Consultancy firms and lawyers handling FTX’s bankruptcy have charged the failed exchange over $145 million for their five-month services, according to court filings.

The companies involved in FTX’s bankruptcy case include law firms Sullivan & Cromwell, Landis Rath & Cobb, and Quinn Emanuel Urquhart & Sullivan. Others are management consulting firms Alvarez & Marsal North America and AlixPartners.

Sullivan Cromwell has billed FTX roughly $70M

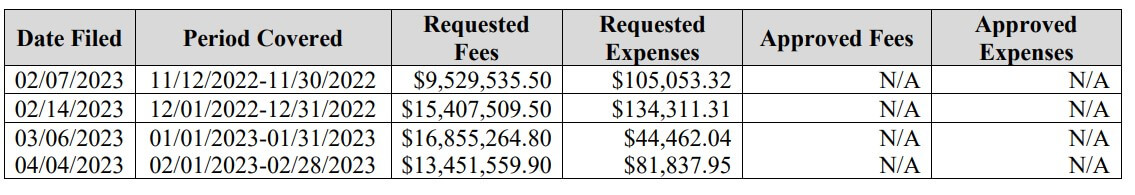

Law firm Sullivan & Cromwell (S&C) has charged $69,304,890 for its five-month services to the bankrupt exchange, according to a court filing.

Within the first month of its service, S&C sought compensation of $9.5 million, describing its services as “one of the most complicated, multi-disciplinary exercises by any law firm.”

Subsequent services have attracted double digits fees from the bankruptcy lawyers. According to the court filing, the firm charged FTX $15.4 million for its services in December 2022 and charged the exchange $27,512,580.6 this year.

In all of these charges, S&C has always maintained that 80% of the charges were “actual, reasonable and necessary.”

Besides that, the law firm said it incurred additional expenses of roughly $450,000 for its work during the five months.

Meanwhile, S&C’s appointment as FTX’s advisor was fraught with issues. FTX founder Sam Bankman-Fried accused the law firm of pressuring him to file for bankruptcy because of the fees it stood to earn. Four U.S. lawmakers also objected to its appointment, citing a conflict of interest over its previous relationship with the bankrupt exchange.

However, FTX’s CEO, John Ray, defended the law firm, saying its services were essential to safeguard the best interest of FTX and its stakeholders.

Alvarez & Marsal charges over $50M

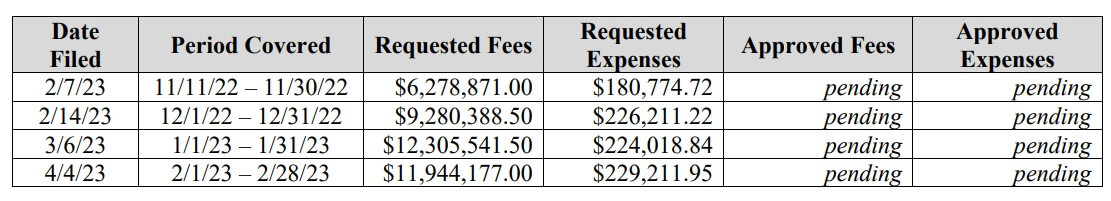

Financial advisor to FTX, Alvarez & Marsal, has charged the bankrupt exchange $53,129,184.5 for its services between November 2022 and March 2023.

Within the first two months of its services, Alvarez & Marsal charged FTX over $15 million for its services. The consultancy firm has subsequently charged $37.5 million for its services in 2023.

During this period, Alvarez & Marsal said it incurred additional expenses of $1.4 million.

According to its filings, some of its services for FTX include avoidance actions, financial analysis, business operations, due diligence, accounting procedures, etc.

Like S&C, the firm has maintained that 80% of the charges were “actual, reasonable and necessary.”

Others charged around $21M

Other firms like Landis Rath & Cobb, Quinn Emanuel Urquhart & Sullivan, and AlixPartners charged FTX around $21 million for their services.

