While a plan to leverage “volcano energy” is great marketing for El Salvador’s planned Bitcoin City, on its own, it might not be the best source.

The creation of a Bitcoin City powered by “volcano energy” proposed by El Salvador’s President Nayib Bukele is appealing for many bitcoiners at an emotional, aesthetic level.

Envisioned in the shape of a perfect circle, like a coin, with a bitcoin-symbol-shaped public square in the middle and a multitude of urban nodes radiating in every direction, the proposed city’s aesthetics aim to resonate symbolically with bitcoiners.

This vision makes sense based on Bukele’s communication and marketing savviness. It could also be a great opportunity for Fr-ee, the architecture and industrial design firm founded by Fernando Romero, as Bitcoin City is a rehash of Romero’s FR-EE City, a 2012 “urban prototype for building new cities in the emerging economies of the 21st century,” as the website describes it.

The emotional, aesthetic foundations of Bitcoin City can be viewed as quite sound among Bitcoiners. But its energy foundations may not be the best possible fit for the Bitcoin edifice Bukele wants to spur — at least in terms of their cost and speed.

The Lead Time For Geothermal Power

The “volcano energy” that Bitcoin City is supposed to tap into is more commonly known as “geothermal energy.” Calling it “volcano energy” sounds, of course, more exciting and it demonstrates once again Bukele’s marketing and branding acumen.

The reason why geothermal energy might not be the best and quickest fit for Bitcoin City has to do with its development time and costs. It can take five to seven years to go through all the phases involved, according to some geothermal project timelines.

In the case of the Colchagua volcano, which is the one near which Bitcoin City would be built, the first phases are underway or have been already carried out, as last June, Bukele tweeted that engineers had already dug a well with 95 megawatts (MW) of geothermal capacity at the site.

Even so, it will likely take at least another two to three years before the plant can start generating electricity, to be used for a bitcoin mining hub around it.

This hints at one big reason why geothermal energy has not been significantly developed in the last few decades, either in El Salvador or in the world in general, even though it avoids the drawbacks of intermittency that solar and wind power suffer. Although it’s cheap to operate and provides almost unlimited hours of operation, geothermal energy has very long lead times and, until all of the technical “i’s” have been dotted and the economic “t’s” have been crossed, results are uncertain. Projects can remain, quite literally, holes in the ground.

Solar and wind power plants can also take time to be developed, but that’s usually due to permitting procedures, not technical difficulties or uncertainties about solar irradiation and wind speeds, and their lead time is generally shorter, about one to two years for utility-scale systems, and less for smaller ones, according to industry interviews.

Issues of time and costs cannot be underestimated in the decisions of public and private investors. Let’s try and paint a simple yet comprehensive picture with broad data that are representative of different renewable energy technologies across the world.

The Relative Costs Of Geothermal Power

In 2020, the average total installed cost of eight new geothermal plants monitored by the International Renewable Energy Agency (IRENA) was $4,486 per kilowatt (kW), ranging from a low of $2,140 per kW to a high of $6,248 per kW.

Focusing on El Salvador, a recent study presented at the last World Geothermal Congress by Salvadoran, Icelandic and Iranian researchers quotes a total cost of $480 million for a 50 MW geothermal plant in the Central American country (table two), or $9,600 per kW.

For comparison, the average total installed cost of solar photovoltaic (PV) projects commissioned in 2020 and monitored in the IRENA database was $883 per kW — about one-fifth the cost per kW of IRENA-monitored geothermal power, or about one-tenth the cost of geothermal power per the World Geothermal Congress study. If we compare it with offshore wind power, its average total installed cost came at $1,355 per kW in 2020 — about one-and-a-half-times cheaper than volcano energy.

Beside development and installation expenses, another important factor is the cost of generating energy once a plant has started production. To do that, let’s look at the levelized cost of energy (LCOE), which measures the average net-present cost of electricity generation for a power plant over its lifetime. It’s a key number used to plan investments and compare different methods of power generation in a consistent way.

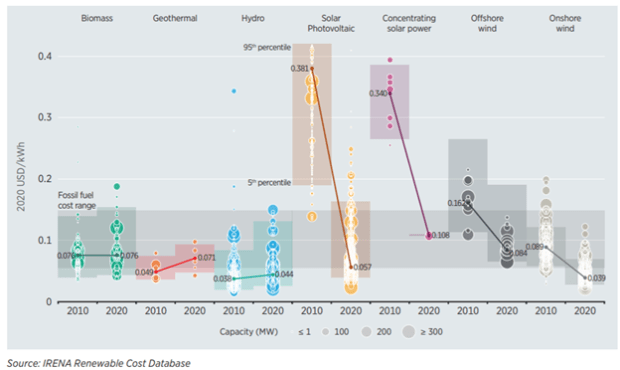

The average LCOE of the geothermal projects commissioned in 2020 was $0.071 per kilowatt hour (kWh), broadly in line with values seen over the previous four years. That compares with an LCOE for solar and onshore wind that has been falling rapidly in the last 10 years and that in 2020 was $0.057 per kWh and $0.039 per kWh, respectively.

