The market saw a dramatic Bitcoin price drop over the past two days, plunging from a high of $64,500 on Sunday to a low of $58,474. Yesterday’s steep decline followed an unexpected announcement from the trustee of the defunct Mt. Gox exchange, revealing plans to commence BTC and BCH payouts in early July—a move that has sent shockwaves through the market.

This news raises urgent questions about the immediate future of Bitcoin’s price trajectory. Amidst this market turmoil, several prominent cryptocurrency analysts have weighed in, offering their insights on whether Bitcoin could be nearing a local bottom. Here is a deeper dive into their analysis and perspectives:

Bitcoin Technical Analysis

Tony “The Bull” Severino, Chief Analyst at NewsBTC, provided a technical breakdown of the current situation. Utilizing the Relative Strength Index (RSI), a momentum oscillator that measures the speed and change of price movements, Severino pointed out that the RSI levels are now as oversold as they were during the collapse of FTX, suggesting a potential cyclical bottom.

“Bitcoin’s daily RSI is as oversold as during the FTX collapse, indicating a cyclical bottom might be forming,” said Severino. This analysis implies that, historically, such levels have often preceded a rebound or at least a stabilization in price.

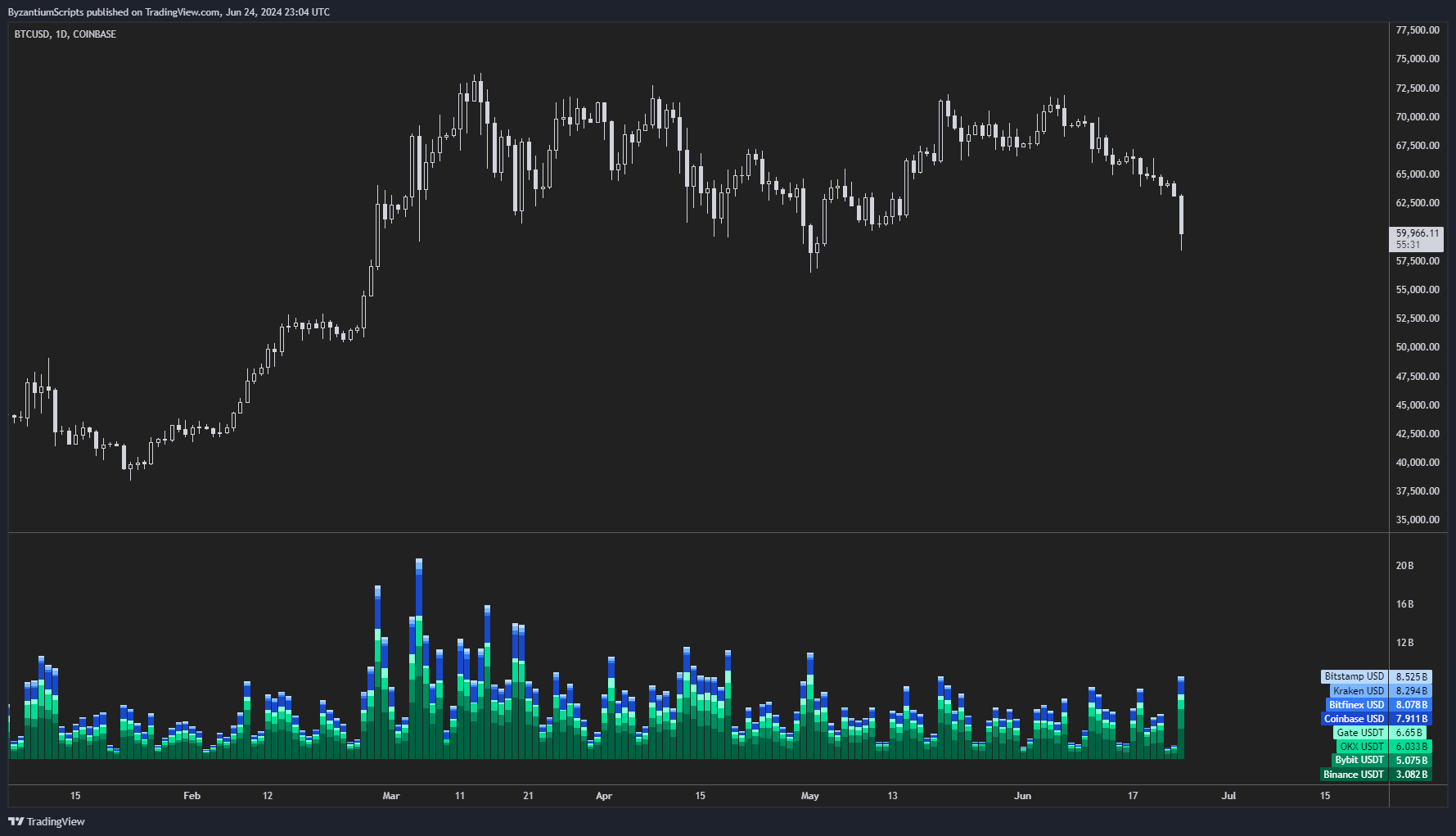

Volume And Market Behavior

The Byzantine General, a trader and market strategist, noted the unusually high spot volume accompanying the price drop. “We’re seeing significantly high spot volume, which historically can signal a local bottom,” he remarked. High trading volumes during a price drop can indicate panic selling, which often exhausts itself leading to potential recovery.

Social Media Sentiment

Santiment, an analytics platform focusing on social metrics, observed a spike in discussions around the term “bottom” across various social media platforms. “This is one of the highest spikes in social volume and dominance for the word ‘bottom’ we’ve observed in the past year,” they reported. Historically, such spikes can signify heightened market attention that may correlate with pivotal market movements.

