Definition

The total amount of coins held on exchange addresses.

STBL is a virtual asset that aggregates the data of all ERC20 stablecoins supported on Glassnode, thereby creating a metric that sums up all exchange balances across stablecoins.

Stablecoins included are: BUSD, GUSD, HSUD, DAI, USDP, EURS, SAI, sUSD, USDT, USDC.

Quick Take

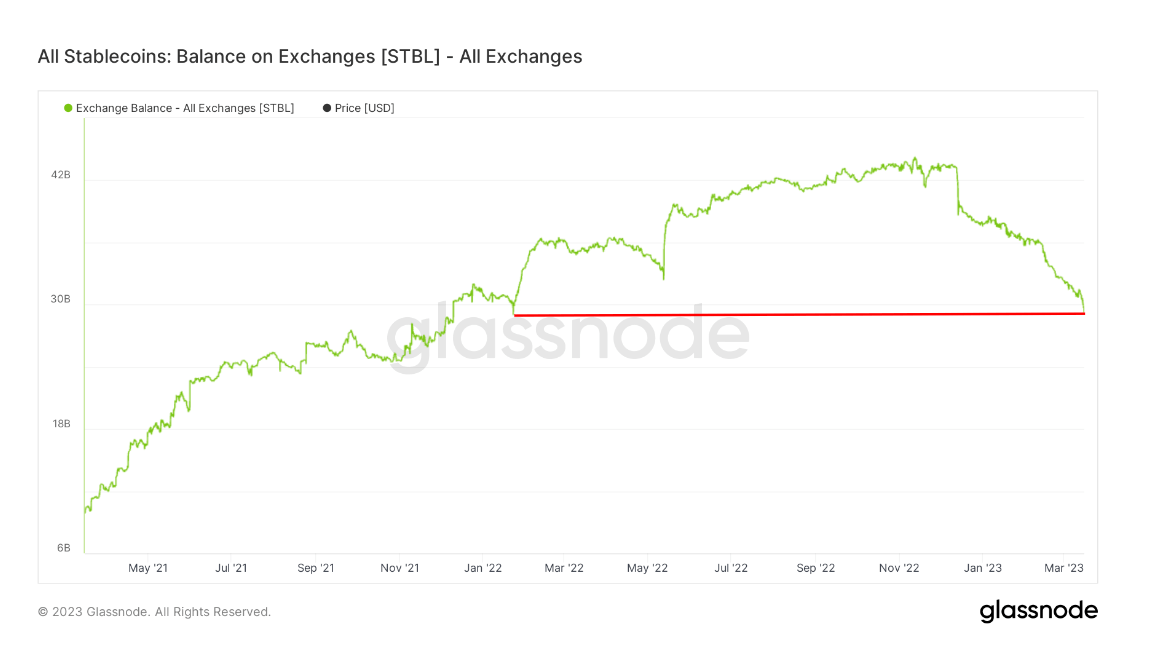

- Less than $30 billion worth of stablecoins now sits on exchanges, the lowest amount since December 2021.

- In the past four months, almost $15 billion worth of stablecoins has been withdrawn from exchanges.

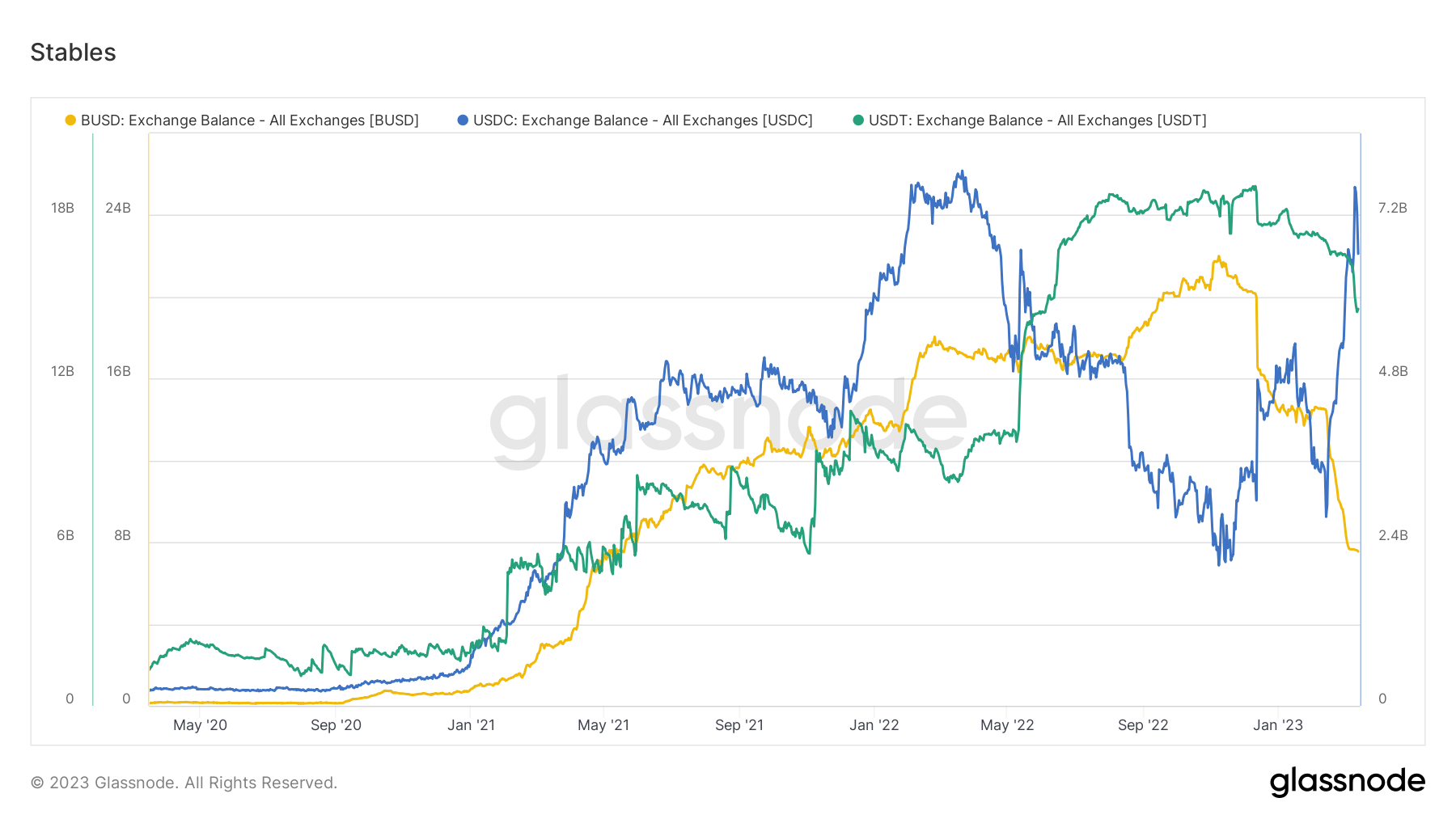

- Most withdrawals have come from BUSD, but USDC and USDT have also seen withdrawals from exchanges recently.

- We expect this trend to continue as the economy heads risk-off and redemptions occur from stablecoins into fiat.

The post Less than $30B of stablecoins now sit on exchanges, wiping out all of 2022’s gains appeared first on CryptoSlate.