The United States Patent and Trademark Office (USPTO) has granted JPMorgan Chase Bank’s trademark registration for “J.P. Morgan Wallet” for use in a wide range of financial services, including virtual currency transfers and exchanges, as well as crypto payment services.

JPMorgan Chase’s Wallet Trademark

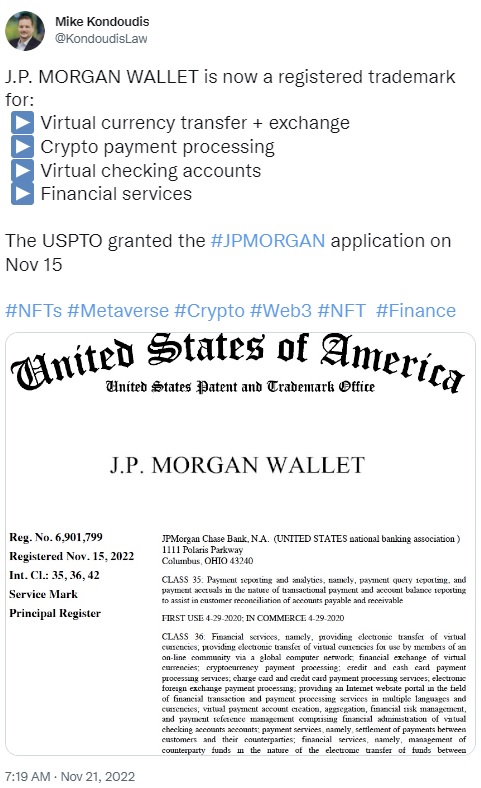

JPMorgan Chase Bank has successfully registered a wallet trademark with the United States Patent and Trademark Office (USPTO). Mike Kondoudis, a USPTO-licensed trademark attorney, tweeted Monday that “J.P. Morgan Wallet” is now a registered trademark.

JPMorgan Chase Bank N.A. is listed as the trademark owner. The USPTO granted the bank’s trademark registration on Nov. 15; the application date was July 24, 2020.

The services listed for the J.P. Morgan Wallet trademark include “electronic transfer of virtual currencies,” “financial exchange of virtual currencies,” and “cryptocurrency payment processing,” the USPTO website shows.

JPMorgan Explains What J.P. Morgan Wallet Is and How It Works

The JPMorgan website provides more information about the J.P. Morgan Wallet, which is part of the bank’s e-commerce service for merchants. The firm described the wallet as:

Real-time virtual sub-ledgers that help manage and scale any number of customer, supplier and vendor payments in an organized, easy-to-reconcile way.

The website adds that the wallet connects “via APIs to help simplify domestic and cross-border receivables and disbursements,” noting that it is used “globally for management of highly-scalable virtual accounts in real-time.”

The banking giant further explained that it is “developing sophisticated payments solutions like connected mobility solutions and blockchain platforms that can help you say more to the world.” The firm’s blockchain-based ecosystem is called Onyx by J.P. Morgan.

Onyx has its own coin system that enables “instant transfer and clearing of multi-bank, multi-currency assets on a permissioned distributed ledger,” JPMorgan detailed, adding that its inaugural product solution is JPM Coin. The firm described JPM Coin as “a permissioned system that serves as a payment rail and deposit account ledger that allows participating J.P. Morgan clients to transfer U.S. dollars held on deposit with J.P. Morgan within the system.”

What do you think about JPMorgan Chase obtaining a trademark for J.P. Morgan Wallet? Let us know in the comments section below.