That means geothermal energy is about 25% more expensive to produce than solar, and about 82% more expensive than onshore wind.

As far as costs and lead times, solar and wind power are the clear winners over geothermal energy, as this IRENA graph shows.

The Relative Effectiveness Of Geothermal Power

As mentioned, geothermal power is not intermittent and plants can produce for more hours than solar or wind systems. The measure of how much electricity any given plant produces compared to its theoretical maximum possible output is called the “capacity factor.” It’s an important measure because it indicates how fully a power plant can be used.

Let’s compare the capacity factors of different energy sources, again using IRENA’s data.

In 2020, the global average capacity factor for new geothermal plants was 83%, ranging from a low of 75% to a high of 91%, while the average capacity factor for new, utility-scale solar PV plants was 16.1% and that for onshore wind farms was 36%, per IRENA.

That means the capacity factor, i.e., the effectively available hours of operation, for geothermal plants was five times higher than for solar and 2.3 times bigger than for onshore wind.

The Relative Efficiency Of Geothermal Power

The amount of usable energy that any power generation technology produces compared to its energy input is called “energy conversion efficiency.”

The highest reported conversion efficiency is approximately 21% at an Indonesian geothermal plant, with a global efficiency average of around 12%, according to a 2014 worldwide review of 94 geothermal plants published in the “Geothermics” journal.

The energy conversion efficiency of new, commercially-available photovoltaic panels is now between 21% and 23%, with researchers that have already developed solar cells with efficiencies approaching 50%. Wind turbines extract on average about 40% of the energy from the wind that passes through them.

Bottom Lines

Basically, geothermal power is five-times more expensive to develop and install than solar, and around two- to three-times more time consuming, but it can produce five times the energy of solar and more than twice that of wind power per MW, as it can work day and night, winter and summer, doldrums and gale — unlike solar and wind (unless one uses battery systems, the development of which is fast progressing, but that presently can only cover a few hours of consumption every day, as is well known in the industry).

But geothermal energy is also a quarter more expensive to produce than solar, almost twice as expensive as onshore wind and its energy conversion efficiency is around 10 percentage points lower than solar PV, and about three- to four-times lower than wind power.

One can capture the combination of these different factors by looking at the dual efficiency score for renewable energies. The higher the score, the better a technology performs on a wide series of criteria.

This score summarizes economic dimensions as inputs on one side, and energy, environmental and social dimension as outputs on the other, based on data from IRENA, the World Bank and the Yale Center for Environmental Law and Policy, as illustrated in a recent study focusing on Organisation For Economic Cooperation And Development (OECD) countries and published in the “Sustainability” journal.

The authors warn that “reliable data for geothermal energy were available for only three countries, Chile, Mexico, and Turkey [in] 2014, with an efficiency score of 77.9%, 72.8%, and 86.4%, respectively.” These data compare with an average of 92.98% for wind and solar energy in 2016, per the study.

It should be reiterated that in the five to seven years since these data were collected, costs for solar and wind have fallen considerably, while their energy efficiencies have increased, as opposed to geothermal energy, whose costs have increased and whose energy efficiency has remained stable.

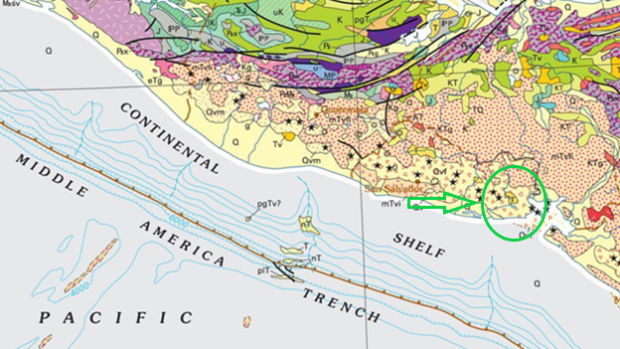

Even so, the geothermal energy in the Central American country considered in the study (Mexico) and sharing some of the same tectonic plates and geological formations as El Salvador, has a dual efficiency of less than 73% — more than 20 percentage points below solar or wind’s dual efficiency.

