The post MicroStrategy CEO Reveals Why Bitcoin Is Surging appeared first on Coinpedia Fintech News

Bitcoin’s price is climbing, and it’s no fluke. Michael Saylor, CEO of MicroStrategy, sees Bitcoin increasingly being recognized as “digital gold”—and Wall Street is paying attention. Major players like BlackRock are entering the Bitcoin space, and shifts in the U.S. Federal Reserve’s approach and upcoming regulations could spark even more interest.

What’s fueling this momentum? Let’s take a closer look

New Respect for Bitcoin

So, why is Bitcoin gaining traction now? Saylor explains that Bitcoin’s image has evolved—it’s no longer just another cryptocurrency. It’s becoming a respected asset class. BlackRock’s move, led by CEO Larry Fink with the launch of their Bitcoin ETF (IBIT), is a clear sign that big financial institutions see Bitcoin as more than a trend; they view it as a genuine investment.

Top 3 Drivers of Bitcoin’s Price Surge

Saylor identifies three main reasons behind Bitcoin’s recent price rally:

- Federal Reserve Rate Shifts: With the Fed hinting at rate cuts, Bitcoin is attracting attention as a solid alternative investment. Lower interest rates often make assets like Bitcoin more appealing.

- Big Banks Offering Bitcoin Custody: Major banks are stepping up to provide Bitcoin custody services, which makes it easier and safer for investors to hold BTC.

- SEC Approves Spot Bitcoin ETFs: The recent approval of spot Bitcoin ETFs by the SEC allows institutions to invest in Bitcoin with fewer complications, making it more accessible for large investors.

MicroStrategy’s All-In Strategy

MicroStrategy has turned the full Bitcoin mode on. Saylor’s company is planning to raise $42 billion over the next three years to buy more BTC. Talk about being committed! Their stock has already seen a massive jump this year, up over 235% and trading close to $230. Some analysts even bumped their price targets, with Canaccord saying $300 isn’t off the table. This shows that MicroStrategy sees itself as a bridge for big investors wanting a piece of the Bitcoin action.

Election 2024: A Turning Point for Crypto?

Now, what could come next? The 2024 U.S. presidential elections might shake things up for crypto. Saylor believes clearer rules could come out of it, making Bitcoin more accessible. Some candidates, like Donald Trump and Senator Cynthia Lummis, have even talked about Bitcoin being part of a strategic reserve for the U.S. That’s not just talk—it’s a sign that Bitcoin might become even more mainstream.

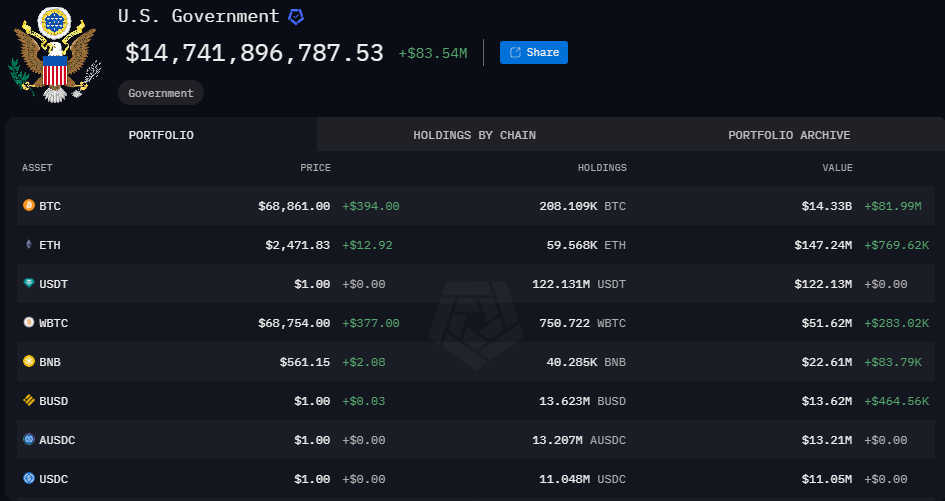

And here’s a fun fact: the U.S. government holds a chunk of Bitcoin it seized and didn’t sell. To Saylor, that’s a sign they see value in it long term. He believes Bitcoin’s market cap could jump from $1 trillion to $10 trillion and even higher one day.

While Saylor is bullish on Bitcoin, he’s cautious about other cryptocurrencies. He believes Bitcoin is the only digital asset with clear recognition as a commodity. In his view, meme coins and even Ethereum lack the regulatory clarity and stability that make Bitcoin unique.

- Also Read :

- MicroStrategy’s Bold Bitcoin Strategy: Analysts Raise Price Targets Amid Strong Market Outlook

- ,

What’s Next for Bitcoin?

With Wall Street’s fresh interest and the 2024 elections on the horizon, Bitcoin’s future looks promising. MicroStrategy’s dedication signals strong confidence in Bitcoin’s growth.

Bitcoin’s journey has just begun. Buckle up for the ride.