Fenbushi Capital, a blockchain-centric venture capital (VC), appears to be cashing out after moving four tokens, including Aave (AAVE) and Compound (COMP), to Binance. The VC is moving these tokens to the exchange, possibly to sell and lock in their profits or cut losses when market participants expect prices to tick higher.

Fenbushi Capital Cashing Out? Sends AAVE, UNI, SNT, and COMP Tokens To Binance

After the series of lower lows after crypto prices peaked, mainly in Q1 2024, the consensus is that Bitcoin and Ethereum prices are ready to turn the corner. If Bitcoin breaches $70,000 and Ethereum soars above $3,000, shaking off recent weakness, they could lift other less liquid altcoins, including those Fenbushi chose to send to Binance.

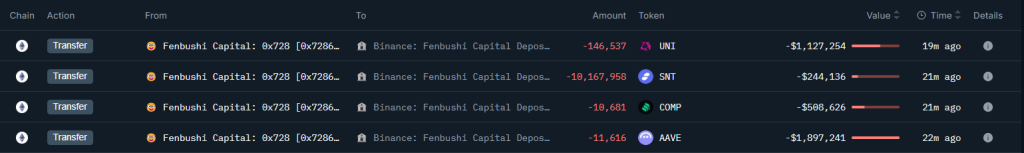

According to on-chain data, the VC transferred 146,537 UNI worth $1.12 million, over 10.1 million SNT worth $244,000, 10,681 COMP worth $510,000, and 11,616 AAVE worth $1.89 million, to Binance. The VC secured over $1.20 million in profits, assuming they sold all these tokens at spot rates.

Of all these tokens, their AAVE holdings has seen them gain over $1.1 million in profits. However, at spot rates, they are in red from their COMP holdings. COMP is the native governance token of Compound, a lending protocol.

Fenbushi received these tokens nearly two years ago, in 2022, months after most of them had soared to record highs in the last DeFi and NFT-driven bull run. When writing, no statement from Fenbushi explained their decision to transfer most of these DeFi tokens to the exchange.

DeFi Rising And Protocols Building: Wrong Timing To Exit?

Whenever coins are moved to a centralized exchange could signal weakness and be seen as bearish. However, considering the current crypto sentiment, Fenbushi’s raises eyebrows and could slow down the uptrend.

According to DeFiLlama, the total value locked (TVL) across DeFi protocols is over $88 billion. At spot rates, TVL is up by over 100% from 2022 lows of around $36 billion.

Out of this, Aave, Uniswap, and Compound are some of the largest platforms. Aave manages over $12.7 billion of assets, while Uniswap controls over $4.8 billion.

Beyond the sharp uptick in total DeFi TVL, these protocols are also actively building. Uniswap, the decentralized exchange, plans to release its v4 in the coming months, while Aave actively attracts new users. By late September, the lending app had received close to $20 billion in user deposits, cementing its position in DeFi.