Crypto analyst Ali Martinez has discussed Ethereum current price action as the second largest crypto by market cap remains below $4,000. The analyst outlined some facts to give a clearer picture of whether or not it is the right time to give up on ETH.

Analyst Discusses Whether It Is Time To Give Up On Ethereum

In an X post, Ali Martinez outlined certain facts to determine whether it is time to give up on Ethereum. First, the analyst noted that ETH has been one of the weakest performers lately, a development that looks to have prompted Vitalik Buterin to shake things up by changing the Ethereum Foundation’s leadership team.

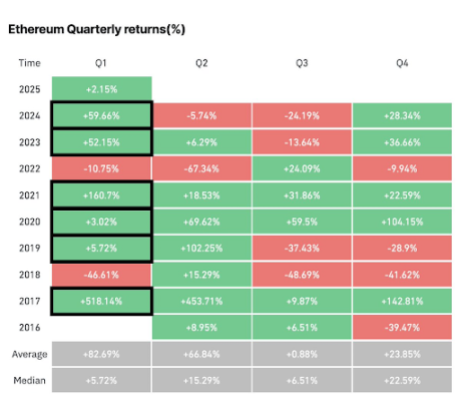

Martinez then alluded to historical data showing that Ethereum performs well in the first quarter of each year. The analyst had previously hinted that this year is unlikely to be different. Back then, he noted that ETH delivers its strongest performance in Q1, particularly in odd-numbered years, and 2025 is one such year.

Given Ethereum’s positive Q1 performance, Martinez remarked that this could explain why crypto whales have accumulated over $1 billion worth of ETH in the past week alone. He previously revealed that these whales had bought over 330,000 ETH, valued at over $1 billion.

Furthermore, the crypto analyst remarked that the buying pressure is also evident in the exchange outflows, with nearly $2 billion in Ethereum withdrawn from crypto platforms over the past month. Specifically, 540,000 ETH, worth $1.84 billion, were withdrawn from exchanges over the past month. This accumulation trend is a positive as it indicates investors are still bullish on ETH.

However, for Ethereum to break out bullishly, Martinez mentioned that it must overcome several key resistance levels. From an on-chain perspective, the crypto analyst highlighted the $3,360 to $3,450 zone as the major supply wall. This range is the most critical resistance level for ETH, while the key support zone is between $3,066 and $3,160.

From A Technical Analysis Perspective

Martinez also provided insights into the Ethereum price action from a technical analysis perspective. He stated that ETH appears to be forming the right shoulder of a head-and-shoulders pattern, with a neckline of $4,000. He added that a decisive breakout above this level could fuel a rally toward $7,000.

The crypto analyst also revealed that this upside target aligns with the Ethereum 3.2 Market Value to Realized Value (MVRV) Pricing Band, which is currently hovering around $7,000. Amid this bullish outlook, Martinez mentioned that one concerning sign is Ethereum’s network growth, which has slowed down. The number of new ETH addresses is said to have declined by 9.32%, indicating reduced adoption.

Despite that, Martinez believes that Ethereum’s outlook is still bullish. He told market participants to keep an eye on the $2,700 to $3,000 support zone. According to him, this demand zone must hold to maintain ETH’s bullish outlook.

At the time of writing, Ethereum is trading at around $3,200, down 4% in the last 24 hours, according to data from CoinMarketCap.