Data reveals a significant imbalance in the Polymarket order book for the 2024 US Election.

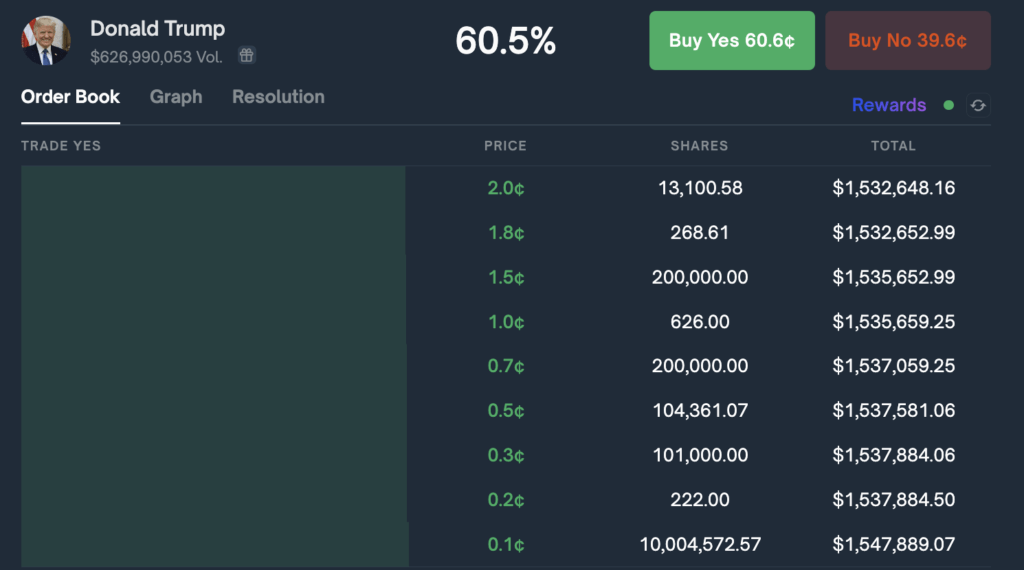

The market betting on a Donald Trump victory currently has asks totaling $32 million and bids at $1.5 million, resulting in a market depth of $33.5 million. Given the nature of prediction markets, which are timed events, it is unsurprising that there would be greater sell-side pressure.

For Trump, $28 million of the $32 million sell orders are placed above $0.99, leaving just $4 million in the rest of the sell-side of the order book.

The total asks above the current price for Harris totals $17 million, with $13 million placed above $0.99, leaving a similar value to Trump for the rest of the sell-side of the order book.

Surprisingly, there is a lack of depth both around and below current prices. There is only around $2.5 million in visible market depth between $0.01 and $0.62, with the current price at $0.60.

In contrast, the market for a Kamala Harris victory has $3.5 million in orders within the same range. Trump has $1.5 million in total bids, and Harris has $1.4 million, as of press time.

With Trump and Harris having low ask values up to $0.62, the liquidity required to theoretically move the market substantially is just over 1.4% of the current reported open interest, around $4 million.

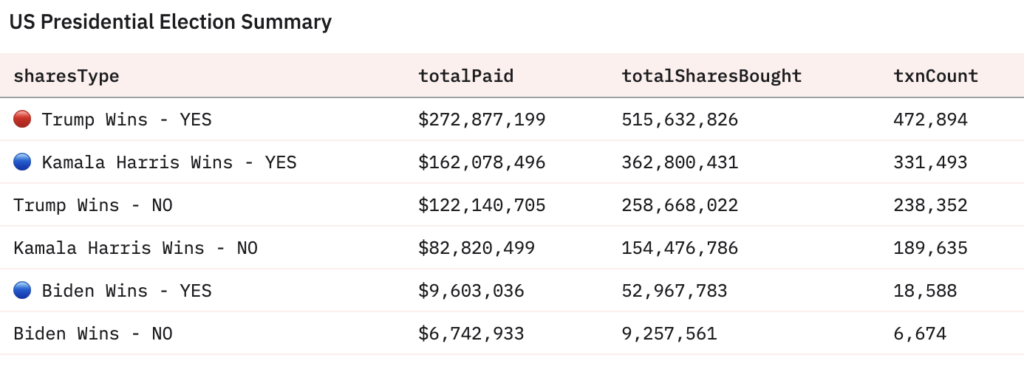

According to Dune Analytics, the open interest for the Trump market alone stands at $276 million. Thus, currently visible market depth suggests that current trading interest represents only a fraction of the total outstanding positions.

Additionally, discrepancies have emerged between reported open interest and actual betting volumes. Trump bets appear to surpass the platform’s total reported open interest of $239 million, as listed by The Block.

Industry observers have noted challenges accessing open interest information on Polymarket’s website. Hasu, strategy lead at Flashbots, pointed out on social media the difficulty in locating these figures and questioned the emphasis on trading volume over open interest.

This data may partly explain why the top four Trump position holders have been placing substantial bets, collectively buying up the order book in recent weeks. $121 million in volume has been traded from the top four accounts, two of which were created this month.

| Trader | Positions Value ($) | Profit/Loss ($) | Volume Traded ($) | Markets Traded | Joined |

|---|---|---|---|---|---|

| Michie | 3,980,981.12 | 341,179.18 | 8,450,962.77 | 0 | Oct 2024 |

| PrincessCaro | 6,978,910.68 | 813,711.08 | 23,473,481.78 | 14 | Sep 2024 |

| Theo4 | 7,280,451.39 | 137,384.50 | 15,206,599.73 | 8 | Oct 2024 |

| Fredi9999 | 16,723,955.99 | 1,556,542.18 | 74,097,607.44 | 45 | Jun 2024 |

| Total | 34,964,299.18 | 2,848,816.94 | 121,228,651.72 | 67 |

These four traders have been persistently betting on Donald Trump since the end of September, placing bets daily and often within minutes of each other.

Therefore, a hypothetical calculation suggests that persistent buy orders totaling around $4 million could significantly move the market, potentially increasing Trump’s odds substantially. This impact is due to the shallow order book above Trump’s current price.

With only $4 million in sell orders between the current price ($0.60) and $0.99, a $4 million buy order would potentially exhaust this liquidity entirely. This could push Trump’s price from $0.60 to nearly $0.99, representing a 65% increase in his odds.

For context, a similar $4 million buy order in the Harris market would have a comparable effect, as the structure of sell orders appears similar.

This $4 million represents just 1.4% of the reported open interest of $276 million for the Trump market, yet due to the current order book structure, it could have a disproportionate effect on the market price.

However, real-world market forces would likely temper this effect. Large orders often attract new liquidity and trigger responses from other market participants. The actual movement might be less dramatic but still significant.

The post Less than $5 million could change the leader in the US Election race on Polymarket appeared first on CryptoSlate.