The echoes of 2021’s meme stock saga reverberated through financial markets this morning, as the obscure ROAR meme coin and video game retailer GameStop experienced a meteoric rise fueled by social media nostalgia. The catalyst? The return of a familiar face – Keith Gill, better known by his online moniker “Roaring Kitty.”

Kitty Claws Back In

Retail investors were sent scrambling after Gill, a superstar among the online investment community on Reddit’s WallStreetBets forum, posted a cryptic message hinting at a significant stake in GameStop.

The post, featuring an image of the “Uno Reverse” card, sent speculation into overdrive. Shortly after, Gill confirmed his bullish stance by revealing a massive holding of 5 million GameStop shares, valued at roughly $116 million based on Friday’s closing price.

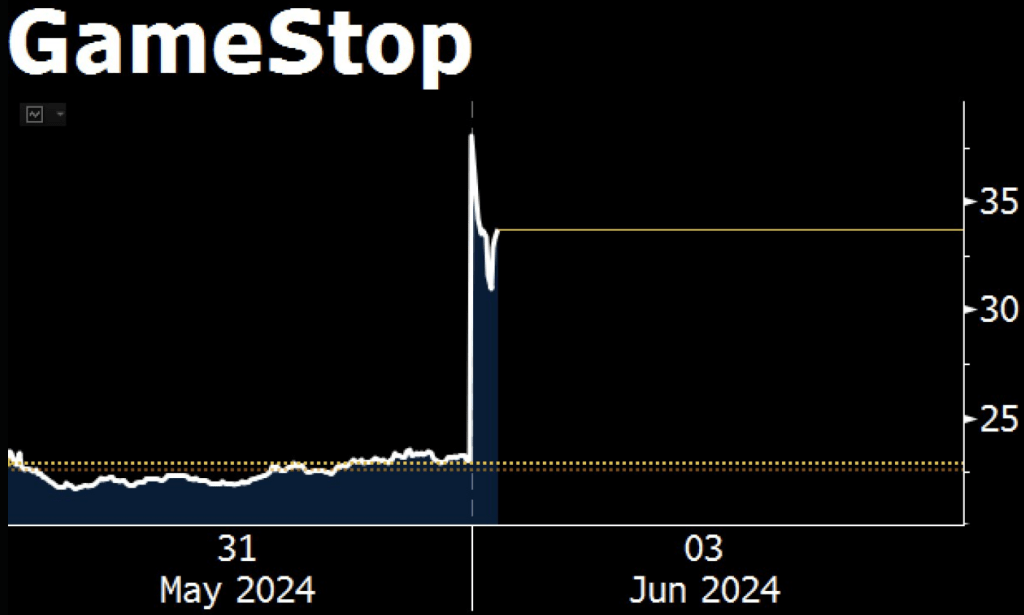

In the 20 minutes that followed Gill’s post, GameStop’s stock price on Robinhood’s overnight markets shot up by 20% to $27.50. This increase followed the stock’s Friday closing price of $23.14. This year, the shares have increased by almost 40%, presumably as a result of Gill’s sudden comeback.

This disclosure sent shockwaves through the market. GameStop’s stock, infamous for its volatility during the meme stock frenzy of 2021, surged over 100% at its peak in pre-market trading on Monday.

NOW: GameStop soars after the Reddit account that drove the meme-stock mania of 2021 posted what appeared to be a $116 million bet https://t.co/0mnyJF4lIf pic.twitter.com/rpRdA2AIWL

— Bloomberg Markets (@markets) June 3, 2024

While the price eventually settled to an impressive 88% increase, the roar from retail investors was undeniable. The ROAR meme coin, seemingly named in homage to Gill’s online persona, mirrored the GameStop price surge of over 300%, reaching a high of $0.001643.

A Meme Stock Revival?

The sudden rise of both ROAR and GameStop has reignited the debate surrounding meme stocks. These assets, often characterized by high volatility and driven more by online hype than traditional financial metrics, captured the imagination of retail investors in 2021. Gill, who played a pivotal role in the initial GameStop saga, appears to be a key player in this potential revival.

However, analysts remain cautious. GameStop itself is in a precarious position, having recently sold a massive chunk of shares to bolster its finances while facing continued net losses and projected sales declines. The company’s long-term prospects remain uncertain, raising questions about whether this is a genuine resurgence or simply a nostalgic echo of 2021.

Weighing Hype Against Reality

The recent surge in ROAR and GameStop presents a classic risk-reward scenario for investors. Early participants who bought in at lower prices stand to reap significant profits. However, the inherent volatility of meme stocks poses a significant danger of substantial losses.

Featured image from HubPages, chart from TradingView