Amid rising institutional engagement in Bitcoin, a sharp spike in exchange-traded fund (ETF) inflows over the past few days has sparked interest from traders and analysts alike.

Earlier today, a noteworthy analysis from the popular trader Skew on social platform X highlighted a potential risk for Bitcoin amidst its current influx of capital.

Skew pointed out the phenomenon he dubs the “headline curse,” noting that while the significant inflow of over $500 million into United States spot Bitcoin ETFs signifies growing institutional confidence, it may also foreshadow a looming price correction.

Record High Bitcoin ETF Inflows Signal Market Shifts

The recent resurgence in popularity for Bitcoin ETFs, particularly spotlighted by the BlackRock iShares Bitcoin Trust (IBIT), which alone saw $526 million in inflows on June 22, brings with it a history of similar occurrences that often led to price sell-offs.

Bitcoin ETF Flow (US$ million) – 2024-07-22

TOTAL NET FLOW: 533.6

(Provisional data)IBIT: 526.7

FBTC: 23.7

BITB:

ARKB: 0

BTCO: 13.7

EZBC: 7.9

BRRR: 0

HODL: -38.4

BTCW: 0

GBTC: 0

DEFI: 0For all the data & disclaimers visit:https://t.co/4ISlrCgZdk

— Farside Investors (@FarsideUK) July 23, 2024

Skew emphasized that such high inflow days usually correspond to market supply zones, where sellers historically start moving back into the markets looking for price weakness.

This spike in inflows represents a critical juncture for the cryptocurrency, potentially setting the stage for either a bullish continuation or a bearish retreat, depending on several market factors that Skew outlined.

Skew further proposed in the analysis that sustaining the current bullish momentum hinges on a few key indicators.

These include a consistent passive spot bid, which involves limiting spot buyers capitalizing on price dips, and the ability of spot takers to continue bidding through existing spot supply, which is necessary to breach the five-month supply barrier.

Additionally, the absorption of sellers plays a crucial role; it is a fundamental aspect that needs to be addressed to reach new all-time highs.

Although the influx of funds into Bitcoin is a sign of positivity, Skew points out that it will test the market’s ability at these crucial levels to keep demand strong and absorb selling pressure.

Another large inflow day

$BTC

As bullish as this is each other time IBIT reported mid – high 9 fig inflow days it occurred around market supply zonessomewhat a headline curse lol

So in terms of actually trading this, the obvious part is now does the market sustain this… https://t.co/qdGwMAvVjl pic.twitter.com/iZ921tpKHW

— Skew Δ (@52kskew) July 23, 2024

Impending Sell Pressure

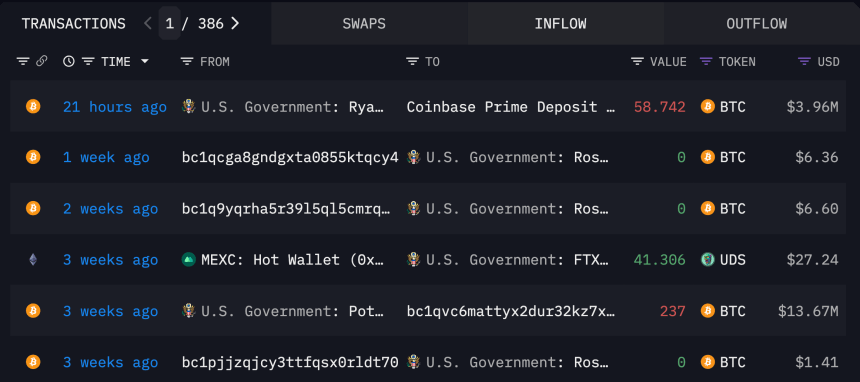

Speaking of sell pressure, blockchain analytics firm Arkham Intelligence recently revealed that the US government has transferred $3.96 million from the seized Bitcoin to Coinbase.

Adding to this possible sell pressure, Arkham Intelligence, in another report on X, also revealed that the defunct crypto exchange, Mt. Gox, may be moving to continue its Bitcoin sale. Yesterday, the exchange made test transactions depositing $1 to 4 separate Bitstamp deposit addresses.

Regardless of these possible sell pressures, Bitcoin still maintains its price above $65,000, with the asset currently trading at $66,981 at the time of writing.

Featured image created with DALL-E, Chart from TradingView