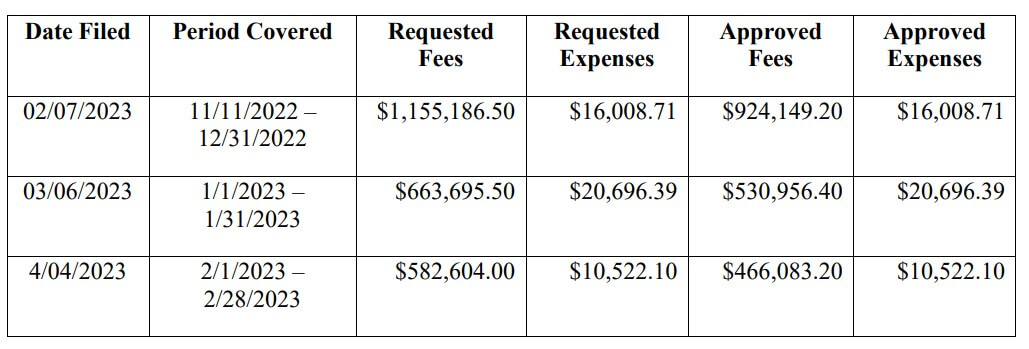

According to court filings, Landis Rath & Cobb charged the bankrupt exchange $3.04 million. Of this fee, the firm revealed that the court had approved $1.9 million and its additional expenses of $47,257.

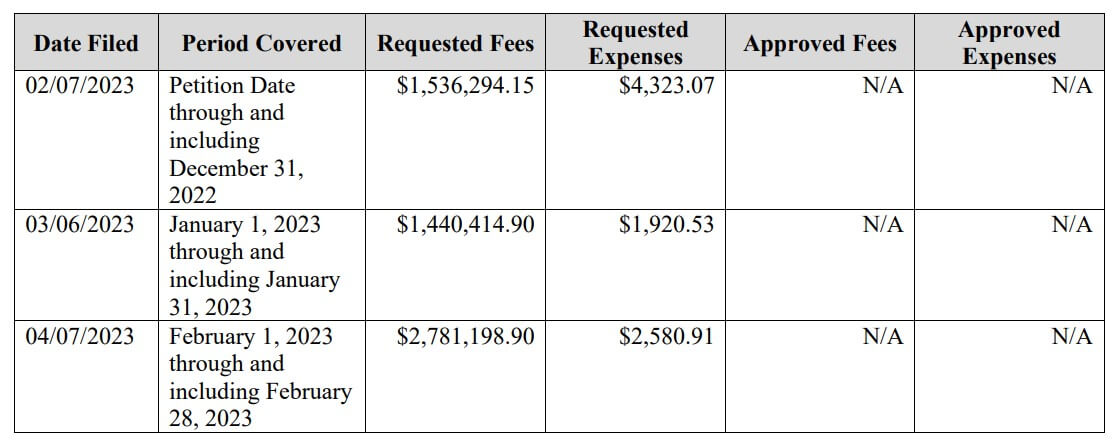

Law firm Quinn Emanuel Urquhart & Sullivan charged FTX $8.95 million for its five months of service. Per the court filing, the firm has incurred an additional $11,854.

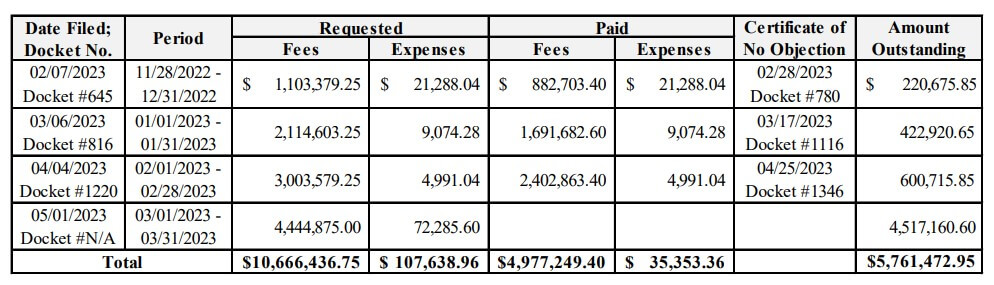

In its filing, management consulting firm AlixPartners said it had charged the bankrupt exchange $10.6 million — of which $4.97 million has been paid. The firm added that FTX paid $35,353 from its $107,638 incurred expenses.

The post Lawyers, consultancy firms charge bankrupt FTX over $145M in 5 months appeared first on CryptoSlate.