The post Memecoin Market Continues to Plummet as Investors Pivot to Real-World Assets (RWAs) Instead appeared first on Coinpedia Fintech News

A quick look at the numbers reveals that the memecoin market has continued to experience a dramatic downturn in recent months, marking a significant shift in investor sentiment while once again raising some serious doubts about the long-term viability of these assets.

To this point, between Jan and Feb of this year, the market cap of these tokens dipped from a sizable $116 billion to $67 billion, representing a loss of nearly $50 billion (or approximately 30% of the industry’s value).

This sharp decline followed what many considered the peak of meme coin enthusiasm, catalyzed by the meteoric rise of Official Trump (TRUMP) earlier this year. The Trump-endorsed cryptocurrency surged to an impressive $72 per token almost overnight following its debut, capturing widespread attention and driving speculative interest across the meme coin sector.

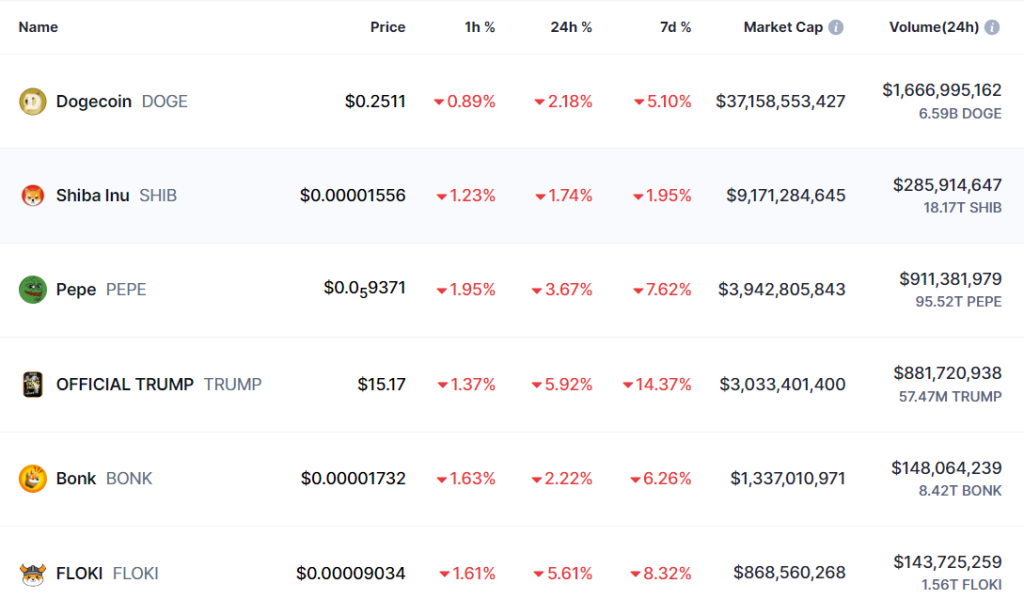

That said, market data from February has painted a rather sobering picture, with TRUMP now trading at just $15.34 — marking a decline of over 12% over the past week — with other prominent memecoins also reflecting similar downward trends.

For instance, market leaders like Dogecoin (DOGE), Pepe (PEPE), Bonk (BONK) and FLOKI have all experienced dips ranging between 5% and 8.5% over the aforementioned time period, once again bringing scrutiny to the fundamental utility and intrinsic value of these currencies.

RWA market musters traction

As capital has continued to exit the memecoin sector, it appears as though investors are increasingly turning their attention (as well as their money) to the real-world asset (RWA) tokenization sector, with industry experts projecting the sector to reach a valuation of $50 billion before the end of 2025.

Infact, the ecosystem has already demonstrated impressive growth, achieving a 32% annual growth rate in 2024, its highest increase over the previous 12 months.

Amidst this upsurge, several projects have continued to come to the fore. For instance, Tezos has made immense strides within this space, thanks, in large part, to its groundbreaking platform, Fraktion.

Following a successful €1.1 million seed funding round backed by notable investors including Cabrit Capital and the Tezos Foundation, the project is actively democratizing access to high-value assets.

Additionally, Tezos has also made waves in the commodity tokenization sector with the launch of Uranium.io, the world’s first blockchain-based uranium trading platform, developed in partnership with Curzon Uranium and Archax.

Similarly, Singularity Finance (SFI) too has established itself as a transformative force in the RWA space — combining AI with tokenization principles — through its recent collaboration with Cicada to launch a $1 million fund. Moreover, its recent launch of the $SFI token, resulting from the merger between SingularityDAO and Cogito Finance, has created a comprehensive ecosystem that serves multiple functions, including gas chain token operations, node staking, and participation in an advanced index vault system.

If that wasn’t enough, SFI’s partnership with Functionland (under the Crestal brand) has further strengthened its position in the market, helping create a platform for institutions and individuals seeking to leverage the convergence of AI and blockchain technology in RWA management.

Lastly, Ondo Finance has emerged as a force in this market, thanks to the launch of its Ondo Global Markets (Ondo GM) platform which brings trad-fi assets onto the blockchain, offering tokenized versions of stocks, bonds, and ETFs. More notably, their announcement of Ondo Chain, a dedicated layer-1 blockchain for institutional RWA tokenization, has attracted an impressive roster of institutional partners.

As per reports, the platform’s development is being guided by industry giants including BlackRock, PayPal, Morgan Stanley, Franklin Templeton, WisdomTree, and Google Cloud, among others. This institutional backing, combined with additional support from ABN Amro, Aon, and McKinsey, has positioned Ondo Chain as a major player in the institutional adoption of RWAs.

Furthermore, the platform’s focus on creating a “strategic reserve” with its native token ($ONDO) has demonstrated its commitment to building a sustainable and liquid ecosystem for tokenized traditional assets.

A multi trillion-dollar opportunity is in the offing

The future of RWA tokenization appears remarkably promising, with a recent report projecting the sector to experience a more than 50-fold increase by 2030, potentially surpassing the $10 trillion mark. This extraordinary forecast reflects the increasing recognition of tokenization as a transformative force within the trad-fi arena, offering enhanced liquidity, accessibility, and transparency to previously illiquid assets. Interesting times ahead!