For federal tax purposes, crypto assets are treated as property, which could be counterproductive for investors in the United States. Although digital assets are a relatively new type of investment, the Internal Revenue Service (IRS) in this country has worked hard to enforce tax compliance.

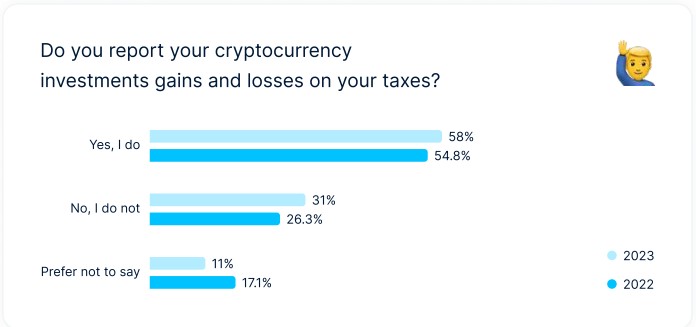

A survey conducted by CoinLedger summarized the percentage of U.S. investors in the space who are aware of the new standards and regulations from the government and how many are reporting their taxes.

Do Crypto Investors Report Taxes?

305 US citizens were sampled with the survey conducted by CoinLedger and carried out by YouGov. The percentage of investors reporting crypto on their taxes was 58% in 2022, between the unprecedented crisis and bankruptcies that enveloped the industry.

31% of crypto investors said they didn’t report taxes on their last year’s gains. Moreover, 50% of the investors who didn’t file their taxes said that the main reason for not filing was that they “didn’t make a profit on crypto assets.”

Most investors surveyed could not correctly identify taxable and non-taxable crypto transactions as defined by IRS standards. However, 38% of investors were able to identify crypto-to-crypto trades as taxable correctly.

In addition, 59% of crypto investors surveyed said they were prepared for tax season, while 49% said they felt unprepared.

Many investors agreed with the statement, “I wish cryptocurrency exchanges gave me more information to help me file my taxes,” representing 68% of the citizens surveyed in the report.

According to CoinLedger’s research, crypto tax reporting has steadily increased as the industry matures. In 2018, Credit Karma found that only 0.04% of its users reported digital assets on their taxes, a significant increase in tax reporting by crypto investors compared to last year.

Are Investors Educated On Tax Reports?

65% of investors correctly identified that selling cryptocurrency is a taxable event, while only 38% of investors correctly identified that a crypto-to-crypto trade is a taxable event, according to the survey’s data.

To CoinLedger, this seems to imply that many crypto investors are inaccurately reporting their cryptocurrency taxes simply because they are unaware of what constitutes a “taxable sale.” CoinLedger Stated in the report:

(…) It’s clear that more education is necessary to help investors better understand how to accurately report their taxes. Here at CoinLedger, we’ve published free guides, articles, and videos to help investors better understand how to accurately report their crypto taxes.

For CoinLedger, crypto tax reporting rates will likely increase as the cryptocurrency ecosystem matures. Over time, investors will become more knowledgeable about how their transactions are taxed and gain access to tax reporting resources.

Bitcoin is currently trading at $22,800. It has not yet been able to climb to its next target of $24,200. Bitcoin has fallen 1.7% in the past 24 hours, moving between $22,800 and $23,200.

The largest cryptocurrency by market capitalization is down 1.3% in the last 7 days but still able to maintain its stats in the green land in the last 30 days with a profit percentage of 33.7%.

Featured image from Unsplash, Image from CoinLedger, Chart From TradingView.