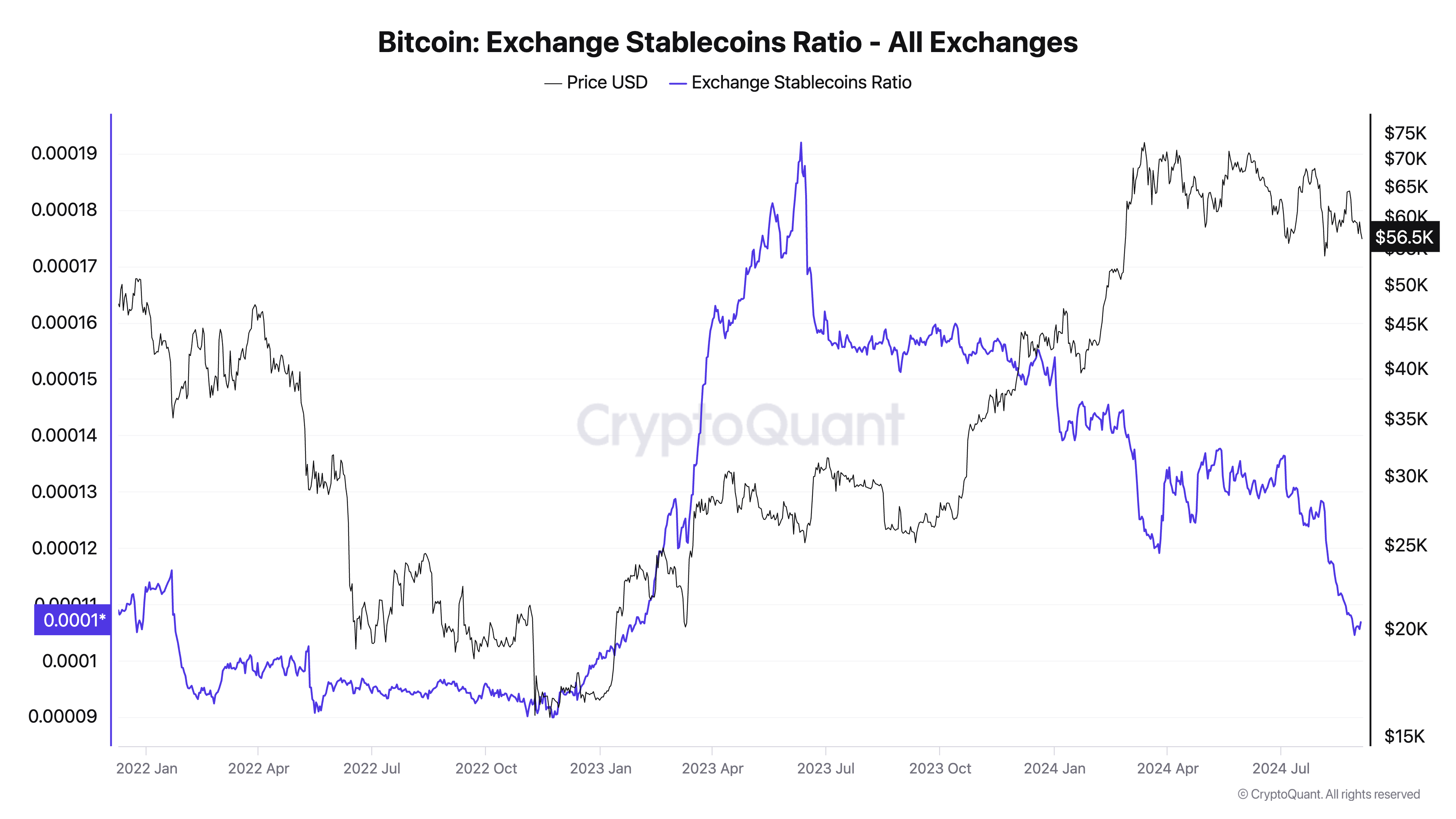

The exchange stablecoin ratio measures the balance between stablecoins held on exchanges and Bitcoin. When this ratio drops sharply, it usually signals a reduction in the amount of stablecoins available on exchanges compared to Bitcoin reserves. It often reflects growing demand for Bitcoin, as traders either convert stablecoins into BTC or withdraw them from exchanges altogether.

Understanding the relationship between stablecoins and Bitcoin is important for interpreting broader market trends. Stablecoins provide a liquid base for traders, enabling them to move quickly in and out of crypto positions without converting to fiat.

A decrease in the exchange stablecoin ratio shows that fewer stablecoins are available relative to Bitcoin, often signaling an accumulation of Bitcoin. Historically, sharp declines in the ratio have accompanied increases in Bitcoin’s price, as we’ve seen in the previous cycles.

