Polygon’s native token, MATIC, has experienced a notable disparity compared to the broader cryptocurrency market. Unlike the top cryptocurrencies that have posted double-digit gains year-to-date, MATIC has failed to post positive performance across all time frames since the 2021 bull run.

Adding to the concern, MATIC’s price has recorded losses amounting to 16.5% over the past seven days. This downward trend has prompted the token to test a crucial macro support level, raising questions about its future trajectory.

Amid these developments, Polygon has announced a strategic partnership with Aragon, a developer of decentralized autonomous organizations, to introduce a “governance hub” for the Polygon community.

Simplified Governance Hub For Polygon?

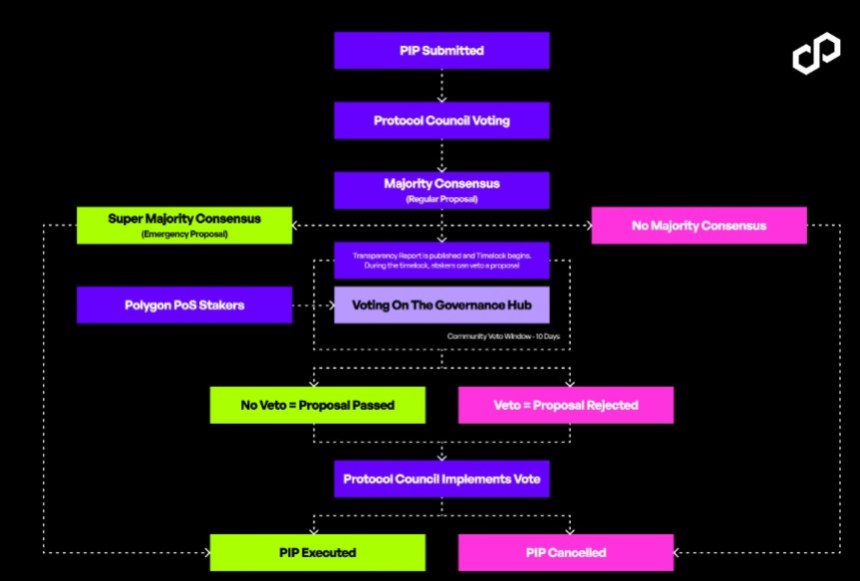

According to a recent blog post by the Layer 2 solution protocol, the governance hub is “designed to empower” users and builders, allowing them to influence the core development of Polygon’s technology. The hub will reportedly be developed in phases in collaboration with Aragon to ensure that community feedback is incorporated to create a decentralized platform that aligns with community values.

The governance hub will feature a unified interface for “two essential pillars” of Polygon’s governance: protocol and system smart contract governance.

The hub seeks to increase transparency and encourage greater community participation in protocol governance. As for system smart contract governance, it introduces an upgraded framework that prioritizes structured decision-making processes while maintaining transparency and safety.

In addition, Aragon will leverage its expertise to build the Polygon Governance Hub using Aragon OSx. This tool enables the construction of customized on-chain governance solutions that can be adapted over time through a modular plugin-based architecture. Polygon stated in its announcement:

Polygon, and all related network architecture, needs flexible, transparent, and future-proof governance mechanisms and tooling. The Polygon Governance Hub is central to achieving this.

MATIC Market Capitalization Drops Dramatically

Despite the developers’ focus on community governance within the Polygon ecosystem, key metrics indicate a consistent decline in the MATIC token’s price over the past year.

For instance, the token’s market capitalization has experienced a significant drop, plummeting nearly 50% in just three months. In March, it was valued at $9.9 billion, whereas it is currently valued at $5.6 billion. This decline suggests a potential capital shift towards other large-cap tokens or profit-taking activities.

Furthermore, MATIC’s trading volume has also seen a notable decrease of approximately 18% in the past 24 hours, according to CoinGecko data. The trading volume now stands at a mere $293 million. Moreover, MATIC has witnessed a substantial 80% decline from its all-time high of $2.92 in December 2021.

Presently, the token faces a critical test at an 8-month support level, as depicted in the MATIC/USD daily chart below, with its current trading price at $0.5982. Should the price continue to decline without a significant catalyst to drive an upward trend and price recovery, attention should be paid to the next support level at $0.5700.

The future trajectory of the MATIC price remains uncertain, and it remains to be seen whether further downside movement is in store or if a bounce at the current support level will materialize, offering potential opportunities for bullish investors.

Featured image from DALL-E, chart from TradingView.com