Recently, reports from IntoTheBlock revealed that the Litecoin (LTC) network has exceeded five million long-term holders. This achievement represents approximately 62.5% of all LTC addresses with a balance, underscoring Litecoin’s widespread adoption and long-term viability within the crypto community.

Rising Long-Term Holder Trend Signals Optimism

The surge in long-term holders has been particularly noticeable in recent months, underscoring a growing inclination towards holding LTC for quite a long time. In February’s closing days alone, the number of long-term holders soared by 170,000, signaling robust investor confidence in Litecoin’s long-term prospects.

In tandem with this surge in long-term holders, the number of individuals holding LTC for more than a year has steadily risen, now totaling 2.54 million addresses. Apart from the numerical growth, the profitability of holding LTC over the long term adds another dimension of interest.

Amazing milestone for Litecoin!

The network now counts over 5 million long-term holders of $LTC.

This figure represents 62.5% of all Litecoin addresses with a balance. pic.twitter.com/K5FHz3Ivjs

— IntoTheBlock (@intotheblock) April 12, 2024

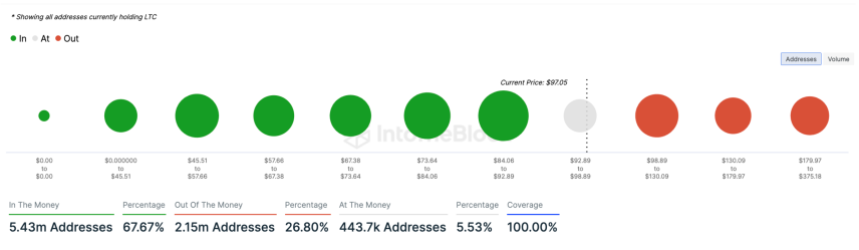

According to on-chain data, roughly 67.67% of all LTC addresses currently stand in profit, collectively holding 49.76 million LTC. In contrast, approximately 26.8% of LTC holders, totaling 2.15 million addresses, are currently at a loss.

Meanwhile, a smaller segment, constituting 5.53% of holders, is situated at breakeven, which means they are neither in a loss nor a profit.

Bullish Sentiment Surrounds Litecoin Amidst Rumors of ETF Approval

So far, Litecoin has seen relatively stable movement, experiencing a minor increase of 0.3% over the past week, followed by a slight downturn of 0.1% in the last 24 hours. As of the current writing, LTC is trading at $96.72.

Despite the altcoin’s current stability in price, analysts such as World of Charts anticipate a potential surge in the coming months, with projections suggesting a climb to $400. This bullish momentum is fuelled by growing institutional interest, particularly surrounding rumors of a potential LTC Exchange-Traded Fund (ETF).

Fox Business journalist Eleanor Terrett has hinted at institutional intrigue towards a Litecoin ETF, citing LTC’s functional similarities to Bitcoin as a potential factor in its approval by the US Securities and Exchange Commission (SEC).

SCOOP (with fixed ticker)

: Hearing rumblings on the institutional level about possible interest in a Litecoin ETF. The logic is that because of $LTC functional similarities to $BTC, the @SECGov may be more inclined to approve it, possibly even more so than $ETH.

Last week,… https://t.co/nsrhE87OLm

— Eleanor Terrett (@EleanorTerrett) March 26, 2024

Additionally, Coinbase Derivatives’ recent launch of futures contracts for Litecoin further contributes to the buzz surrounding the cryptocurrency.

Renowned crypto analyst Luke Martin echoes this sentiment, suggesting that the approval of an Ethereum ETF could pave the way for other “old altcoins” like Litecoin to gain regulatory approval. Martin emphasizes that LTC and Dogecoin may have a stronger case for not being classified as securities, particularly in comparison to Ethereum.

Featured image from Unsplash, Chart from TradingView