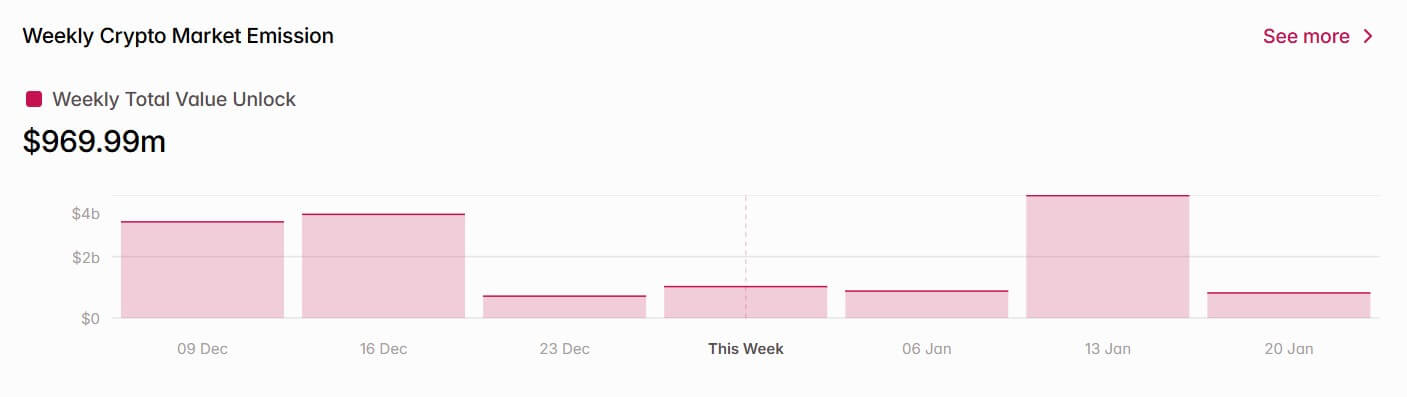

The crypto industry begins the year with approximately $7 billion in tokens set to be unlocked throughout January, according to data from Tokenomist (formerly Token Unlock).

Crypto unlocks are designed to gradually release cryptocurrencies, often to prevent significant sell-offs by early investors or team members.

While this process ensures a controlled flow of tokens into circulation, it typically results in short-term price declines. Recent analysis shows that most token unlocks negatively impact prices, though the effects may take weeks to materialize fully.

January unlock

January’s unlocking schedule includes a mix of one-time “cliff” unlocks and steady “linear” releases. Cliff unlocks—large, one-time releases—linear unlocks will distribute tokens gradually throughout the month.

The first week alone will release around $1 billion worth of tokens, with $3.7 billion expected in the third week between Jan. 13 and Jan. 19.

On Jan. 1, the market witnessed the release of 64.19 million SUI tokens worth $270 million. This event allocated tokens to investors, community reserves, and the Mysten Labs treasury.

Similarly, ZetaChain unlocked 54 million ZETA tokens, valued at $42 million, to fund growth initiatives, advisory roles, and liquidity incentives.

Other significant unlocks this month include:

- Kaspa (KAS): Releasing 182.23 million tokens worth $20 million on Jan. 6.

- Ethena (ENA): Unlocking 12 million tokens worth $12.16 million for ecosystem development by Jan. 8.

- Optimism (OP): Distributing 31.34 million tokens valued at $57 million by Jan. 9.

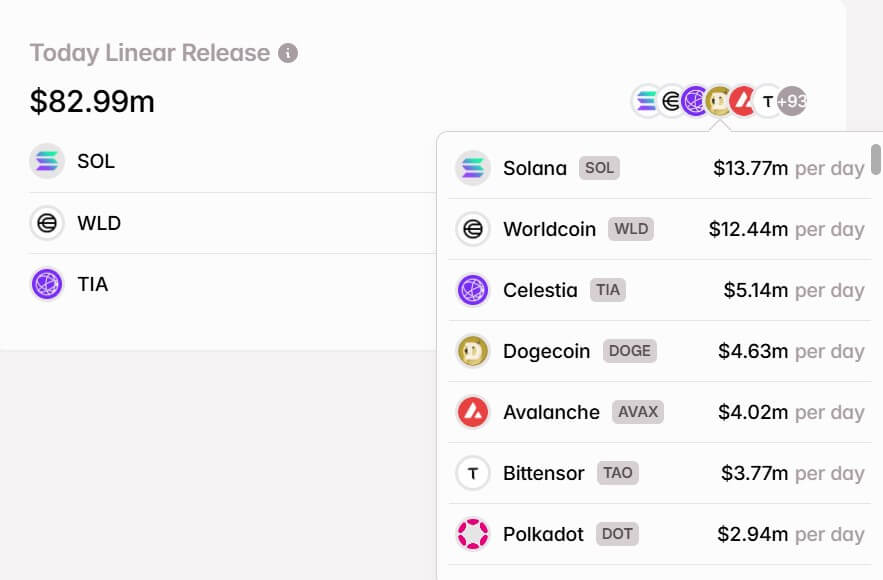

Linear unlock

Linear unlocks, which distribute tokens daily, add a steady stream of new supply throughout the month, led by several high-profile projects.

Key projects in this trend include:

- Solana (SOL): Unloading $14 million worth of tokens daily.

- Worldcoin (WLD): Releasing $12.4 million per day.

- Celestia (TIA): Unlocking $5.1 million daily.

- Dogecoin (DOGE): Releasing $4.63 million daily.

- Avalanche (AVAX): Unlocking $4.02 million per day.

- Polkadot (DOT): Distributing $2.94 million daily.

The post January to see $7 billion crypto token unlock amid market uncertainty appeared first on CryptoSlate.