Bitcoin has faced intense selling pressure since Tuesday, following a strong breakout above the $100K mark. The rally, which many investors hoped would solidify Bitcoin’s bullish structure, quickly reversed, driving the price down to a low of $92,500. The sudden downturn has rattled market sentiment, leaving investors cautious about the immediate direction of the crypto market leader.

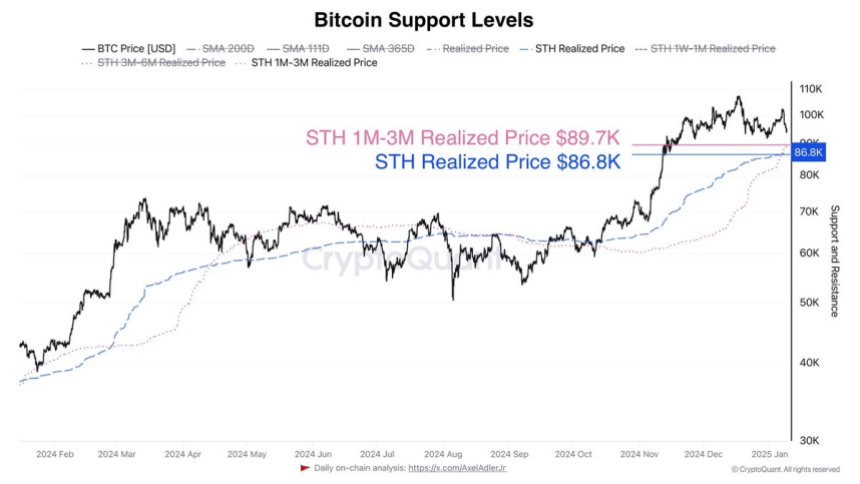

Top analyst Axel Adler has shared crucial data on X, highlighting Bitcoin’s nearest support levels. According to Adler, the key levels to watch are between $86.8K and $89.7K, representing the short-term holders’ realized price. These metrics suggest that Bitcoin is approaching a significant demand zone, where accumulation might take place if the selling pressure eases.

As Bitcoin consolidates near these levels, the market waits for signs of stabilization. Whether Bitcoin can recover from this setback or extend its correction remains uncertain. However, the current support levels could serve as a turning point, offering a foundation for bulls to regain momentum.

Bitcoin Consolidates Between Key Levels

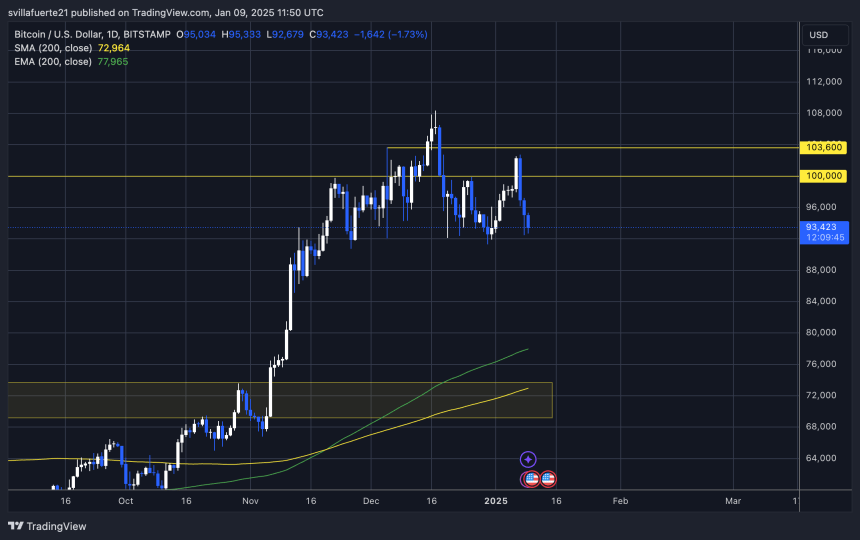

Bitcoin is navigating a critical consolidation phase, with the price fluctuating between $100K and $92K. While there have been brief deviations above the $100K mark, the market leader has struggled to maintain momentum, raising concerns about a potential drop to lower demand zones. Investors and analysts alike are closely monitoring this range, with expectations of Bitcoin finding stronger footing below the $90K area.

Top analyst Axel Adler recently shared insights on X, shedding light on Bitcoin’s nearest support levels. According to Adler, the Short-Term Holders 1M-3M Realized Price is currently $89.7K, while the broader Short-Term Holders Realized Price sits at $86.8K.

These levels represent key demand zones that could provide Bitcoin with the fuel needed for its next rally. A dip into these areas would likely attract buyers, setting the stage for a potential reversal.

This period of consolidation is seen as pivotal for Bitcoin, as holding above or reclaiming key levels like $92K will determine its trajectory. While the broader market sentiment remains cautious, a drop into these lower support zones could offer a significant accumulation opportunity for long-term investors. The coming days will be crucial in deciding whether Bitcoin can stabilize and prepare for a renewed bullish push.

BTC Faces Critical Support Test Below $95,000

Bitcoin is trading at $93,400, navigating a precarious position as it faces increasing risk with each moment spent below the $95,000 mark. After a brief surge above $100K earlier this month, the bulls lost control, failing to sustain support above this psychological level. This decline has left Bitcoin vulnerable to further downside, with investors closely watching key support levels.

For bulls to regain momentum, reclaiming the $95K level is crucial. Beyond this, the $98K mark must also be retaken to confirm a bullish consolidation and signal strength in the market. Until then, uncertainty looms, with Bitcoin’s current range reflecting a lack of decisive control by either side.

The critical $92K support level now acts as a short-term safety net. However, losing this level would expose Bitcoin to lower demand zones around $85K, a key area that could attract buyers and stabilize the price. The next few days will be pivotal as Bitcoin either stages a recovery or risks a deeper correction.

Featured image from Dall-E, chart from TradingView