Is Solar A Better Initial Fit For Bitcoin City?

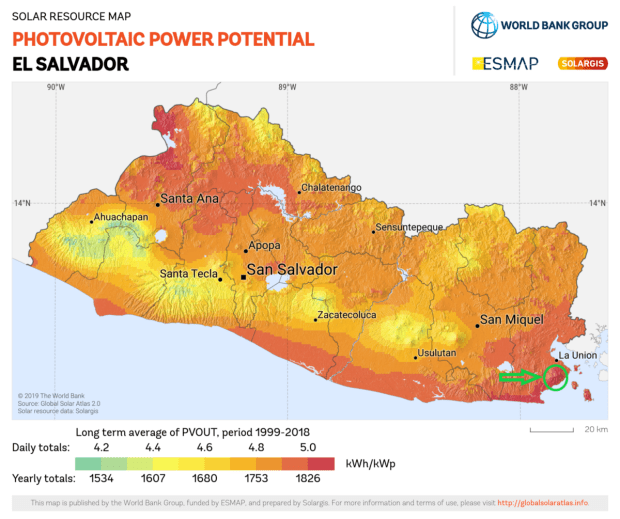

Even if El Salvador has a rainy season from May to October, the area of the Colchagua volcano, in the southeast of El Salvador, is blessed with very high sun irradiation, as the below illustration of El Salvador’s photovoltaic power potential shows.

As an example, one only needs to look at the Capella Solar PV-plus storage facility which officially opened in December 2020, providing electricity and power reserve to El Salvador’s grid.

The Capella Solar operation is located in the Usulután department in El Salvador’s southeast — in the same area as the Bitcoin City would be, about 100 kilometers to the west of the Colchagua volcano.

The solar plant is now the country’s largest. It has a 20-year power purchase agreement with local power distributors at an average price of $0.049 per kWh ($49.55 per megawatt hour [MWh]), which is now the cheapest energy in the Salvadoran market. Attached to it, there is a 3.2 MW and 2.2 MWh lithium-ion battery storage system, which provides frequency regulation support to the grid and is the largest system of its type to date in Central America.

Volcano Bonds

President Bukele intends to finance construction of Bitcoin City by issuing a series of so-called “volcano bonds.” worth $1 billion each, carrying a coupon of 6.5%. The name refers to the idea that these 10-year bonds will be backed by bitcoin, both mined with “volcano energy” and bought on the market. Half of the sum would go to buying bitcoin on the market and the other half would pay for the city’s infrastructure, such as the development of bitcoin mining facilities, Bukele has said. The first 10-year bond should be issued this year and others will follow.

As construction is to be funded by volcano bonds, which are to be backed by bitcoin, which are at least in part to be mined with geothermal energy, timing and costs of the energy infrastructure is a key factor both for the long-term sustainability of the city and the upfront financial viability of the project itself.

The biggest bang for El Salvador’s buck would come from mining its own bitcoin with its own renewable energy as soon as possible, as opposed to buying bitcoin on the market. As any miner would attest, access to the cheapest possible energy is the single most important factor in determining the viability of a mining project.

If time and cost are of the essence for bitcoin mining and Bitcoin City, then maybe geothermal energy is not the best possible option.

Developing a geothermal project presents a unique set of challenges when it comes to assessing the resource and how the underground reservoir will react once production starts. Underground resource assessments are expensive and need to be confirmed by test wells. Bukele has said that engineers have already done at least part of this job.

“Much, however, will remain unknown about how the reservoir will perform and how best to manage it over the operational life of the project,” IRENA has stated. “In addition to increasing development costs, these issues mean geothermal projects have very different risk profiles compared to other renewable power generation technologies, in terms of both project development and operation.”

Mix It Up

Research focusing on the relationships between energy flows and urban development has shown that “intensive and diversified energy sources build up the structure and enhance metabolism in urban areas,” according to a study published in “Ecological Modelling.”

As geothermal energy is home grown in El Salvador, as well as less polluting, more available than many other sources and directly usable both for thermal and electric energy generation, it’s certainly worth pursuing, but not necessarily as a first choice. It would probably work better as a component of a wider renewable energy mix.

One should be able to install a utility-sized solar PV field in about a year and start mining bitcoin much sooner than in the two to three years minimum that a geothermal project would take. That headstart could make a big difference in making the financial foundations of volcano bonds sounder and Bitcoin City more likely to succeed.

This is a guest post by Lorenzo Vallecchi. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.