Bitcoin (BTC) has recently struggled to regain bullish momentum, remaining in a consolidation phase just above the crucial $60,000 support. Despite reaching an all-time high three months ago, the largest cryptocurrency witnessed a dip to as low as $59,500 on Wednesday due to increased selling pressure from miners.

BTC Selling Spree

The ongoing miner capitulation, the longest observed since the summer of 2022 before the FTX implosion, indicates the Bitcoin Halving supply-squeeze effect.

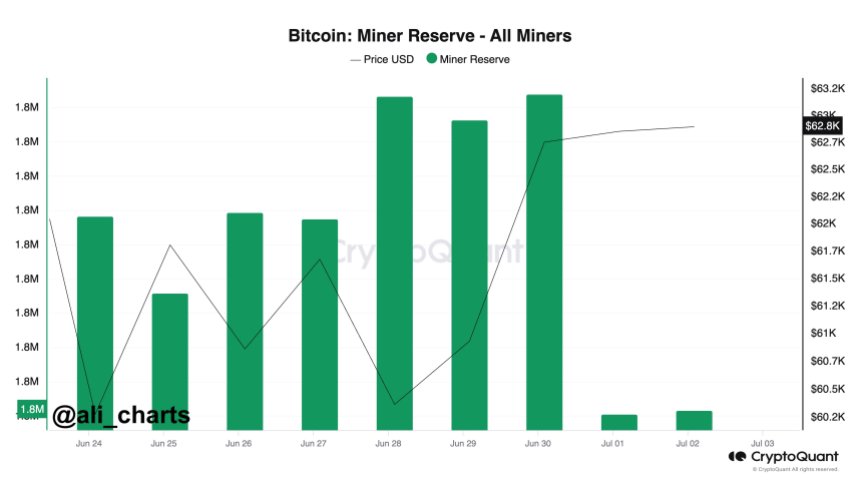

Crypto analyst Ali Martinez noted that Bitcoin miners have sold more than 2,300 BTC in the past 3 days, amounting to approximately $145 million.

This selling pressure from miners adds to the recent BTC sales by the US and German governments, contributing to the market’s downward pressure and keeping prices within the lower range of the wider consolidation zone between $60,000 and $70,000 witnessed in recent months.

Notably, addresses linked to the German and US governments have sent $737 million worth of BTC to exchanges, including Coinbase, Bitstamp, and Kraken, in various transactions.

As the selling pressure from governments and miners subsides over time, market observers expect a potential price recovery for BTC, following the typical pattern observed during the post-Halving period, where new all-time highs are often achieved.

Bitcoin Price Outlook

Market expert Scott Melker points out that the market may be nearing a crucial signal, stating that if a daily candle closes below the $60,300 level, it could lead to a bullish divergence.

This would involve the daily RSI (Relative Strength Index) moving out of oversold territory, similar to last August when the price was around $26,000.

Melker emphasizes the need for a close below the mentioned level, followed by a clear upward move in the RSI without making a lower low. It would require a significant downward move for the RSI to go lower than its level on June 24th.

However, crypto analyst Andrew Kang highlights the significance of a potential loss of the four-month range on Bitcoin, drawing parallels with the range observed in May 2021 following a parabolic rally of BTC and altcoins.

Kang notes that over $50 billion in crypto leverage is currently at near all-time highs, compounded by the fact that the market has been in a prolonged consolidation phase for 18 weeks without experiencing extreme washouts, as seen during the 2020-2021 bull market.

Moreover, Kang suggests that initial estimates of the low $50,000s may have been too conservative, and a more significant reset to the $40,000s could be possible.

Such a pullback would substantially impact the market and likely necessitate a few months of choppy or downward price action before a reversal and an upward trend could be established.

At the time of writing, BTC has recovered the $60,350 level after its brief dip below this crucial support for further movements to the upside.

The largest cryptocurrency in the market has erased all gains in wider time frames, and it is currently recording a 12% price decrease in the monthly time frame.

Featured image from DALL-E, chart from TradingView.com