The post Is Crypto Bull Run Over? appeared first on Coinpedia Fintech News

The crypto market is now in turbulence, amid the global economic policies and widespread liquidations. The recent wave of volatility has led to a staggering 7.48% decline in the total crypto market capitalization, pulling it down to $2.91 trillion.

This abrupt drop has left traders in shock, with the Fear & Greed Index plunging to 29, deep in the fear territory, after sitting at a neutral 40 just yesterday. Bitcoin, has lost its critical $90,000 support level, now trading at $89,652.23. Despite its dominance rising to 61.39%, its market cap has shrunk to $1.77 trillion.

Meanwhile, Ethereum has suffered a steep 10.37% drop, slipping to $2,410, while Solana and XRP have plummeted even further, losing 12.6% and 10.67%, respectively. The question now looms, what’s behind this sharp selloff, and where does the market go from here?

Trump’s Tariff Plan, And Its Impact

The catalyst behind this downturn traces back to U.S. President Donald Trump’s recent announcement regarding a 25% tariff on imports from Canada and Mexico. Speaking alongside French President Emmanuel Macron on February 24, Trump reaffirmed his commitment to imposing these tariffs despite growing economic concerns.

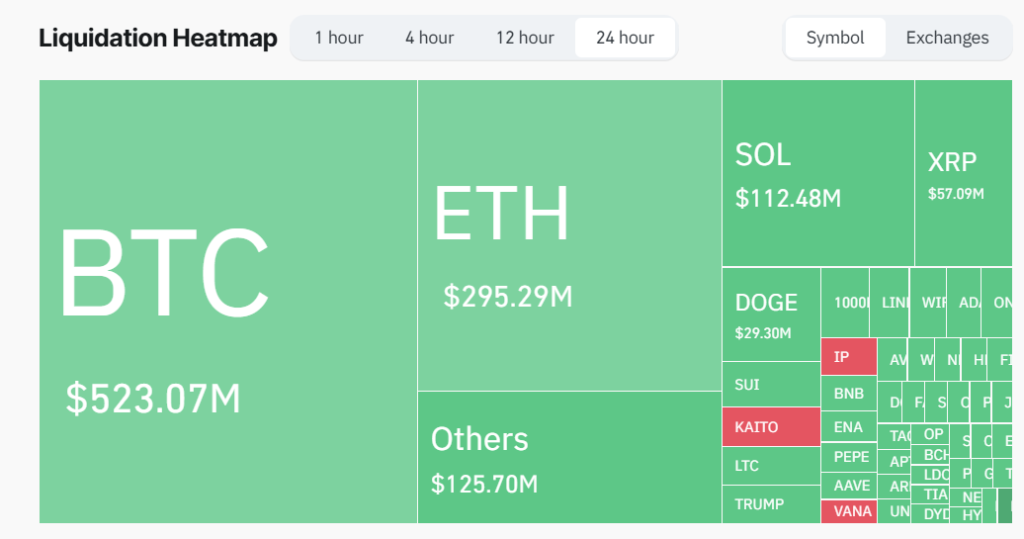

The broader financial markets have already felt the shockwaves. The S&P 500 has slid 2.3% over the past five trading days, while the Nasdaq Composite has tumbled 4%. With investors adopting a risk-off approach, cryptocurrencies have not been spared. The turmoil led to massive liquidations of over $900 Million in just a few hours. The heat map by CoinGlass below gives an overview of the liquidations top cryptocurrencies witnessed.

How Low Can Top Cryptos Fall?

With uncertainty at an all-time high, analysts are warning of further downside risks, particularly for major altcoins. A significant factor contributing to this selloff is Binance’s recent large-scale offloading of Ethereum, Solana, TRUMP, and other assets. As the world’s largest exchange liquidates significant holdings, fears of a prolonged market downturn grow stronger.

Renowned analyst Capo in hits recent X post, has cautioned that Ethereum could dip into the $1,800-$2,100 range if it fails to maintain its crucial $2,381 support. Bitcoin, on the other hand, is staring at a possible test of $85,000 before any hopes of recovery emerge. If these levels break, a deeper correction may be on the horizon.

The Road to Recovery: This Is What Lies Ahead!

Despite the ongoing bearish sentiment, hope remains. A market recovery is still within reach, if key conditions align. The first critical step is Bitcoin holding its ground at $85,000. Should institutional investors step in with renewed buying pressure, a relief rally could materialize.

A case in point is Strategy, which recently acquired 20,356 BTC for approximately $1.99 billion at an average price of $97,514 per Bitcoin. The firm now holds an impressive 499,096 BTC, purchased for a total of $33.1 billion at an average cost of $66,357 per BTC. Other institutional players following suit, could lead to Bitcoin regaining its footing.

However, persistent selling pressure from Binance and worsening macroeconomic conditions due to rising tariffs could push the market into a prolonged consolidation phase. In such a scenario, Bitcoin may remain range-bound, while altcoins continue their downward trajectory.

A Healthy Correction or Is the Bull Run Over?

While fear and uncertainty cloud the market, seasoned analysts believe that this correction could serve as a necessary shakeout before another leg up. Some experts argue that Bitcoin’s long-term bullish trajectory remains intact, despite the current turbulence. If institutional interest picks up and the market absorbs the ongoing sell pressure, a reversal may be in sight.