The post LINK Price at Risk of Dropping to $14.75, Despite Whale Buying appeared first on Coinpedia Fintech News

Despite a notable price drop in recent days, LINK, the native token of Chainlink, remains in the sights of investors and whales. Today, February 18, 2025, a prominent crypto expert posted on X (formerly Twitter) that, amid the recent decline, crypto whales have purchased over 1.10 million LINK tokens in the past 24 hours.

LINK Current Price Momentum

Besides substantial LINK purchases, the token has experienced a notable price drop of over 10% during the same period and is currently trading near $17.50. Meanwhile, the asset’s trading volume has jumped by 20%, indicating heightened participation from traders and investors.

LINK Technical Analysis and Upcoming Levels

Following this notable price drop, the LINK token is poised for further decline as it has confirmed its bearish outlook. At the beginning of February 2025, LINK broke below its crucial support level of $20 and has since been consolidating in a tight range beneath that level.

However, with today’s price drop, the asset has breached its consolidation zone, opening the path for further downside. Additionally, LINK has fallen below the 200 Exponential Moving Average (EMA) on the daily timeframe, confirming that the asset is now in a downtrend.

According to expert analysis, if LINK closes a daily candle below the $17.45 level, there is a strong possibility that the asset could decline by 15% to reach the $14.75 level in the near future.

Short Sellers Take Control

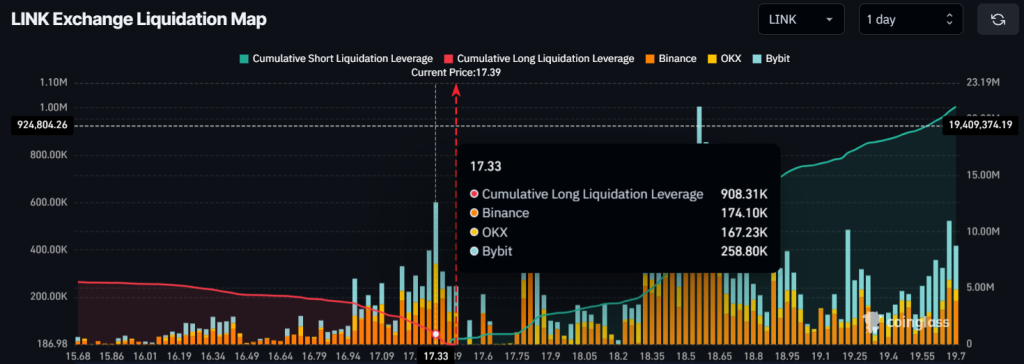

As this bearish price action is confirmed, traders betting on the short side have increased their open positions, believing that the price won’t rally anytime soon, according to on-chain analytics firm Coinglass.

At press time, traders holding long positions are over-leveraged at $17.33, with nearly $1 million worth of long positions. On the other hand, $18.56 is another key level where traders holding short positions are over-leveraged, having accumulated nearly $10 million in short positions.

It appears that short sellers believe LINK’s price won’t surpass the $18.56 level.

When combining these on-chain metrics with technical analysis, it suggests that bears have taken control and that the price could soon experience a significant drop.