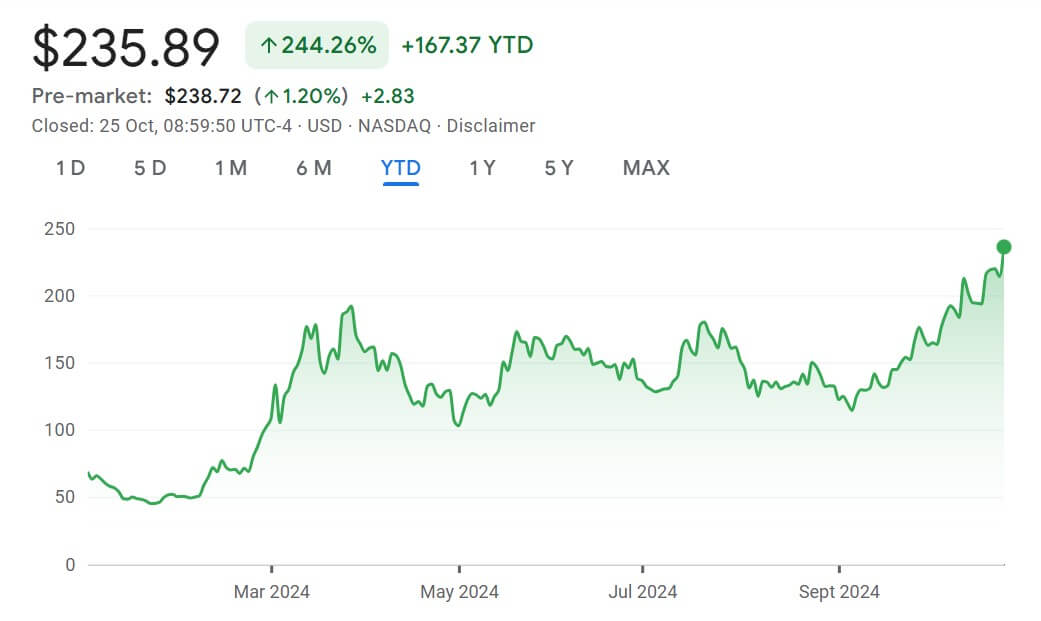

MicroStrategy’s (MSTR) stock has reached a new 25-year peak amid Bitcoin’s potential climb towards the $70,000 mark.

Google Finance data reveals that MicroStrategy’s stock, bolstered by its significant Bitcoin holdings, has shown consistent upward momentum throughout the year. As of press time, MSTR has soared by 244% year-to-date and climbed 55% over the past month, reaching $235.89 as of the market close on Oct. 24.

This impressive stock performance aligns with Bitcoin’s recent rally. The top digital asset has gained 6% over the past month and edges closer to the $70,000 mark amid increasing institutional interest in the premier asset.

