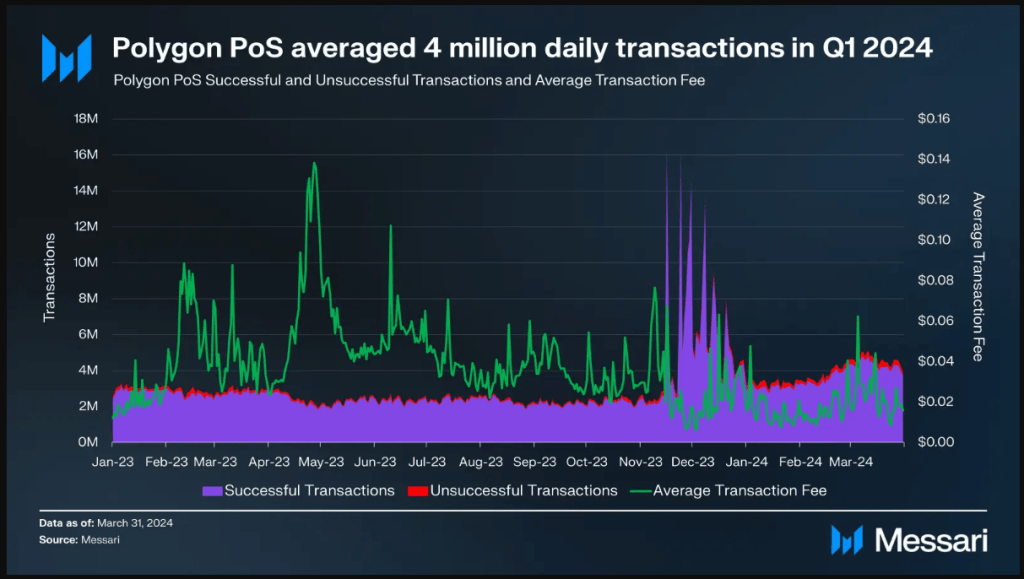

Polygon (MATIC), a Layer-2 scaling solution for the Ethereum blockchain, finds itself in a curious position. Recent data from Messari paints a picture of a network brimming with activity – daily active addresses surging nearly 120%, new user sign-ups exploding by 70%, and daily transactions reaching a staggering 4 million. Yet, beneath this bustling surface lies a troubling undercurrent: a 19% drop in quarterly revenue compared to the previous quarter, and a hefty 40% decline year-over-year.

Polygon: A Network On Fire

Polygon’s user base is clearly smitten. The first quarter of 2024 witnessed a land rush, with new addresses flocking to the network at an unprecedented rate. This surge in user adoption translated into a transaction frenzy, with daily interactions on the platform quadrupling.

The decentralized finance (DeFi) sector on Polygon also thrived, with the total value locked (TVL) in DeFi projects climbing 30% compared to the previous quarter. The non-fungible token (NFT) ecosystem on Polygon also got a shot in the arm, with sales volume rising by nearly 20%.

The Revenue Riddle

So, why the long face amidst the celebratory confetti? The answer lies in Polygon’s dwindling revenue stream. Despite the exponential growth in activity, the network’s coffers are taking a hit.

The $7 million earned in Q1 2024 pales in comparison to the $10 million and $12 million raked in during the previous quarter and the same period last year, respectively. This disconnect between booming activity and declining revenue is the million-dollar question that has analysts scratching their heads.

Fee Fiasco Or Funding Flux?

There are two main suspects behind this revenue paradox. The first culprit could be Polygon’s transaction fee structure. Perhaps, in a bid to attract more users, the network lowered its fees to an extent that, despite the massive increase in transactions, the overall revenue generation suffered.

Another possibility lies in a potential shift in Polygon’s revenue sources. Maybe there was a decline in income from a specific source, such as grants or partnerships, that wasn’t adequately compensated for by growth in other areas.

What Lies Ahead

Polygon faces a critical juncture. The network’s ability to attract users and foster a vibrant DeFi and NFT ecosystem is undeniable. However, if it fails to address the revenue conundrum, its long-term sustainability could be at risk. Moving forward, transparency from Polygon regarding its fee structure and revenue streams will be crucial in assuaging investor concerns.

Additionally, exploring alternative revenue models, such as offering premium services or strategic partnerships, could be the key to unlocking Polygon’s full financial potential.

Featured image from Zameen.com, chart from TradingView