Luxor has launched the first ever ASIC RFQ platform with the goal of maximized market transparency and access.

Luxor has launched the first ever ASIC RFQ platform with the goal of maximized market transparency and access.

Luxor Technologies, a full-stack Bitcoin mining software and services company, has launched the first request-for-quote (RFQ) platform for buying and selling Bitcoin mining hardware.

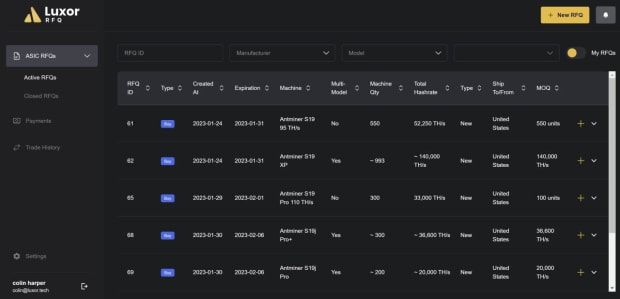

The press release sent to Bitcoin Magazine describes what an RFQ platform is, saying “An RFQ is a marketplace where users can create orders (requests) for specific items. Luxor’s double-sided RFQ allows both buyers and sellers to create requests for Bitcoin mining ASICs.”

The idea is that it will create a more liquid and easy to use marketplace for ASICs — specialized machines specifically built to mine bitcoin. According to the release, “Using an open-bid system, ASIC traders can place requests and negotiate prices directly, improving price discovery and increasing liquidity in the secondary market.”

Prior to this market, ASIC traders have struggled with a fragmented and opaque over-the-counter market. This system will theoretically improve the transparency of the market, while allowing for easier access and more precise market pricing. ASIC brokers will form the backbone of market makers on the platform, and they will be able to leverage it to increase their deal flow and facilitate more transactions.

“We built Luxor RFQ because we saw the need for a unified platform for trading Bitcoin mining hardware,” Luxor Operations Manager Lauren Lin commented. “Before, buyers and sellers relied on a patchwork of venues to buy and sell mining hardware. Now, they can observe offers, listings, and settlement prices all in one place, which improves pricing transparency and expedites the mining hardware procurement process.”

The RFQ platform will offer major flexibility to buyers, allowing them to specify orders by quantity, condition, model type, location and more. In addition to this, sellers will be able to mix-and-match models from different manufacturers in their orders. The platform’s auction-style bidding process will benefit sellers and brokers.

Luxor states that it is committed to transparency, saying that “Platform fees are transparent and volume based so that market makers can transact in a larger, more profitable way.”.

Bitcoiners interested in learning more about Luxor’s RFQ, can visit the RFQ website or contact the company at: [email protected].