The post Memecoin Regulation: SEC’s Hester Peirce Challenges Gensler’s Stance appeared first on Coinpedia Fintech News

Indirectly denouncing former SEC chairman gary gensler

gary gensler

Gary Gensler is a pioneer and the current chair of the U.S. Securities and Exchange Commission. He has extensive experience that spans Wall Street, government regulation, and an angel teaching about cryptocurrencies and blockchain at MIT. Gary S. Gensler was on born October 18, 1957, in Baltimore, Maryland.He graduated from Pikesville High School in 1975, where he was later given a Distinguished Alumnus award. He also earned a degree in economics.Gensler served in the United States Department of the Treasury as Assistant Secretary for Financial Markets from 1997 to 1999, then as Undersecretary for Domestic Finance from 1999 to 2001He has expressed his desire to present crypto-related approach changes later on that include token commitments, decentralized finance, stablecoins, guardianship, exchange-traded resources, and advancing stages.

Chairman

stance on whether cryptocurrencies are securities, US Securities and Exchange Commission Commissioner hester peirce

hester peirce

Hester Peirce of the Securities and Exchange Commission, often known as "Crypto Mom," is one of the most outspoken supporters of cryptocurrency at the government level in the United States. Prior to joining the Securities and Exchange Commission, she worked in a variety of roles evaluating and formulating financial regulations, having graduated from Yale Law School. She worked at George Mason University's Mercatus Center, a libertarian think tank, most recently before becoming commissioner, where she produced, among other things, critiques of legislation like the Dodd-Frank Act.

She, often known as "Crypto Mom," is a member of the Securities and Exchange Commission. She was born in Ohio and graduated from Yale Law School. Prior to joining the Securities and Exchange Commission, she worked in a variety of capacities evaluating and creating financial regulations. She worked at George Mason University's Mercatus Center, a libertarian-leaning think tank, most recently before becoming commissioner, where she produced, among other things, critiques of legislation like the Dodd-Frank Act.

As chairman Jay Clayton steps out and a Joe Biden nominee takes his place, Republican Peirce will find herself in the minority. Clayton, on the other hand, was not particularly forward-thinking when it came to digital assets. President Biden has declared his intention to select Gary Gensler, a crypto expert who would presumably be more prepared to deal with Peirce than Clayton was.

The SEC's approval of initial public offerings for crypto businesses like Coinbase, the first U.S.-authorized Bitcoin ETF, and, of course, the ICO safe harbour are all obvious targets for Peirce. We won't know what Peirce thinks about the SEC's pursuit of Ripple until after the fact, per SEC protocol, but the outcome of that case will almost certainly serve as a springboard for more clarity.

Peirce told guests at the Crypto Finance Conference in January that the future SEC chairman's priority should be supporting innovation and giving regulatory clarity: "We need to embrace innovation and figure out how to create a regulatory framework that encourages it, which, in our field, I believe means providing clarity."

EntrepreneurInvestorFinanceCrypto and Blockchain Expert

states that a good number of the memecoins in the market do not come under the purview of the country’s securities regulatory agency. What makes her statement extremely significant is that Peirce chairs the crypto task force recently appointed by US President Donald Trump

Donald Trump

Donald Trump is an American former president politician, businessman, and media personality, who served as the 45th president of the U.S. between 2017 to 2021. Trump earned a Bachelor of science in economics from the University of Pennsylvania in 1968. Trump won the 2016 presidential election as the Republican Party nominee against Democratic Party nominee Hillary Clinton while losing the popular vote. As president, Trump ordered a travel ban on citizens from several Muslim-majority countries, diverted military funding toward building a wall on the U.S.–Mexico border, and implemented a family separation policy. Trump has remained a prominent figure in the Republican Party and is considered a likely candidate for the 2024 presidential election

President

to determine which cryptocurrencies fall under the definition of ‘securities’ – thus under the jurisdiction of the SEC – and which do not.

SEC’s Stance on Memecoins

US SEC Commissioner Herster Peirce’s statement on the Memecoin regulatory environment explains what the current position of the securities regulatory agency on the matter is.

It appears that the current SEC leadership does not think it has the legal authority or responsibility to regulate a good number of the memecoins in the market.

