down to $49,000 or even lower. This would signal a bearish shift, challenging the current market sentiment and testing the resilience of Bitcoin’s recent gains.

Traders should watch these key levels closely, as a break below $54,500 could exacerbate the current downturn, while a recovery above $60,000 could reignite bullish enthusiasm.

Featured image from Dall-E, chart from TradingView