Quick Take

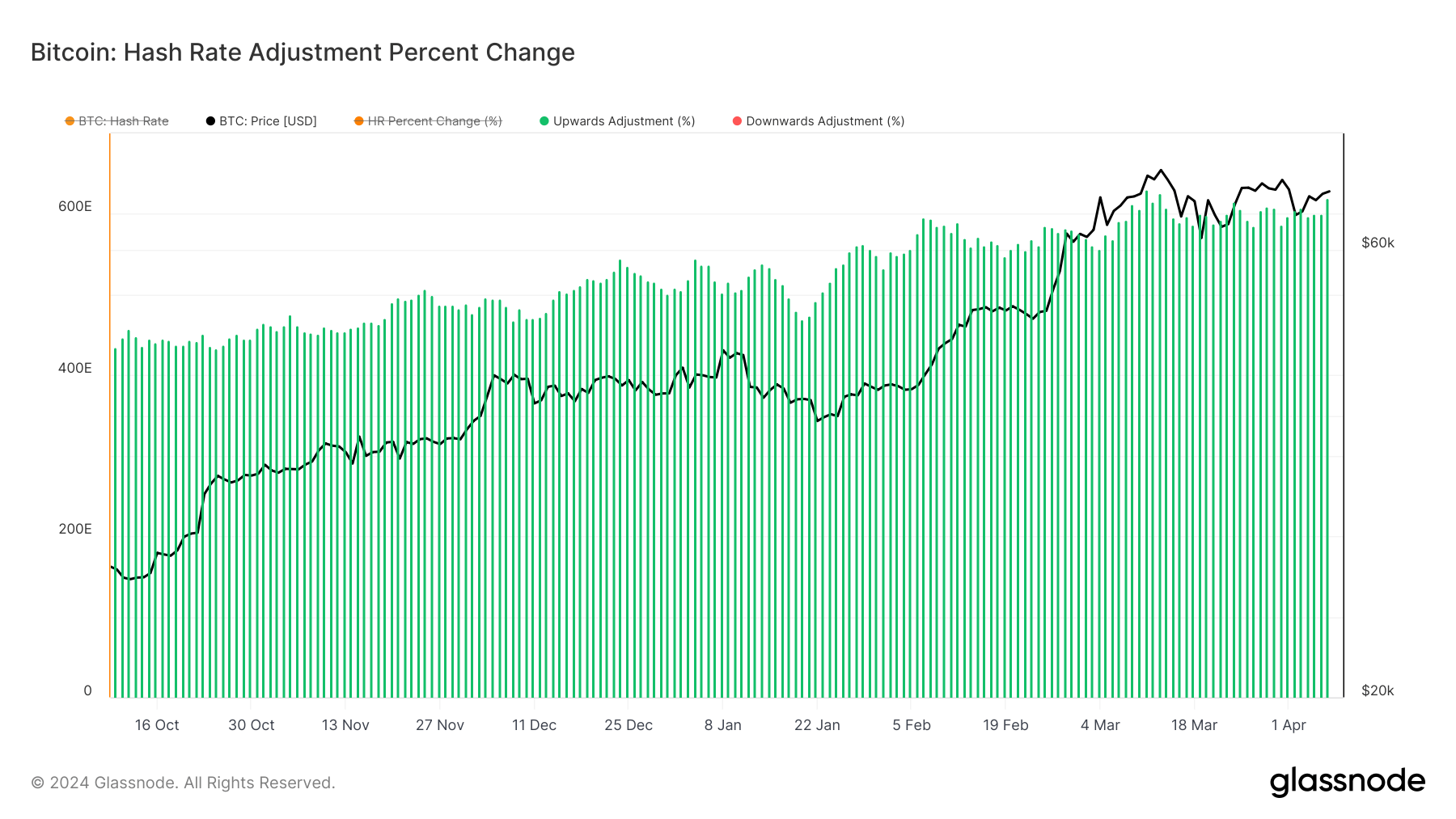

The Bitcoin network is experiencing a remarkable surge in its hash rate, a crucial metric that reflects the computing power dedicated to processing transactions and maintaining the blockchain. According to the latest Glassnode data, the 7-day moving average hash rate has reached an astonishing 620 EH/s, nearing all-time highs.

Notably, the upcoming difficulty adjustment, scheduled for Apr. 10, is projected to exceed 3%, according to Newhedge, further reflecting the growing computational power securing the network. This adjustment is particularly significant as it precedes the much-anticipated Bitcoin halving event scheduled for Apr. 20, where the block reward for miners will be reduced by 50%.

Marathon Digital Holdings CEO Fred Thiel shared a thought-provoking perspective during his appearance on Anthony Pompiliano’s podcast. Thiel suggests that sovereign nations are now actively contributing to the global hash rate surge, a trend with potentially significant implications.

Thiel explained:

“Soverigns who are interested in getting into the mining of Bitcoin initially for monterary reasons but really for cash reserve and treasury reasons and those are people who are willing to mine at potentially lower profits than businesses whose focus is generating a profit from Bitcoin mining”.

A compelling angle to consider is CryptoSlate’s analysis of a potential hash rate correction following the halving, as older miners may become unprofitable and disconnected. Suppose a significant correction in the hash rate fails to materialize. Could it be attributed to sovereign nations engaging in mining without profitability concerns, possibly leveraging abundant access to inexpensive renewable energy sources?

The post Marathon CEO hints at sovereign contributions to Bitcoin’s burgeoning hash rate appeared first on CryptoSlate.