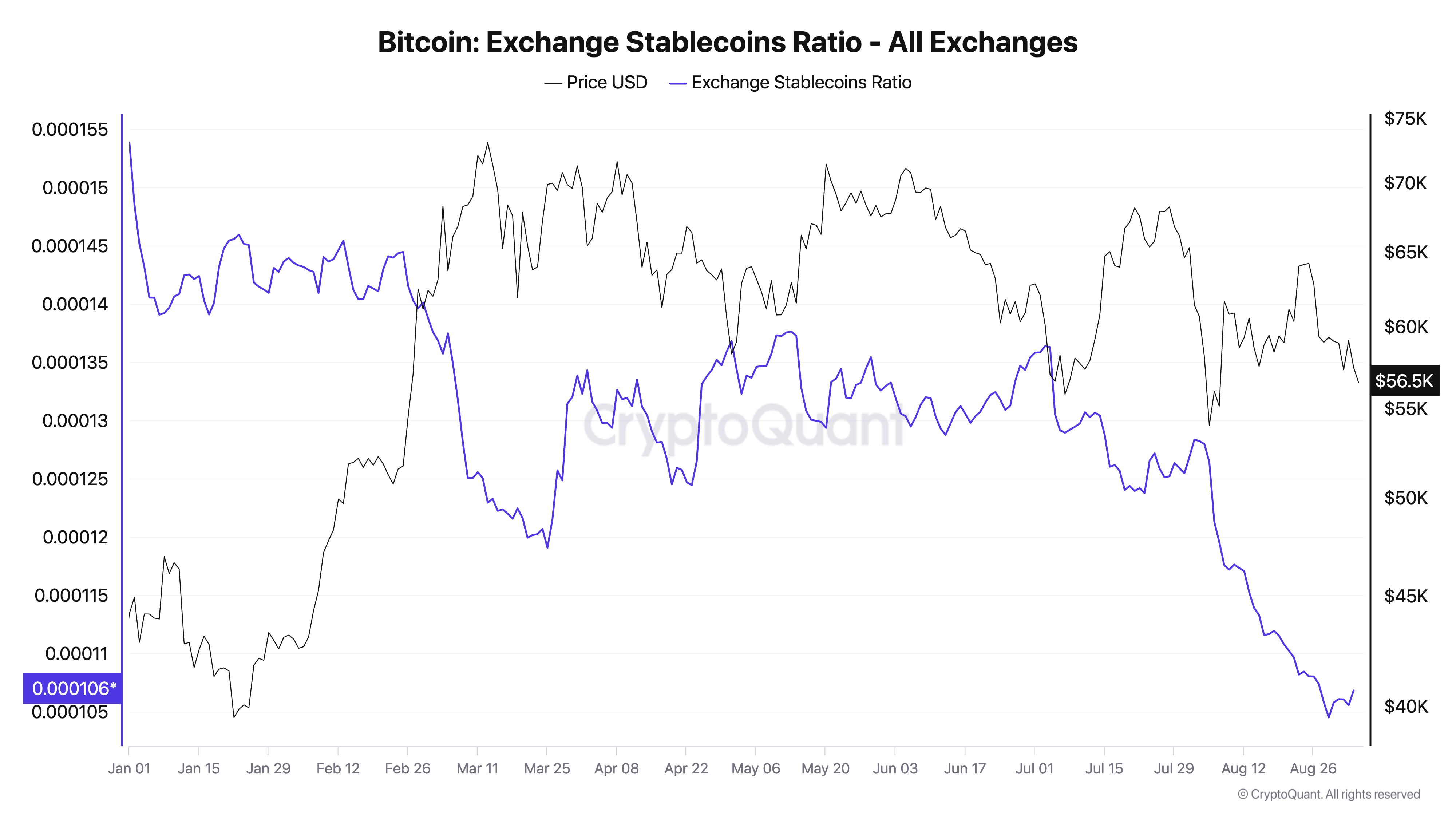

A drop in the exchange stablecoin ratio typically correlates with rising buying pressure for Bitcoin. On Aug. 29, the ratio reached its lowest point this year, though it has since slightly recovered. Even at its current level of 0.0010714, it significantly declined from 0.0015387 at the beginning of the year. It suggests that traders are either continuing to convert stablecoins into Bitcoin, pushing the price upward, or moving stablecoins off exchanges.

This trend aligns with the market’s behavior in recent years. As Bitcoin trades around the resistance at $60,000, the declining stablecoin ratio indicates that traders are well-positioned for further price increases. The ratio’s drop suggests sustained confidence in Bitcoin’s price appreciation.

The low levels of the exchange stablecoin ratio also imply that selling pressure on Bitcoin is minimal, with demand continuing to drive the market. With fewer stablecoins available on exchanges, there is a limited supply that could be rapidly deployed to trade for Bitcoin in large volumes.

As every trade requires a buyer and a seller, this could contribute to price stability if the market sees another volatile September, especially as Bitcoin has already shown some price recovery in the past few weeks. As long as the ratio remains low, it shows that traders favor Bitcoin over holding stablecoins, which bodes well for any potential upward momentum in Bitcoin’s price.

In essence, the exchange stablecoin ratio serves as a barometer of market sentiment. When the ratio is low, it suggests that traders are using stablecoins to buy Bitcoin, which reduces the pool of stablecoins available for selling. This typically reflects confidence in a rising Bitcoin market.

Conversely, an increase in the ratio can indicate that more stablecoins are accumulating on exchanges, possibly signaling a shift toward selling pressure. However, with the ratio currently at a low point, the market appears to be stable or in an accumulation phase.

The post Low exchange stablecoin ratio hints at strong Bitcoin demand appeared first on CryptoSlate.