With the start of the highly anticipated Uptober here, market experts have been super bullish on the Bitcoin future outlook. In line with this, a crypto analyst has identified a major catalyst that could propel Bitcoin to new all-time highs (ATHs) in the Fourth Quarter (Q4) of 2024.

Bitcoin Sets Sights On New ATH In Q4

Bitcoin has been on a roll these past few days, with its price skyrocketing towards the end of September after experiencing a decline earlier. The cryptocurrency has been confirming analyst’s predictions of a bullish Q4 with its recent price movements.

According to CoinMarketCap’s data, Bitcoin rose by about 1.03% in the past seven days, ending September on a bullish note. Given the cryptocurrency’s positive momentum in September, crypto analyst, Eric Crown has predicted on X (formerly Twitter) that Bitcoin could rise to new all-time highs in Q4.

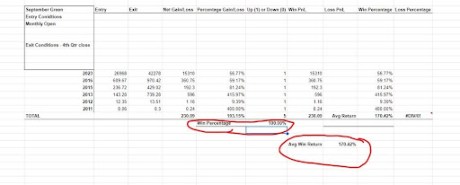

Crown has based his predictions on the historical performance of Bitcoin, particularly focusing on the months following September. He disclosed that historically, whenever Bitcoin closed a green September, it followed up with a bullish trend in Q4 every single time.

Following this trend, Crown has surmised that Bitcoin closing September in the green was a major catalyst for a bullish surge. As a result, he predicts that the average return for Bitcoin in this current Q4 would be close to 170.42%.

If a few major “outliers” are removed, a modest return of 50% would be a more realistic expectation of potential gains. Calculating Bitcoin’s projected price using these percentage returns would see the cryptocurrency rising to $173,344 with a 170.42% return and $96,153 with a 50% return.

While he remains generally bullish on Bitcoin’s price outlook, Crown has also disclosed in a more recent X post that the month of October has generally seen low momentum in Bitcoin during the first 10 days. This analysis is also evident in Bitcoin’s current price which has declined today by 0.69% and is trading at $63,976, as of writing.

Considering this trend, Crown has projected that Bitcoin is likely to witness a price low at the beginning of the month, before starting its projected bullish rally to new highs.

Analysts Confirm Green Q4 For BTC

According to crypto analyst Kaizen, Bitcoin’s price performance in October from 2013 to 2023 was 80% in the green. The analyst also disclosed that during every United States (US) election year, the months of Q4 were 100% green. Moreover, each year after Bitcoin closed positively in September, it always had a green October.

Following this recurring historical trend, Kaizen notes that this Q4 could be extremely bullish for Bitcoin. He highlighted that not only is 2024 an election year, but Bitcoin has recently closed the month of September on a positive trend, as a result the cryptocurrency could be gearing up for a major rally.