Onchain Highlights

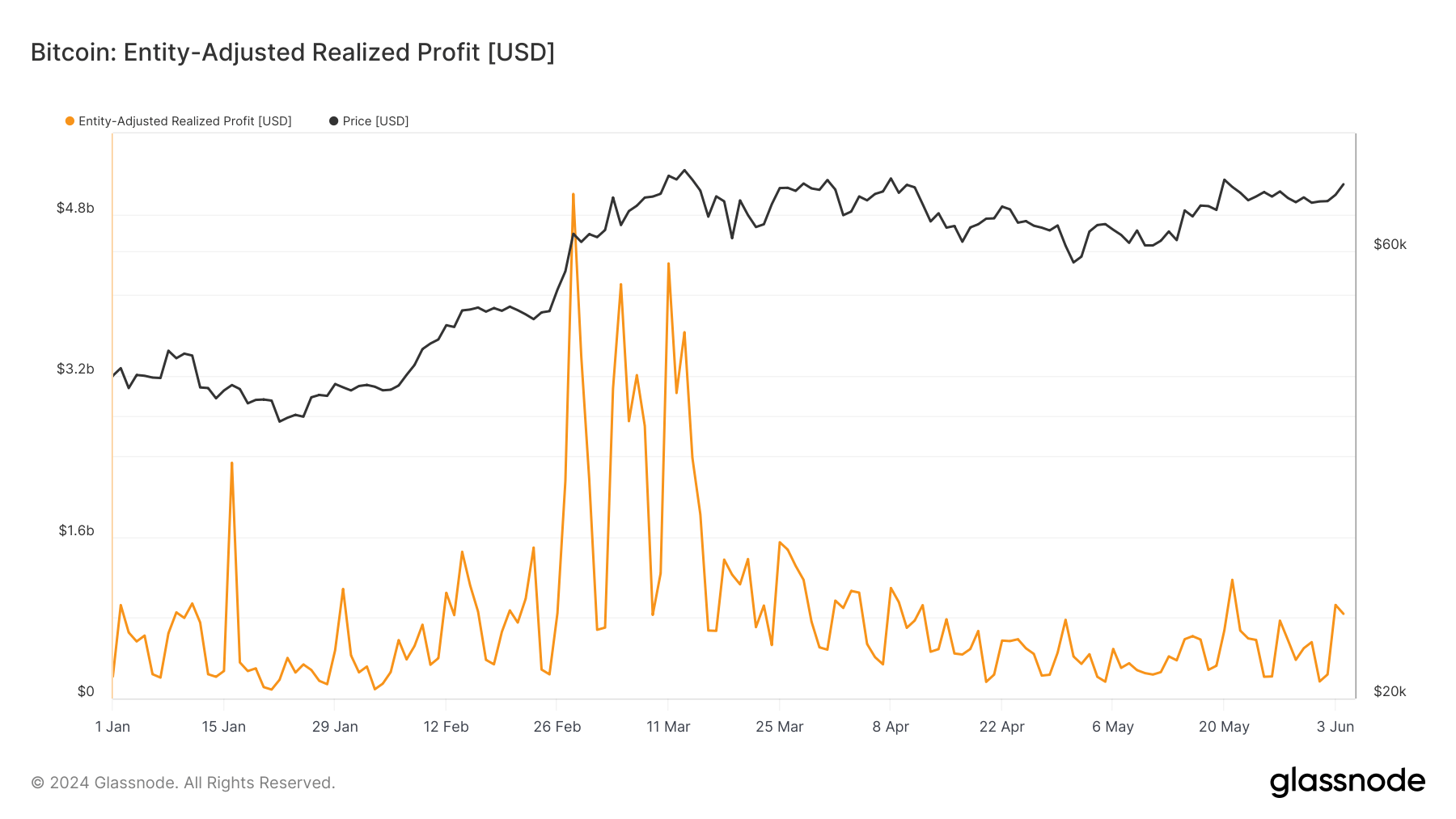

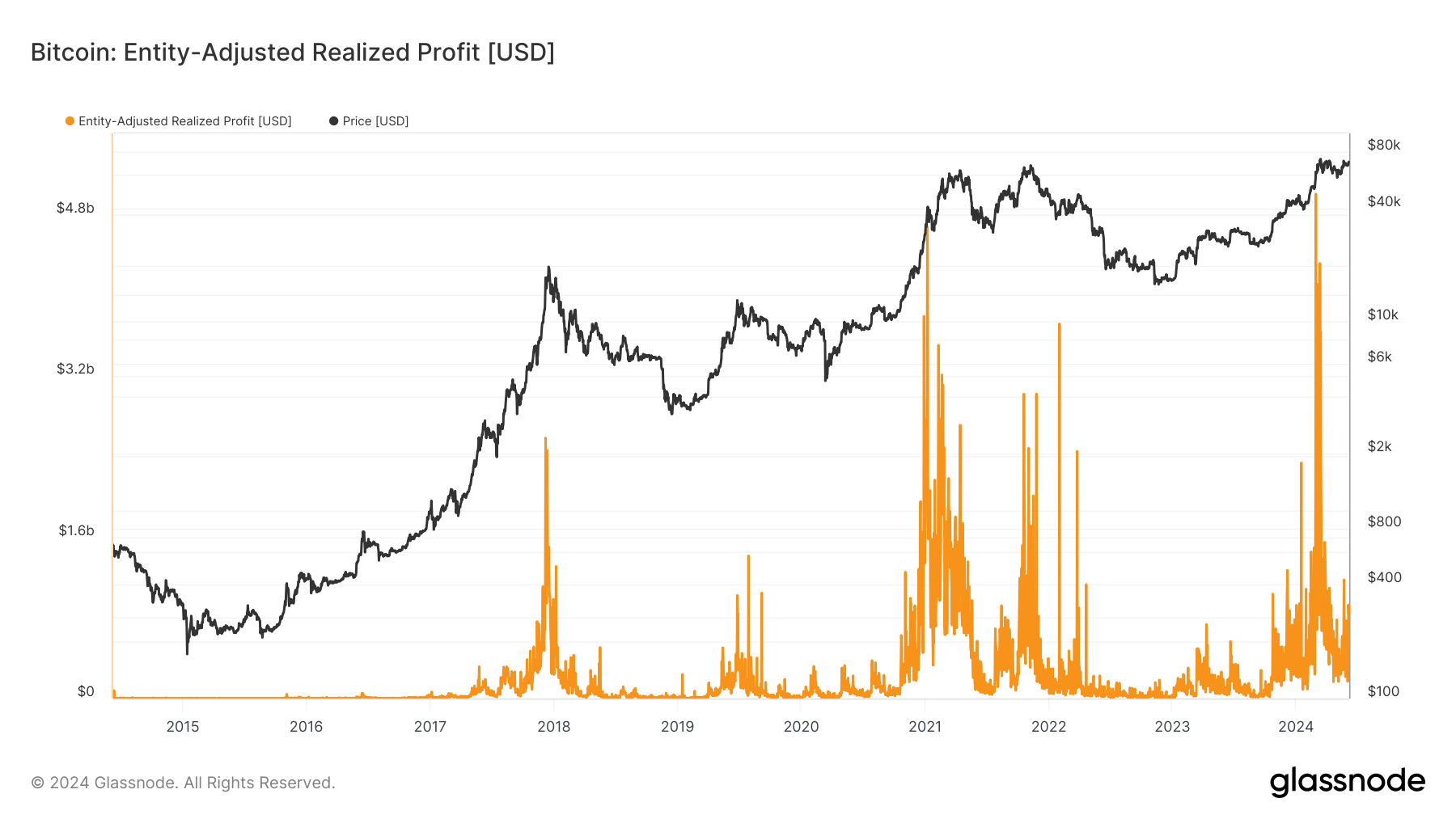

DEFINITION: Bitcoin’s entity-adjusted realized profit is the entity-adjusted variant of Realized Profit, which denotes the total profit (in USD) of all moved coins whose price at their last movement was lower than the price at the current movement.

Bitcoin’s realized profit metric reached significant highs this year, reflecting dynamic market behavior. In March 2024, realized profits soared to an all-time high of $3.51 billion, paralleling Bitcoin’s price rally and suggesting strong market accumulation despite intermittent sell-offs.

Investors’ behavior highlights a complex interplay of market psychology and profit maximization strategies. Despite Bitcoin’s price fluctuations, the stability in realized profit/loss ratios suggests investor satisfaction and steady confidence in Bitcoin’s value.

Current levels, while far below the recent peak, are equivalent to levels seen throughout the 2021 bull market, and far above the 2022 – 2023 bear market.

These trends highlight the critical role of market timing and strategic trading in navigating Bitcoin’s volatility. Post-halving, these patterns are essential for anticipating future market movements.

The post Market accumulation drove Bitcoin’s realized profits to all-time high pre-halving appeared first on CryptoSlate.