Kronos Research, a Taipei-based market maker, trading firm, and venture capital fund, witnessed the withdrawal of significant amounts of crypto assets due to a breach of its security system.

Kronos Breach: Investigation Underway

On Sunday, November 19, Kronos Research disclosed – via a post on X (formerly Twitter) – a security incident that involved unauthorized access to its API keys. Consequently, the company lost a significant amount of crypto funds and has halted all trading operations in a bid to launch a full investigation into the incident.

In the interest of transparencyAround 4 hours ago, we experienced unauthorized access of some of our API keys. We paused all trading while we conduct an investigation. Potential losses are not a significant portion of our equity and we aim to resume trading as soon as possible.

— Kronos Research

(@ResearchKronos) November 18, 2023

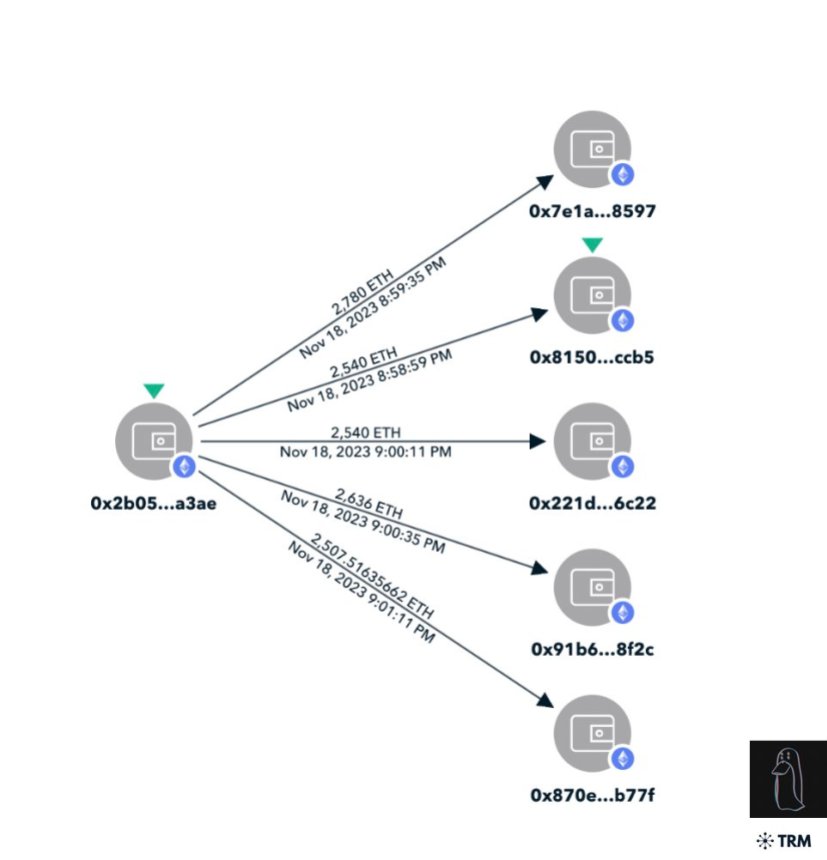

A map of funds outflow by on-chain sleuth ZachXBT summed Kronos’ losses to over $25 million in Ether. In a follow-up post on X, the company also confirmed that the losses are about $26 million in crypto assets.

In its initial announcement, Kronos revealed that the potential losses are not a significant portion of its equity. Meanwhile, the trading firm said in its latest update that all losses will be covered internally, and no partners will be affected.

Although Kronos has yet to provide an update on its resumption process, the company did say that it aims to resume trading as soon as possible.

This $26 million attack on Kronos Research represents the third most significant crypto theft in November 2023. Before this latest incident, data from blockchain security firm Certik revealed that about $173 million had been lost to crypto attacks in November, with Poloniex’s $113 million hack being the most notable yet.

How Did This Hack Affect WOO X?

Interestingly, Kronos is not the only one affected by this security incident, as WOO X is another cryptocurrency entity that has had to pause its operations momentarily. WOO X is an exchange on which Kronos functions as the market maker for its spot and perpetual futures markets.

In an address on the X platform, WOO X acknowledged Kronos’ security situation and announced a temporary pause on all trading to protect users’ positions from a lack of liquidity. The exchange, however, emphasized that all customer funds are safe.

As of this writing, WOO X has resumed trading in both the spot and perpetual futures markets. Meanwhile, the exchange claims that clients can now make withdrawals for all assets.

Nevertheless, the trading platform has faced some backlash from the online crypto community, with some people pointing to its unclear relationship with Kronos.