On-chain data shows a Litecoin whale has withdrawn around $20 million in LTC from Binance, which could be bullish for the asset’s price.

Litecoin Whale Has Just Made A Large Outflow From Binance

According to data from the cryptocurrency transaction tracker service Whale Alert, a massive transfer has been spotted on the Litecoin blockchain during the past day.

The transaction saw the movement of 286,482 LTC across the network, worth almost $20.6 million when the move went through. Given this large scale, it’s likely that a whale entity was behind it.

Whales are considered influential beings on the blockchain due to their large holdings, so their transactions can be worth keeping an eye on as they may end up causing fluctuations in the asset’s price.

How exactly a whale transfer would affect the market depends on the intent behind it. Usually, it’s hard to say why a transfer was made, but address details can sometimes provide some hints.

Below are details for the latest transfer that may shed light on its context.

As is visible above, the sending address for this Litecoin whale transaction was a wallet attached to the cryptocurrency exchange Binance. The receiver, on the other hand, was an unknown wallet.

Unknown wallets aren’t affiliated with any known centralized platform and are likely to be investors’ addresses. Transfers like this that go from an exchange to a self-custodial wallet are exchange outflows.

Exchange outflows can be a sign of fresh buying in the market, or at the very least, that the investors are planning to hold for extended periods. As such, transfers of this type can potentially be bullish for the asset.

Thus, if the whale has made this large exchange outflow for accumulation purposes, Litecoin could naturally see positive effects from it. There also exists a scenario, however, where the whale has made the withdrawal for selling through over-the-counter (OTC) deals instead.

In such a case, the effect on the cryptocurrency could be bearish. It remains to be seen what influence this Litecoin whale move would have on its price, if any.

In other news articles, LTC has recently continued to be the most active blockchain in the world, as the official X handle of the coin has been shared in a post.

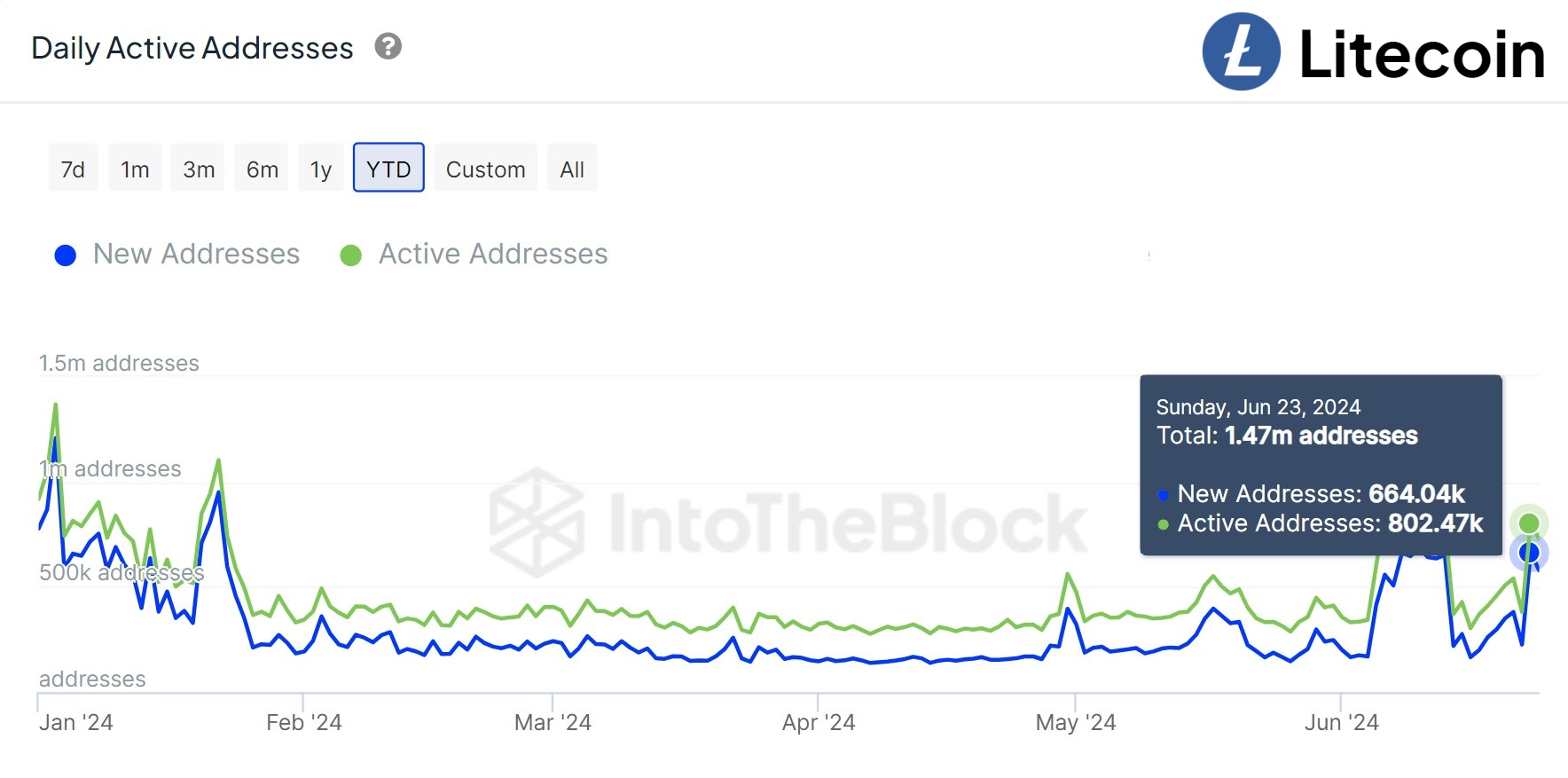

As is visible in the above chart, the daily active address count for Litecoin has surged recently and stands at 802,470. Active addresses refer to those participating in some transaction activity on the network daily.

The count of these addresses reflects the traffic the chain receives. At the current levels, LTC is observing a higher active user count than the likes of Bitcoin (BTC) and Ethereum (ETH).

LTC Price

At the time of writing, Litecoin is trading at around $71, down more than 4% over the past week.