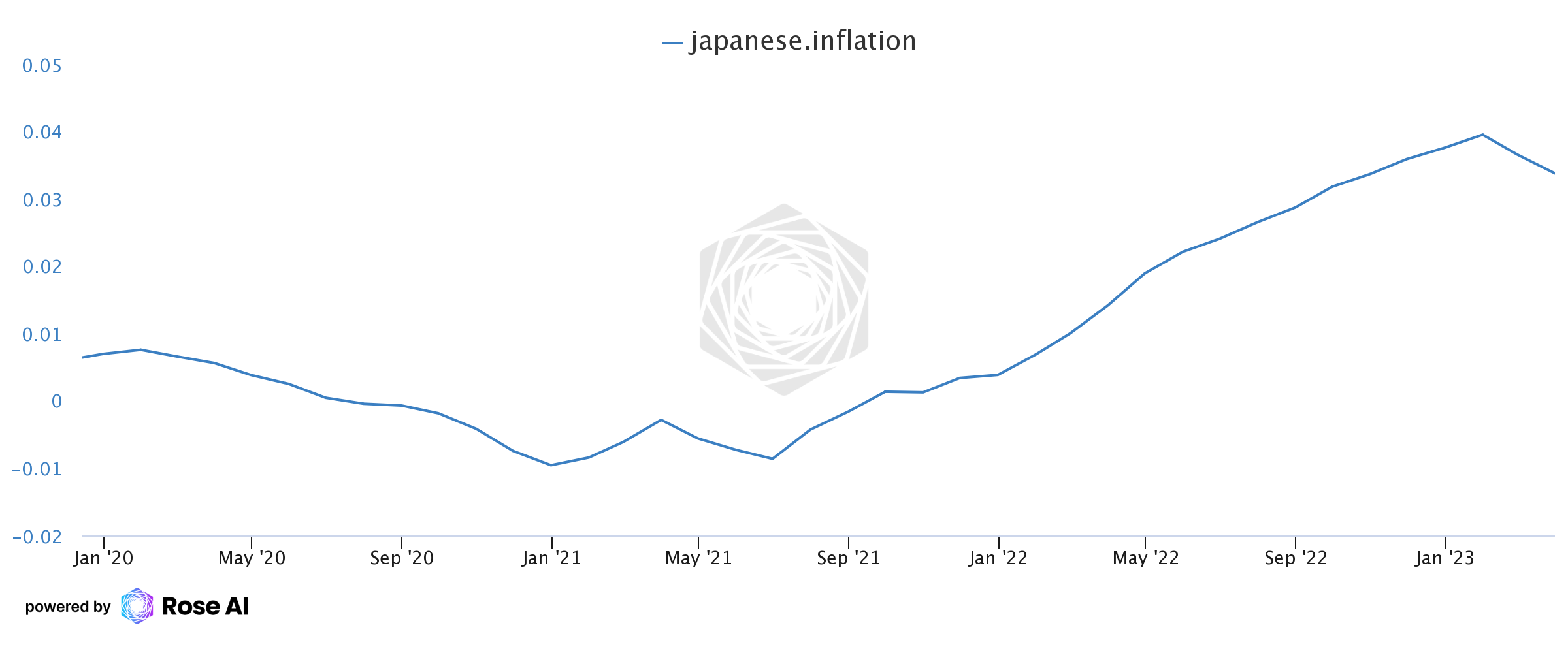

This week, the Statistics Bureau of Japan unveiled the latest core consumer price index (CPI) report for the country, revealing a surge to 3.5%. This figure comes as a surprise to analysts who had predicted a more modest 2.9% for the end of the quarter. It’s worth noting that Japan’s inflation has been steadily rising since June 2021. The timing of this uptick is also notable, as Kazuo Ueda has recently assumed the role of the 32nd governor of the Bank of Japan.

New BOJ Governor Faces Rising Inflation, Central Bank to Conduct Review of Monetary Policy Measures

In April, Japan experienced a surge in its year-over-year inflation rate — excluding fresh food and energy prices — which increased to 3.5%. This worsening inflation rate is a concern for the Bank of Japan (BOJ), which aims to bring the rate back down to the 2% range, like several central banks worldwide. However, the country’s economy is facing significant challenges, including the aftermath of the Covid-19 pandemic, which resulted in substantial stimulus measures and lockdown policies.

Moreover, Japan is grappling with a shrinking workforce, which could significantly affect its ability to sustain economic growth. These challenges are compounded by the fact that the BOJ has a new governor, Kazuo Ueda, who addressed his first monetary policy meetings on April 27 and 28. Ueda, a Japanese economist, has opted to keep interest rates unchanged, maintaining the negative rate that Japan has held since 2016.

‘The Last and Final Source of Excess Liquidity’

The recent news is likely to add pressure on the BOJ to address the country’s accelerating inflation rate. The central bank, however, stated that it has “decided to conduct a broad-perspective review” of its monetary policy measures, indicating that it may explore new approaches to stabilize the economy. As the BOJ grapples with these challenges, it remains to be seen how it will navigate Japan’s economic future.

“With extremely high uncertainties surrounding economies and financial markets at home and abroad, the bank will patiently continue with monetary easing while nimbly responding to developments in economic activity and prices as well as financial conditions,” the BOJ announcement notes. “By doing so, it will aim to achieve the price stability target of 2 percent in a sustainable and stable manner, accompanied by wage increases.”

Overall, the country’s recent CPI report highlights the challenges that Japan’s economy is facing. On Friday, Hiromi Yamaoka, a former BOJ official, told CNBC’s “Squawk Box Asia” that “there remains some uncertainty in the Japanese real economy, but at the same time, inflationary pressures is becoming more imminent.”

Graham Summers, an MBA at Phoenix Capital Research, believes that Japan may be the final straw in terms of liquidity. On Friday, Summers wrote, “With inflation surging in Japan, the Bank of Japan will soon be forced to end its money printing, which means the financial system would lose its last and final source of excess liquidity.”

What do you think the BOJ’s broad-perspective review of its monetary policy measures will entail, and how do you believe it will impact Japan’s economic future? Share your thoughts in the comments section below.