The post Is Mt. Gox Behind $1.18 Billion Crypto Liquidations? Here’s What Happened appeared first on Coinpedia Fintech News

The overall cryptocurrency market experienced a significant price decline, resulting in billions of dollars worth of crypto liquidations. This market crash began shortly after Jerome Powell’s anti-crypto stance following the Fed rate cut and the recent transfer of $100 million worth of Bitcoin (BTC) by the defunct cryptocurrency exchange Mt. Gox.

Mt Gox $100M BTC Transactions Sends Shockwaves

On December 19, 2024, the blockchain intelligence firm Arkham posted on X (formerly Twitter) that Mt. Gox transferred a significant $102.5 million worth of BTC last night following the Fed rate cut meeting. The post also noted that this substantial amount of BTC was distributed across three separate transactions to three different addresses, each receiving $30.18 million.

However, Arkham further noted that the remainder is still in Mt. Gox’s custody.

These transactions by the defunct cryptocurrency exchange appear to have a significant impact on the crypto market. Mt. Gox is required to distribute billions of dollars worth of BTC to its creditors, which is heavily influencing BTC prices and the overall crypto market.

$1.18 Billion Worth Crypto Liquidation

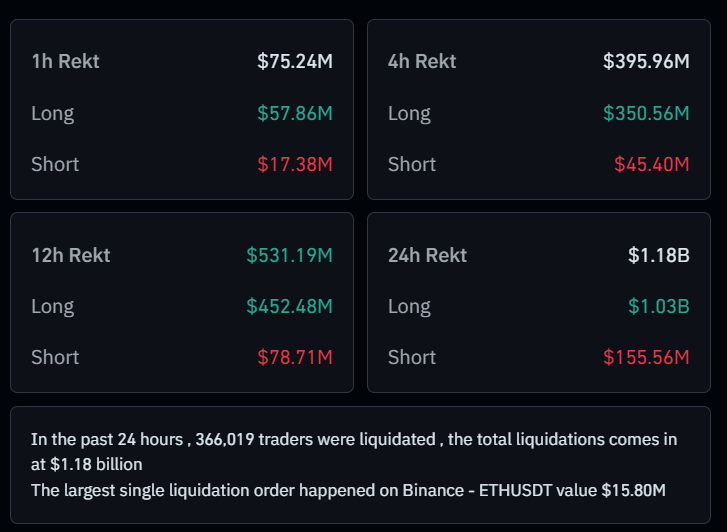

The current market sentiment appears extremely bearish, with traders and investors experiencing heightened fear due to billions of dollars in liquidations. According to the on-chain analytics firm Coinglass, the recent market crash resulted in the liquidation of a significant $1.18 billion worth of long and short positions.

The majority of the liquidations came from long positions, as traders holding $900 million worth of long positions were liquidated. In contrast, the crypto market witnessed only $160 million in short liquidations over the past 24 hours.

As a result, the overall cryptocurrency market has seen a 3.51% decline, with major assets like Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL) witnessing even steeper drops of over 4.75%, 9.2%, 6.5%, and 9%, respectively, in the past 24 hours. This bearish sentiment is compounded by ongoing fears related to the Mt. Gox distributions.