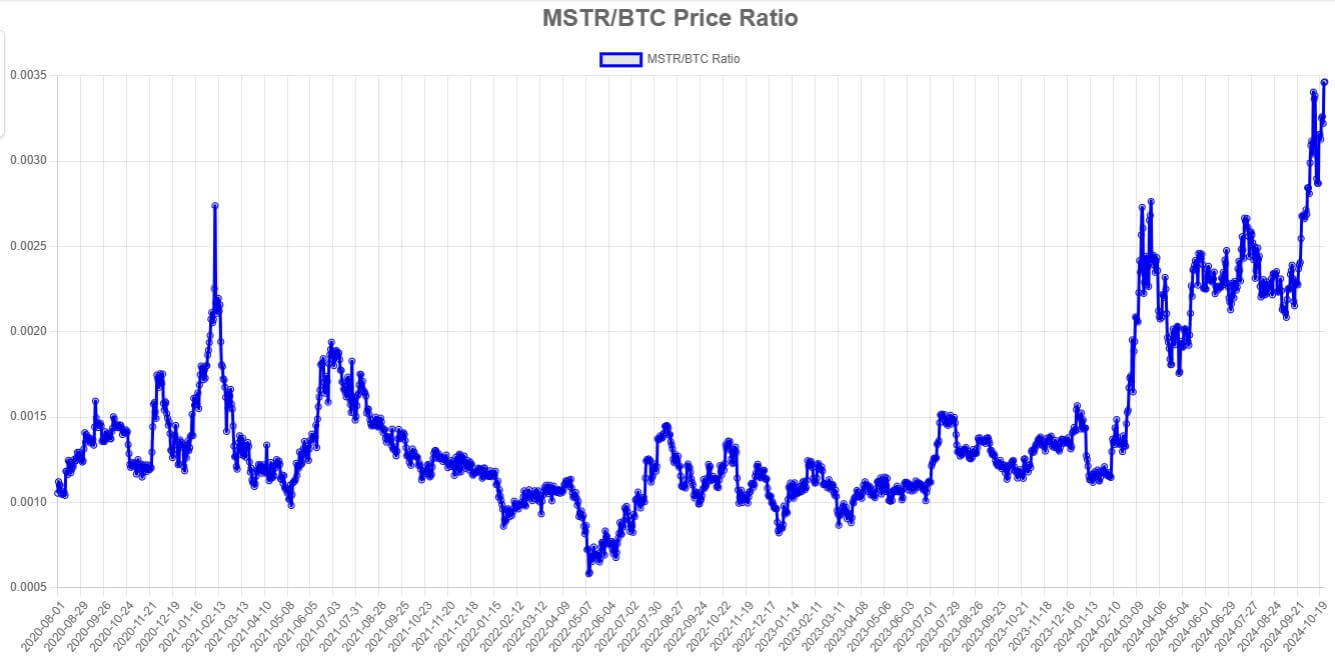

Data from the MSTR tracker unsurprisingly highlights that two key metrics have risen in tandem with these price rallies. The “MSTR/BTC Ratio” chart, which compares MicroStrategy’s stock value with Bitcoin’s price, hit an all-time high of 0.00346. This marks a higher level than during Bitcoin’s 2021 bull run.

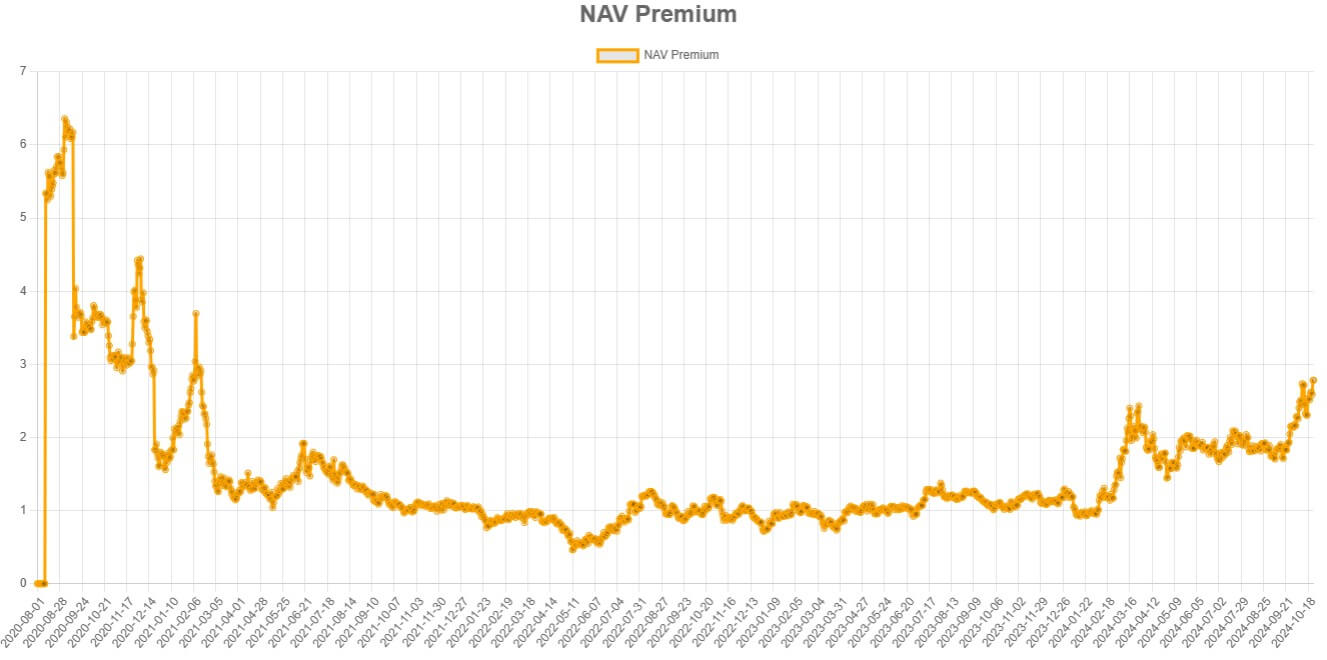

Likewise, the “NAV Premium” chart shows that MicroStrategy’s stock is currently trading at its highest premium over its Bitcoin holdings in three years. This premium suggests the market values the company’s stock at 2.783 times its Bitcoin-equivalent net asset value.

The post MicroStrategy stock to BTC ratio hits all-time high, surpassing 2021 bull run appeared first on CryptoSlate.