Litecoin (LTC) is currently attempting to sustain its position above the critical $120 threshold, eliciting concern among investors.

The crypto is presently valued at $112, reflecting a 9% decline over the past 24 hours, making its trajectory a topic of interest for investors amid a broader market downturn that has led to over $250 million in liquidations across cryptocurrency exchanges. In light of the escalating selling pressure, is it plausible for LTC to evade hitting lower support levels in the near future?

Network Growth Defies Price Action

Still, despite the adverse price swings, Litecoin’s basic network metrics present a different story. Higher than the 30-day average of 8.15 million, the overall count of addresses now stands at over 8 million.

Concurrent with this growth in transaction volume—which has quadrupled from $3.70 billion to $11.30 billion over the past six months—are other developments. These basic indicators show a strong adoption rate that contrasts sharply with the present price downturn, therefore creating an interesting scenario for market observers.

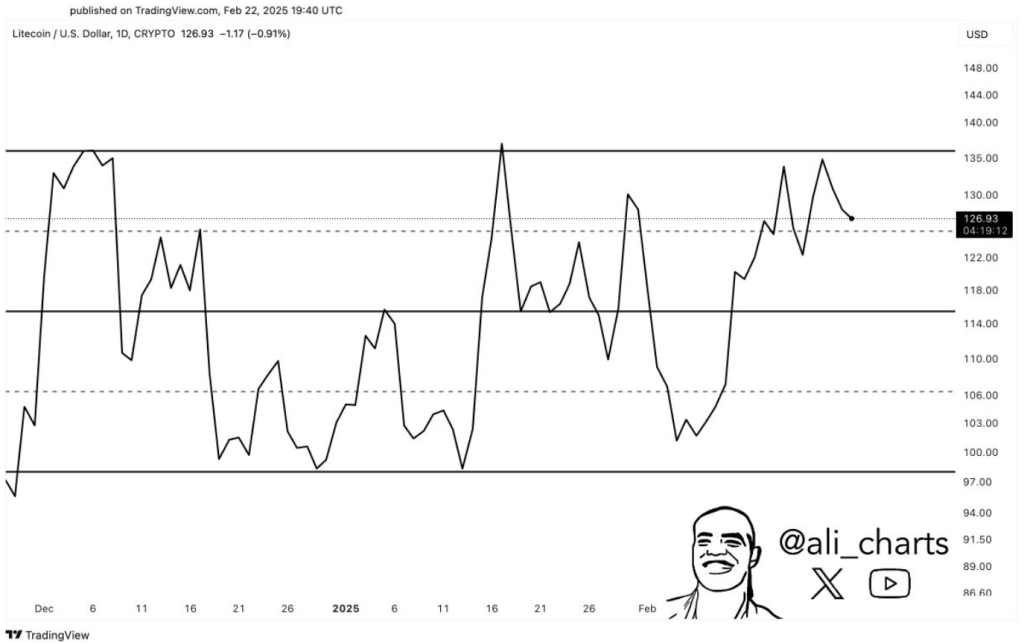

#Litecoin $LTC faced rejection at the $135 resistance, which could lead to a pullback toward support at $98! pic.twitter.com/UchvWgc6G8

— Ali (@ali_charts) February 23, 2025

Technical Patterns Indicate Potential Downturn

Ali Martinez, a known crypto analyst, has detected a parallel channel formation on the daily chart of Litecoin that concerns him. This technical structure, in conjunction with a double-top reversal pattern at the upper boundary, suggests that there is ongoing downward pressure that could lead LTC to the midline of the channel, which is approximately $115.

The parallel channel’s lower band is around the $98 threshold. If the decline reaches the mid-line at $115, bears will probably test the lower boundary line. This will be Litecoin’s second decline below the $100 milestone.

Derivatives Data Shows Mixed Sentiment

Divergent signals about Litecoin’s future abound from the derivatives market. While the general long-to-short ratio is 0.90, which suggests that there are rather more negative than optimistic holdings, the ratios of important exchanges like Binance and OKExchange are more positive.

This divergence suggests that despite the broader market’s uncertainty, prominent traders with larger accounts remain confident. In the past 24 hours, the market’s volatility was further exemplified by liquidation data, which showed that bulls suffered $2.70 million in losses while bears took a $440 hit.

Strategic Opportunities Emerge From Volatility

The current state of the Litecoin market is a critical turning point for investors. If you are looking at the bigger picture, the possible pullback to the $98 support level could be a great time to get in, as long as it happens. If the price breaks clearly above $135, it could start a bigger rebound phase and show that the price is once again moving up.

Featured image from Gemini Imagen, chart from TradingView