Historical Patterns And Technical Indicators

Teddy (@TeddyCleps), a cryptocurrency trader, emphasized the importance of historical patterns and specific technical indicators such as the 21-week Exponential Moving Average (EMA). “Historically, each correction in the BTC bull run has touched the 21-week EMA before rebounding. We’re approaching this indicator; if history is any guide, $61k could represent the bottom,” Teddy explained. The 21-week EMA is a key technical level watched by many traders for signs of long-term trend support.

On-Chain Data Analysis

James Check (@Checkmatey), an on-chain data analyst, shared his approach focused more on value acquisition rather than exact timing: “My strategy isn’t about pinpointing the absolute bottom but acquiring Bitcoin at significant discounts, as indicated by on-chain metrics like STH-SOPR and STH-MVRV both being below 1.” These metrics suggest that short-term holders are selling at a loss, which can be an opportunistic entry point for long-term investors.

I prefer acquiring sats when both STH-SOPR and STH-MVRV are below 1.

I’m not looking for bottoms, I’m looking for meaningful discounts.

Love to see it.#Bitcoin pic.twitter.com/Jou9TSH3A9

— _Checkmate

(@_Checkmatey_) June 25, 2024

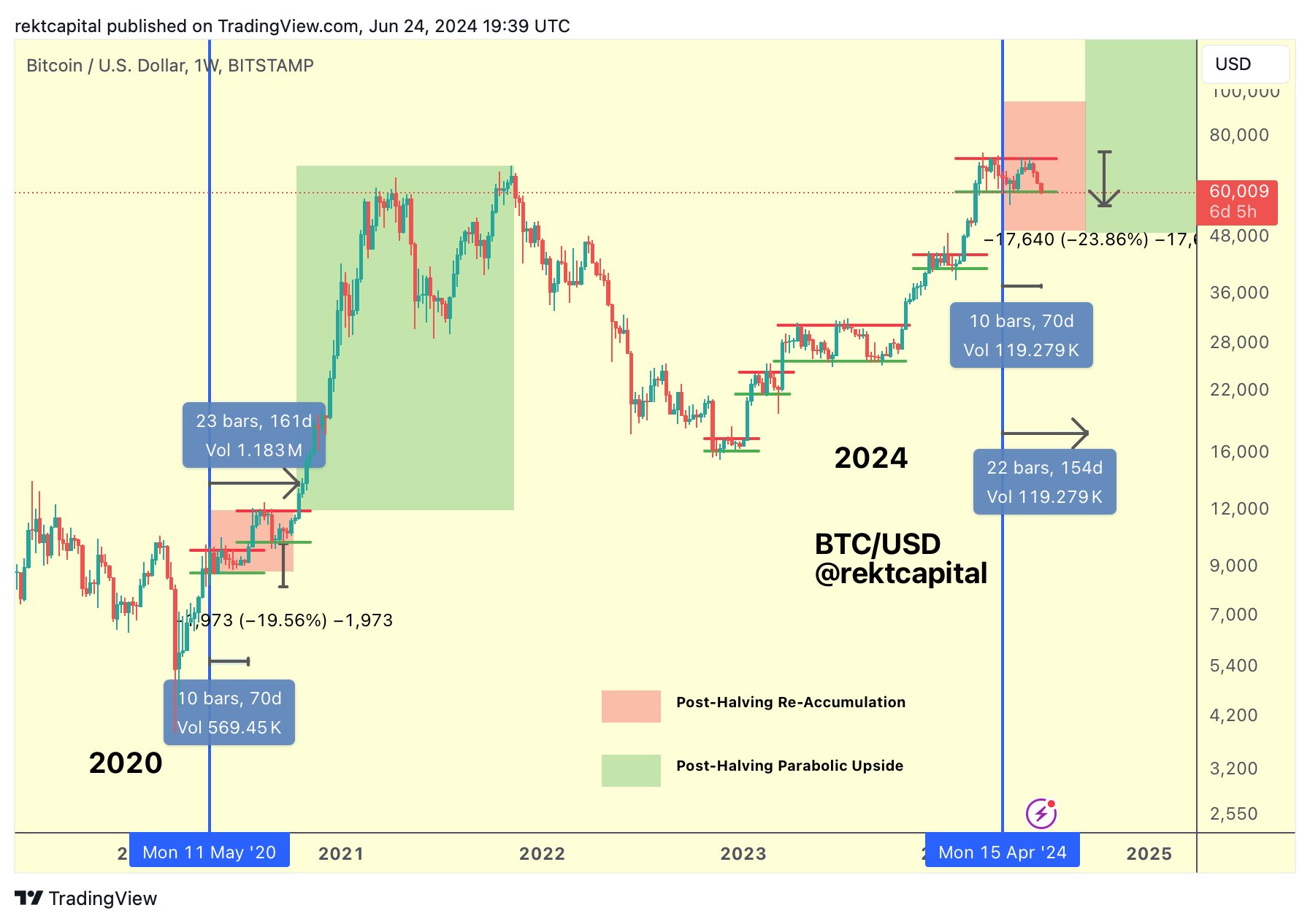

Historical Post-Halving Performance

Rekt Capital (@rektcapital) analyzed Bitcoin’s performance in post-halving periods, referring to the event where Bitcoin mining rewards are halved, theoretically increasing its scarcity. “BTC has not broken the high nor lost the low of its ReAccumulation Range in any post-halving period. This historical precedent suggests that Bitcoin should hold these levels,” he outlined.

Market Psychology

Cred (@CryptoCred), another respected trader, offered another angle and is not convinced the bottom is already in: “If this is the BTC bottom, I am likely to miss it. Often, a market that fails to break down at a level, only to return and close below it later, indicates a more legitimate breakdown. I’m not shorting but am also not buying.”

At press time, BTC traded at $61,014.