The MakerDAO community voted in favor of keeping Gemini USD stablecoin as part of the protocol’s DAI stablecoin reserves amid concerns about insolvency.

The MakerDAO community earlier started voting on two governance polls in an attempt to limit DAI’s exposure to Gemini due to the liquidity crisis plaguing Gemini’s Earn program. The GUSD stablecoin can be used as collateral to mint Maker’s DAI stablecoin.

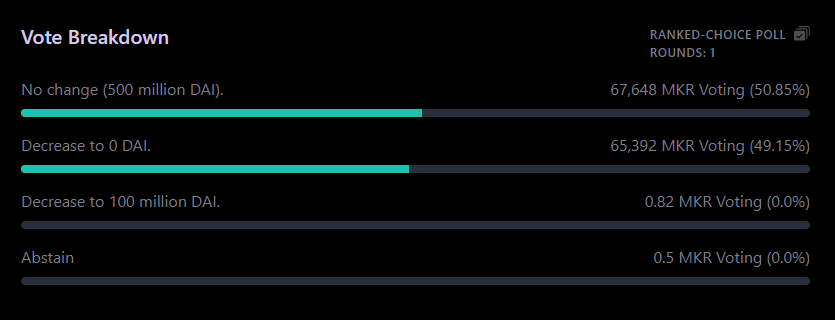

The poll that ended on January 19 avoided a tragedy for GUSD as 50.85% of the votes supported keeping the GUSD debt ceiling at $500 million in Maker’s Peg Stability Module (PSM), and 49.15% supported removing it completely.

PSM is a mechanism that allows users to mint DAI in exchange for collateral accepted by Maker. Furthermore, it keeps DAI’s peg with the U.S. Dollar. The outcome means that MakerDAO will continue to hold 85% of all GUSD in circulation in its PSM.

Concerns about GUSD

There have been concerns about MakerDAO’s exposure to Gemini, mainly with the $900 million Gemini Earn assets remaining locked up with Genesis, which has suspended withdrawals. Gemini is also under pressure after it halted withdrawals from its yield-generating Earn program. Further, the U.S. Securities and Exchange Commission charged the exchange for alleged unregistered securities sales.

A further concern for GUSD’s value is that it’s partly backed by cash held at Silvergate Capital. The embattled crypto-friendly bank is one of the many firms that suffered from last year’s crypto-related meltdowns.

However, Genesis CEO Tyler Winklevoss reassured the Maker community by stating the only exposure MakerDAO had to Gemini was through the Peg Stability Module. In addition, the CEO assured that the GUSD reserve backing DAI stablecoin would not be subject to bankruptcy proceedings.

Maker currently has $489 million in GUSD collateral against its debt ceiling of $500 million, the maximum amount of DAI that can be minted with the Gemini Dollar. The proposal from the Strategic Finance Core Unit notes that MakerDAO currently earns $7.3 million from its exposure to GUSD.

The post MakerDAO approves 85% Gemini USD holdings in DAI stablecoins appeared first on CryptoSlate.