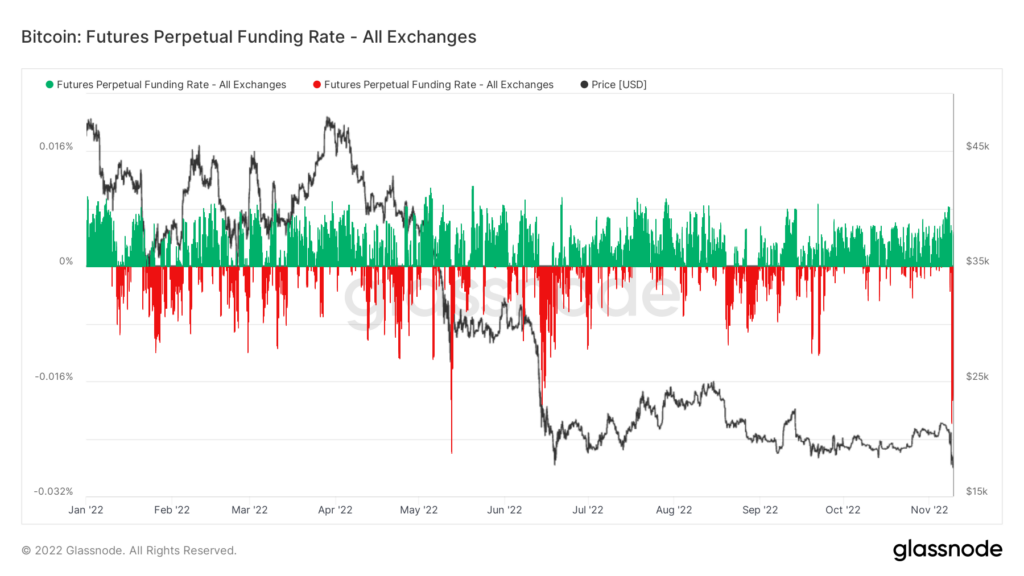

The second most significant short of the year has assisted in sending Bitcoin to $17k. Amid the turmoil in the crypto markets due to the uncertain future ahead for the FTX exchange, prices across the board tanked on Nov. 8. Capitilizating on the situation; short positions were opened up at a volume not seen since the Terra Luna collapse in May.

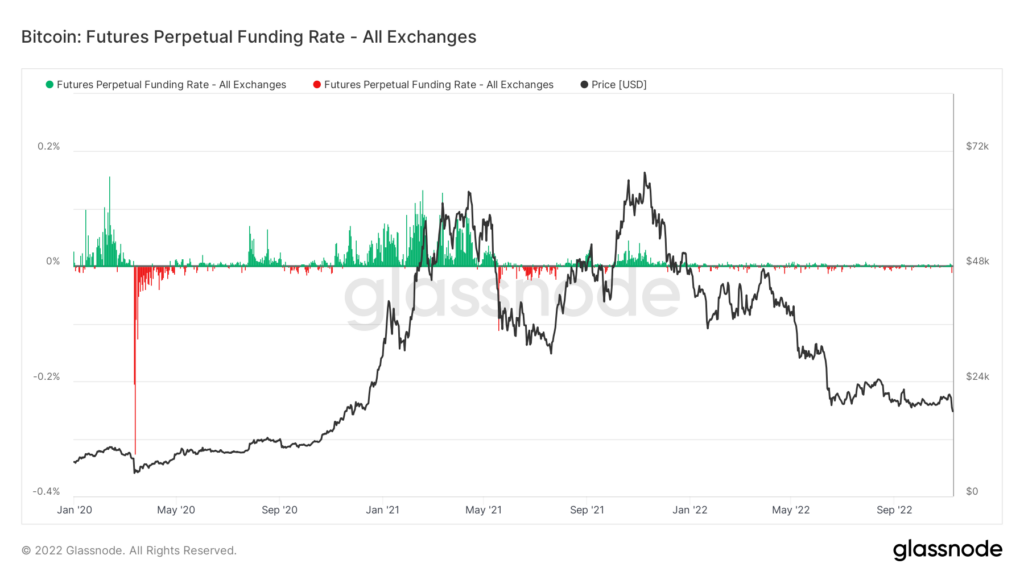

The average funding rate (in %) set by exchanges for perpetual futures contracts is currently negative. When the rate is positive, long positions periodically pay short positions. Conversely, when the rate is negative, short positions periodically pay long positions. While the funding rate is close to the level seen in May, it has spiked below the neutral line. However, the rate is nowhere near the negative funding rate recorded during the COVID-19 crash of March 2020.

Each time BTC makes a capitulation low, traders will often short aggressively. These positions typically mark a new bottom in the short term. A similar situation happened during the COVID-19 crash, the miner ban in china in 2021, the Terra Luna collapse, and now the potential failure of FTX.

There has been $861 million in crypto liquidations over the past 24 hours, with $250 million made up of Bitcoin shorts, according to data analyzed from Coinglass. Bitcoin is currently down 15% over the past 48 hours, trading at $17,453 as of press time.

The post Large short positions push Bitcoin toward $17k amid $861M in crypto liquidations appeared first on CryptoSlate.