Onchain Highlights

DEFINITION: Bitcoin Illiquid Supply Change is the monthly (30d) net change of supply held by illiquid entities.

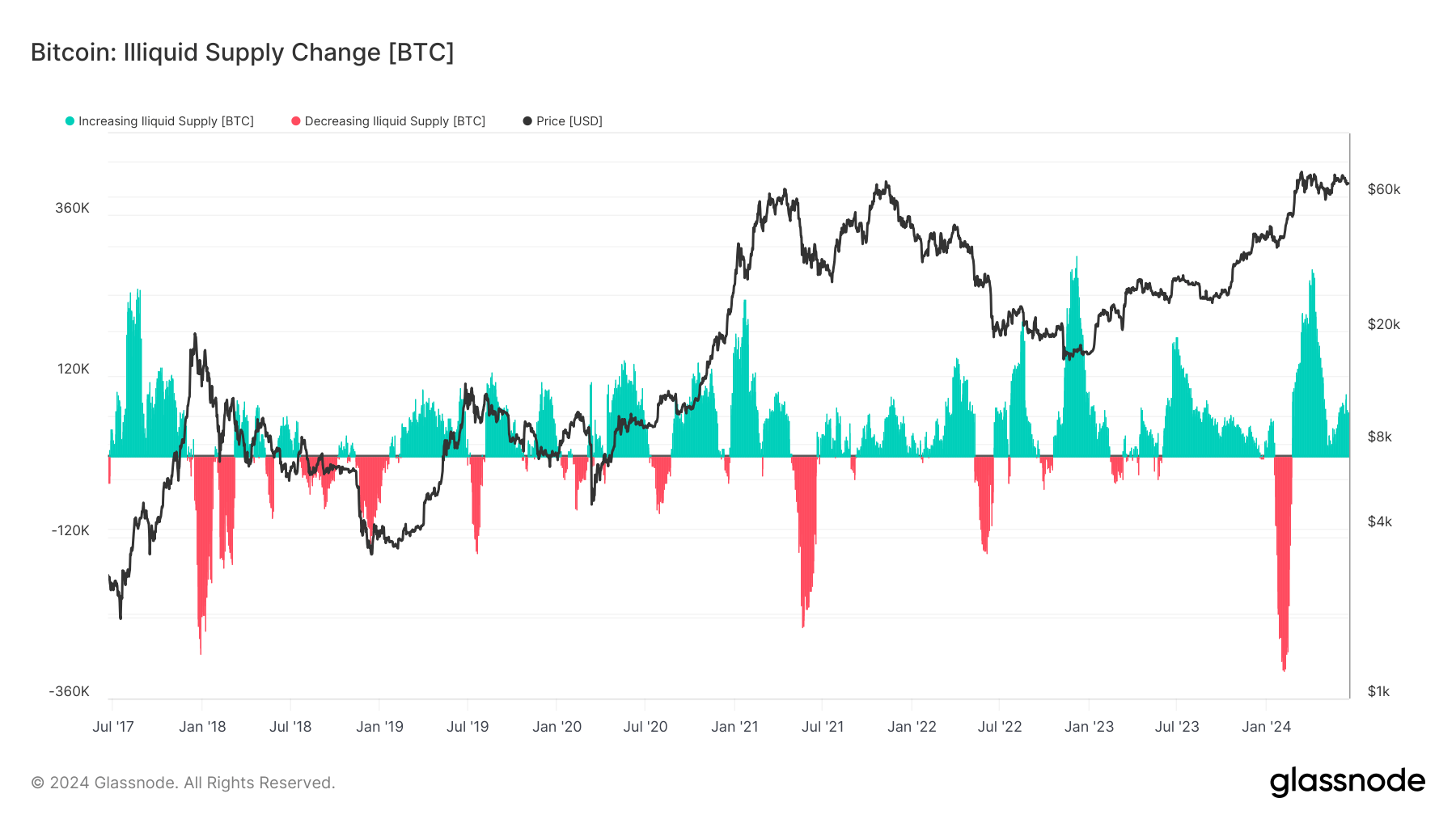

Bitcoin’s illiquid supply may be at a critical juncture, indicating substantial market changes. Recent data from Glassnode reveals a renewed increase in the illiquid supply of Bitcoin since May, highlighting a strong trend toward self-custody among investors. This shift suggests a growing preference for long-term holding over active trading.

