Samara Asset Group, a publicly listed German investment firm, has announced plans to raise up to €30 million ($32.8 million) through a senior secured Nordic bond issuance. The capital raise is aimed at expanding the company’s investment portfolio and significantly increasing its Bitcoin holdings, positioning it to potentially rival Michael Saylor’s MicroStrategy.

$32.8 Million In Bonds To Buy Bitcoin

The company has mandated Pareto Securities as the sole manager to arrange a series of fixed-income investor meetings. The bond issuance, subject to market conditions, is intended to be listed on the unregulated markets of the Oslo and Frankfurt Stock Exchanges. The private placement requires a minimum subscription and allocation amount of €100,000.

The bond will be issued by Samara Asset Group p.l.c., with a newly formed special-purpose vehicle (SPV), Samara Asset Holdings Ltd., pledged in favor of the bond and acting as the guarantor. This structure leverages the Nordic bond framework, which is known for its flexibility and investor-friendly terms.

“The proceeds from the bond are intended to expand Samara’s diversified investment portfolio by acquiring additional limited partnership stakes in alternative investment funds, as well as increase its position in Bitcoin, which Samara uses as its primary treasury reserve asset,” the company stated in its official press release.

Patrick Lowry, CEO of Samara Asset Group, expressed enthusiasm about the bond issuance: “We are excited by the prospect of placing this bond and look forward to using the proceeds to acquire more Bitcoin and continue to seed the world’s best emerging managers. The proceeds will allow Samara to further expand and solidify its already robust balance sheet as we diversify into new emerging technologies through new fund investments. With Bitcoin as our primary treasury reserve asset, we also enhance our liquidity position with bond proceeds.”

Christian Angermayer, a member of Samara’s Advisory Committee, added: “Our mission at Samara is to drive humanity forward through innovation by seeding the world’s best managers and builders. With this new dry powder, we are excited to invest in and partner with the builders of tomorrow’s most disruptive technologies and grow our Bitcoin position.”

The German MicroStrategy

Taking to X (formerly Twitter), Patrick Lowry shared the company’s aspirations to invest in innovative technology and increase its Bitcoin treasury through the bond issuance. He reaffirmed Samara’s commitment to holding Bitcoin long-term and its belief in technology as a key driver for advancing humanity.

“At publicly listed Samara AG, we are issuing up to €30 million in bonds to invest in innovative tech through managers and builders, and to increase our Bitcoin treasury! We are forever HODL’ers and believe technology best drives humanity forward!” he remarked.

In response to a news report on X, Lowry stated: “We at Samara AG have HODL’d for years and are now increasing our Bitcoin treasury and investing in disruptive tech through top managers and builders. Not sure it’s possible, but it’d be a dream to stack as much as @saylor.”

When asked by a user on X about the challenges of offering bonds for European corporations, Lowry revealed that this is the first ever bond issuance at Samara AG, and the first of this specific type ever in Europe. “I’ll let you know how it goes in the coming weeks based on feedback,” he remarked.

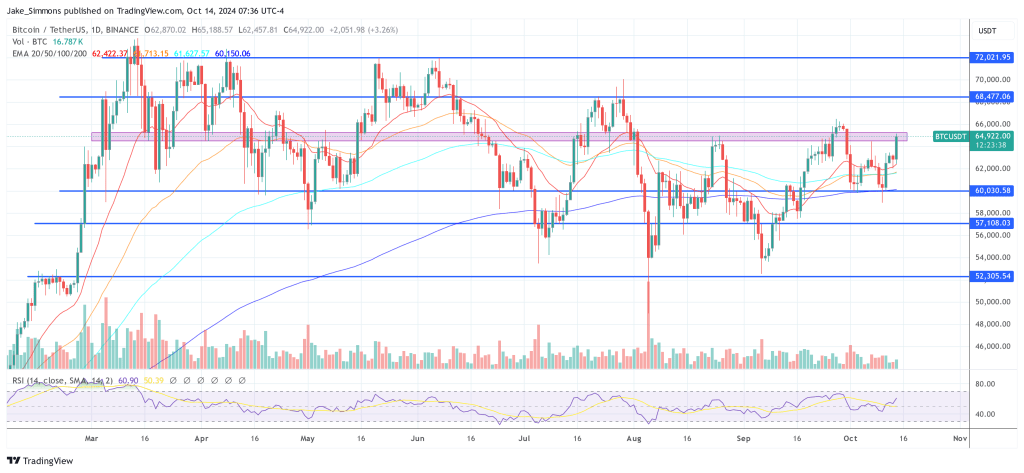

At press time, BTC traded at $64,922.