The global crypto investment market has witnessed a significant influx of capital, with recent reports indicating a continued positive trend in inflows. According to the latest data from CoinShares, digital asset investment products have seen an additional $1.35 billion in net inflows last week.

This recent injection of funds has brought the total for the current positive streak to $3.2 billion. The fact that money has been flowing to this extent is a testament to the amount of steam behind recent market sentiment and confidence among investors regarding cryptocurrencies.

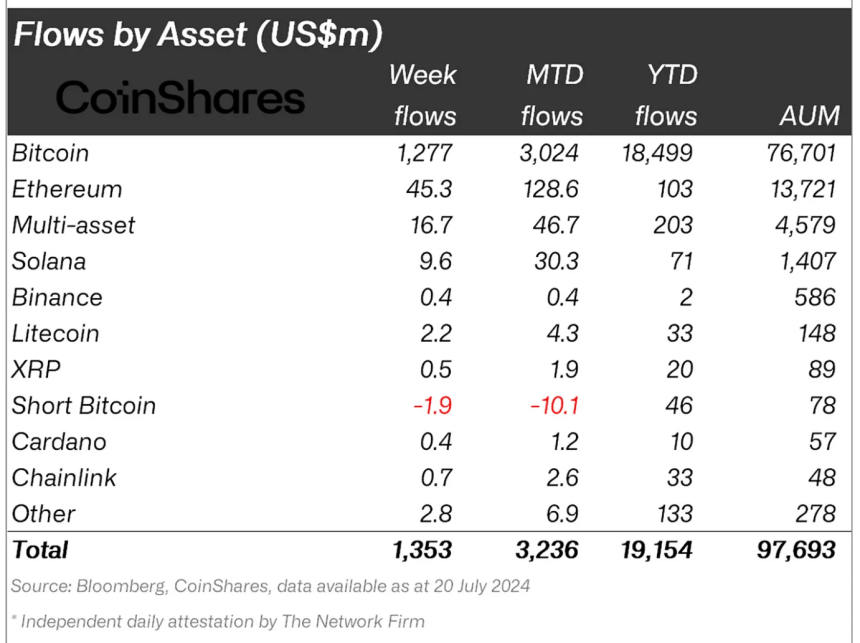

According to Coinshares, this inflow trend is not isolated to one particular cryptocurrency but is rather widespread across various digital assets.

The report reveals that major asset managers such as Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares, and 21Shares have all reported substantial inflows.

Which Crypto Asset Led The Charge?

Unsurprisingly, most investments still flow into Bitcoin, with decent contributions from Ethereum and other altcoins.

According to the report, Bitcoin registered roughly $1.27 billion of inflows last week, with short-Bitcoin exchange-traded products (ETPs) seeing further outflows of $1.9 million, bringing outflows since March to US$44 million.

Notably, the transaction volume spurred so far has contributed to a 45% week-over-week increase in ETP trading volumes, representing 22% of the broader crypto market’s total trading volumes.

Aside from Bitcoin’s continuous dominance, Ethereum’s recent performance relative to other altcoins has also been noteworthy.

James Butterfill, Head of Research at CoinShares, noted a turning point in investor portfolio allocation, with Ethereum overtaking Solana for net inflows year-to-date. Butterfill noted:

The outlook for Ethereum seems to have turned a corner, seeing a further US$45m of inflows last week, overtaking Solana for the altcoin with the most inflows year-to-date (YTD) at US$103m. Solana also saw inflows last week totalling US$9.6m, but now lags Ethereum with US$71m inflows YTD.

This change can be seen as important since it suggests a larger market rotation where investors may be re-aligning their portfolios with Ethereum as it continues to see potential strong long-term growth prospects, such as the upcoming launch of its spot exchange-traded funds (ETFs).

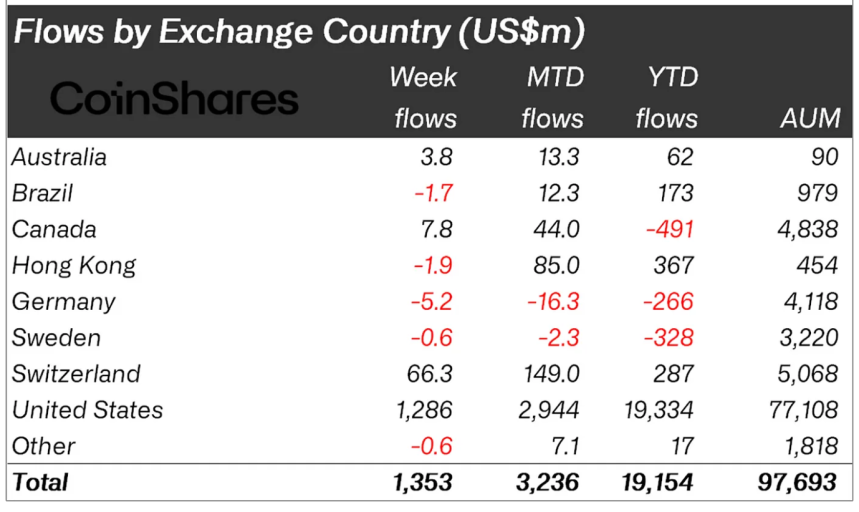

Furthermore, investment flows have also varied significantly across regions. While the US and Switzerland top the table by a margin, there were only small net outflows from Brazil and Hong Kong.

Market Performance Over The Past Week

While the crypto market fund flows have been positive in the past week, the global price performance also appears to have mirrored this positiveness. Over the past week, the global crypto market valuation has surged from $2.4 trillion to $2.6 trillion.

This increase comes against the backdrop of Bitcoin seeing a notable recovery that brought its price to trade as high as above $68,000 earlier today before now trading below $67,000 at the time of writing.

Ethereum and Solana, on the other hand, have also managed to see a recovery in price, just like Bitcoin. Interestingly, although Ethereum seems to be overtaking Solana in fund flows, SOL refuses to accept defeat regarding price performance.

Particularly, according to data, between these two assets, SOL has been the top gainer over the past week, up by 16.8%, a significant difference compared to ETH’s mere 2.6% surge over the same period.

Featured image created with DALL-E, Chart from TradingView