The post MicroStrategy Buys 27,200 Bitcoin at $74,463, Time to Buy? appeared first on Coinpedia Fintech News

In this ongoing bull run, MicroStrategy (MSTR) the largest corporate holder of Bitcoin (BTC) has shown the world how it views BTC irrespective of its price. On November 11, 2024, the founder and chairman of MSTR, Michael Saylor, posted on X (formerly Twitter) that the firm had acquired a significant 27,200 BTC for $2.03 billion.

MicroStrategy’s Revised Bitcoin Holding

Saylor further noted that the average buying price of this substantial Bitcoin acquisition is $74,463, and it has achieved a BTC yield of 7.3% OTD and 26.4% YTD. With the recent acquisitions, MicroStrategy’s Bitcoin holdings have risen to 279,420 BTC, which it acquired for $11.9 billion, suggesting an average price of $42,692 per BTC.

MSTR Bitcoin Buying Strategy

One thing that traders and investors should know is that MicroStrategy bought this Bitcoin as the price broke its all-time high on November 6, 2024. This shows how industry leaders are buying and accumulating BTC as market sentiment turns bullish following the U.S. election results and strong price action.

With this massive acquisition by whales and investors, BTC prices have been continuously moving upward without any halt or price correction, which suggests a potentially bullish signal.

Current Price Momentum

At press time, Bitcoin is trading at $82,000 and has experienced a price gain of 2.7% over the past 24 hours. During the same period, its trading volume jumped by 37%, indicating heightened participation from traders and investors as prices continued to rise.

Bitcoin Technical Analysis and Rising Open Interest

According to expert technical analysis, Bitcoin appears bullish and could rally significantly in the coming days. However, with an impressive price surge of over 22% since election result day, there is a strong possibility of a price correction in the near future. As of now, BTC’s Relative Strength Index (RSI) is in the overbought territory, suggesting a potential price correction ahead.

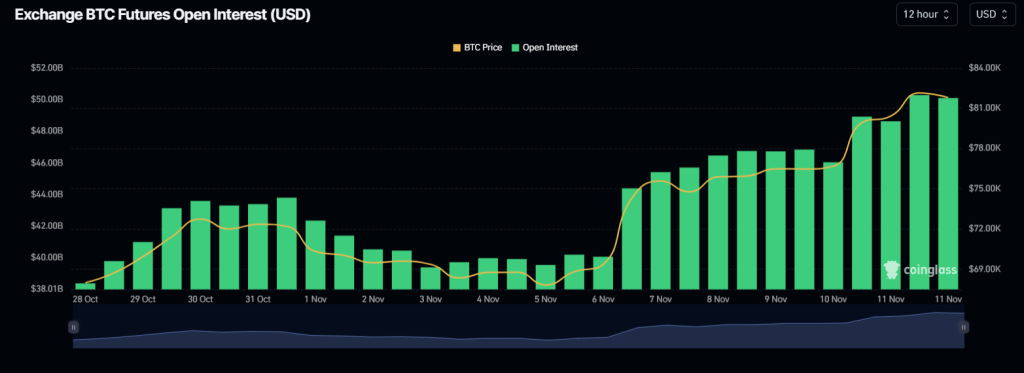

On-chain metrics further support the asset’s positive outlook. The on-chain analytics firm Coinglass suggests that, along with whales and investors, traders also appear bullish and have shown strong participation since November 6, 2024.

According to the data, BTC’s open interest soared by 3.5% over the past 24 hours.