Here’s what the data of this historical on-chain indicator suggests regarding whether Bitcoin has become overvalued after its latest uptrend.

Bitcoin MVRV Z-Score Hasn’t Climbed Too High Yet

As the Reflexivity Research co-founder pointed out in a post on X, the BTC MVRV Z-Score readings have heated up little compared to the values observed in past bull runs.

The “Market Value to Realized Value (MVRV) ratio” is an indicator that measures the ratio between the Bitcoin market cap and the realized cap. The “realized cap” refers to a capitalization model for the cryptocurrency that assumes the “true” value of any coin in circulation is the price at which it was last transacted on the blockchain.

Since the last transaction price of any coin was likely the price at which it changed hands, one way to interpret the realized cap is that it represents the total capital the holders have invested into the asset.

Since the MVRV ratio compares the market cap (the spot price) against this model, it can tell us whether the investors are holding more value than they put in right now.

If the investors are holding more than what they bought the coin for (that is, they are in net profits), they might be tempted to sell, and thus, BTC might be likely to see a correction. Similarly, the market being in losses can suggest the cryptocurrency’s price is currently undervalued and might be due to a rebound.

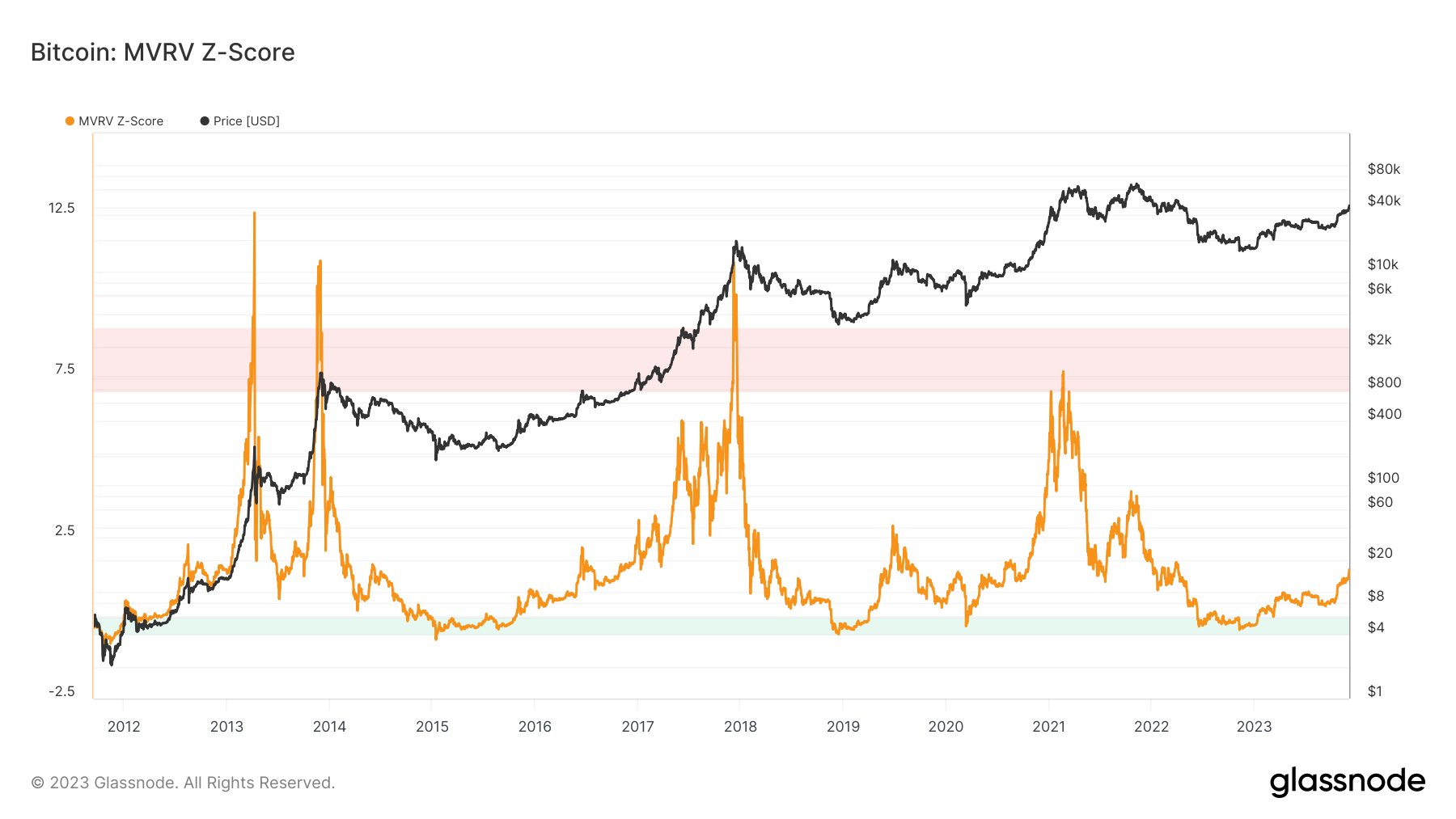

Now, here is a chart that shows the trend in the Z-Score of the Bitcoin MVRV ratio over the history of the coin:

The “Z-Score” is a statistical tool used to measure how far a data point is from the mean. In the graph, the analyst has marked two zones for the Bitcoin MVRV Z-Score where BTC has attained an overbought/underbought condition.

It would appear that historical bottoms in the asset’s price have formed when the metric has dipped inside the green zone. The tops haven’t been so simple, though, as they fluctuate a bit.

One common thing between all tops is that they have occurred at decently high values of the indicator. At such values, the investors make very high profits, so tops naturally become significantly probable.

The chart shows that the Bitcoin MVRV Z-Score has been climbing recently as the asset has rallied, but it’s yet to arrive at levels similar to past tops. “There will be corrections along the way, but zooming out Bitcoin is far from overvalued based on historical readings,” notes the analyst.

BTC Price

At the time of writing, Bitcoin is trading at around $43,800, up 15% in the last week.