Importantly, reports indicate that Peirce even thinks that the US Congress and the Commodity Futures Trading Commission are the competent authorities to address the sensitive matter of memecoin regulation.

Contrasting Views: Former SEC Chair Gensler’s Stance Analysed

Former SEC Chairman Gary Gensler was infamous for his conservative stance on crypto regulation. Under his leadership, the SEC maintained a position that a good number of cryptocurrencies are securities. It was this position that prompted the regulatory agency to open a series of legal battles against prominent crypto companies including Binance, Coinbase and Kraken.

The Memecoin Phenomenon: A Short Overview

The total market cap of the memecoin sector stands at $75,568,127,803 – which makes at least 2.31% of the total market cap of the cryptocurrency sector of $3,267,930,674,001.

As of now, Dogecoin, Shiba Inu, Pepe, Official Trump and Bonk are the top five memecoins by market cap.

The market cap of DOGE stands at $37,387,932,934; SHIB at $9,238,118,808; PEPE at $4,021,074,346; TRUMP at $3,080,509,036; and BONK at $1,345,093,611.

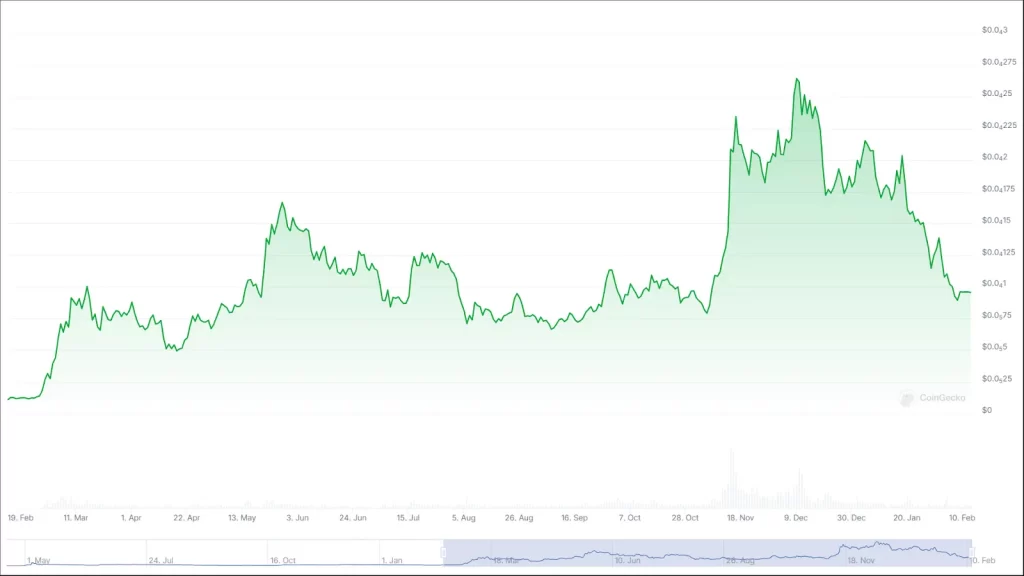

In the last one year, Dogecoin has surged by 214%; Shiba Inu by 68%; Pepe by 850%; and Bonk by 41.4%.

- Also Read :

- Big News: Novogratz Says Bitcoin Could Appear on U.S. Government Balance Sheets in Six Months

- ,

Memecoin Regulation: Concerns and Challenges

Critics express serious concerns about the memecoin market primarily because of its unregulated environment and extreme volatility.

In the last seven days, DOGE has dropped by 4.5%; SHIB by 2%; PEPE by 6.5%; TRUMP by 14.5%; and BONK by 6%.

Moreover, many believe that the market is highly susceptible to fraudulent projects and pump-and-dump schemes.

Recently, a memecoin investor filed a lawsuit with the support of Wolf Popper and Burwick, prominent US law firms, against Pump.Fun, a platform built on Solana to allow users to create and trade meme coins easily, accusing it of violating securities laws by offering extremely volatile memecoins.

In conclusion, Hester Peirce says ‘most memecoins are not securities’, a stance different from Gary Gensler’s. Meanwhile, the memecoin market keeps growing, but concerns over fraud and volatility remain. A new lawsuit against Pump.Fun adds to regulatory uncertainty as the debate over memecoin regulation continues.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.