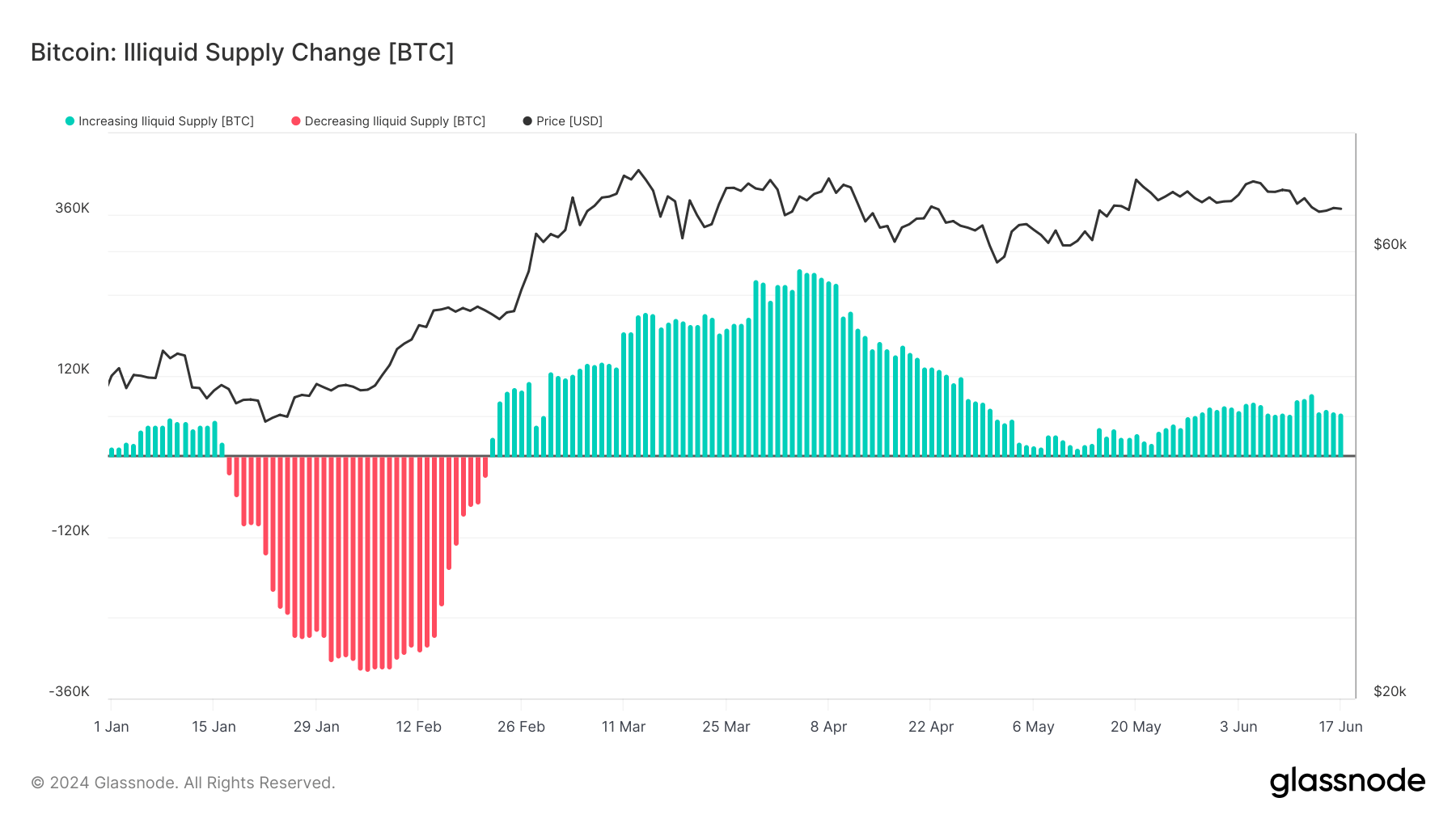

The illiquid supply of Bitcoin, representing coins moved out of exchanges into non-custodial wallets, has seen substantial fluctuations in 2024. These changes often correlate with broader market forces and investor sentiment. This trend reflects a deeper understanding among investors of the importance of secure storage, especially following recent market turmoil and high-profile exchange failures.

Moreover, CryptoSlate noted that Bitcoin’s illiquid supply hit a ten-year high in December 2023, showcasing strong investor conviction. This increase in illiquid supply typically coincides with upward price movements, suggesting that as more Bitcoin is held in long-term storage, the available supply for trading decreases, potentially driving prices higher.

The illiquid supply continued to increase throughout 2024, starting in mid-February. While the rate of change decreased in May, it has again begun to rise.

Overall, the trend towards increased illiquid supply spotlights growing confidence in Bitcoin’s long-term value and investors’ strategic shift toward minimizing exposure to market volatility.

The post Long-term Bitcoin holding trends push illiquid supply higher appeared first on CryptoSlate.