Quick Take

As the digital assets market continues to evolve, two prominent US-based companies have taken vastly different approaches to their Bitcoin investments, with starkly diverging outcomes.

MicroStrategy, a business intelligence firm, made its first Bitcoin purchase in August 2020 when the asset was trading at around $10,000. Since then, the company has steadily accumulated Bitcoin, now holding over 1% of the total supply. In contrast, electric vehicle maker Tesla entered the market slightly later, buying Bitcoin in January 2021, near the 2021 market frenzy.

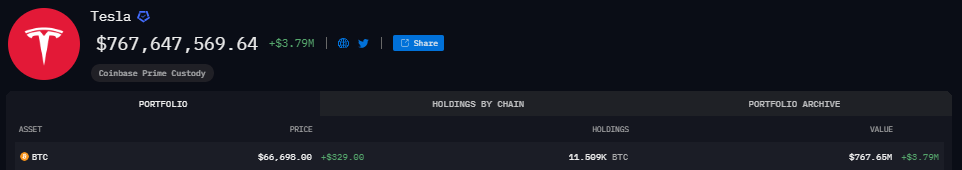

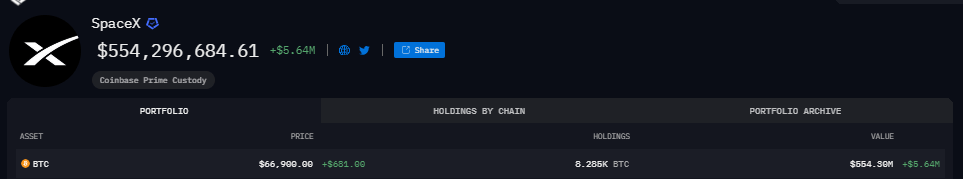

Based on data from Arkham Intelligence, Tesla currently possesses approximately 11,509 Bitcoin valued at approximately $767.6 million, while SpaceX holds around 8,285 Bitcoin valued at approximately $554.3 million. Together, their combined Bitcoin holdings total nearly 19,794 coins, with an approximate market value of around $1.3 billion based on current market prices.

In 2021, Tesla bought $1.5 billion worth of Bitcoin, likely to be around 38,900 BTC, but sold a substantial portion in 2022. Had Musk held until now it could have been worth around $2.6 billion.

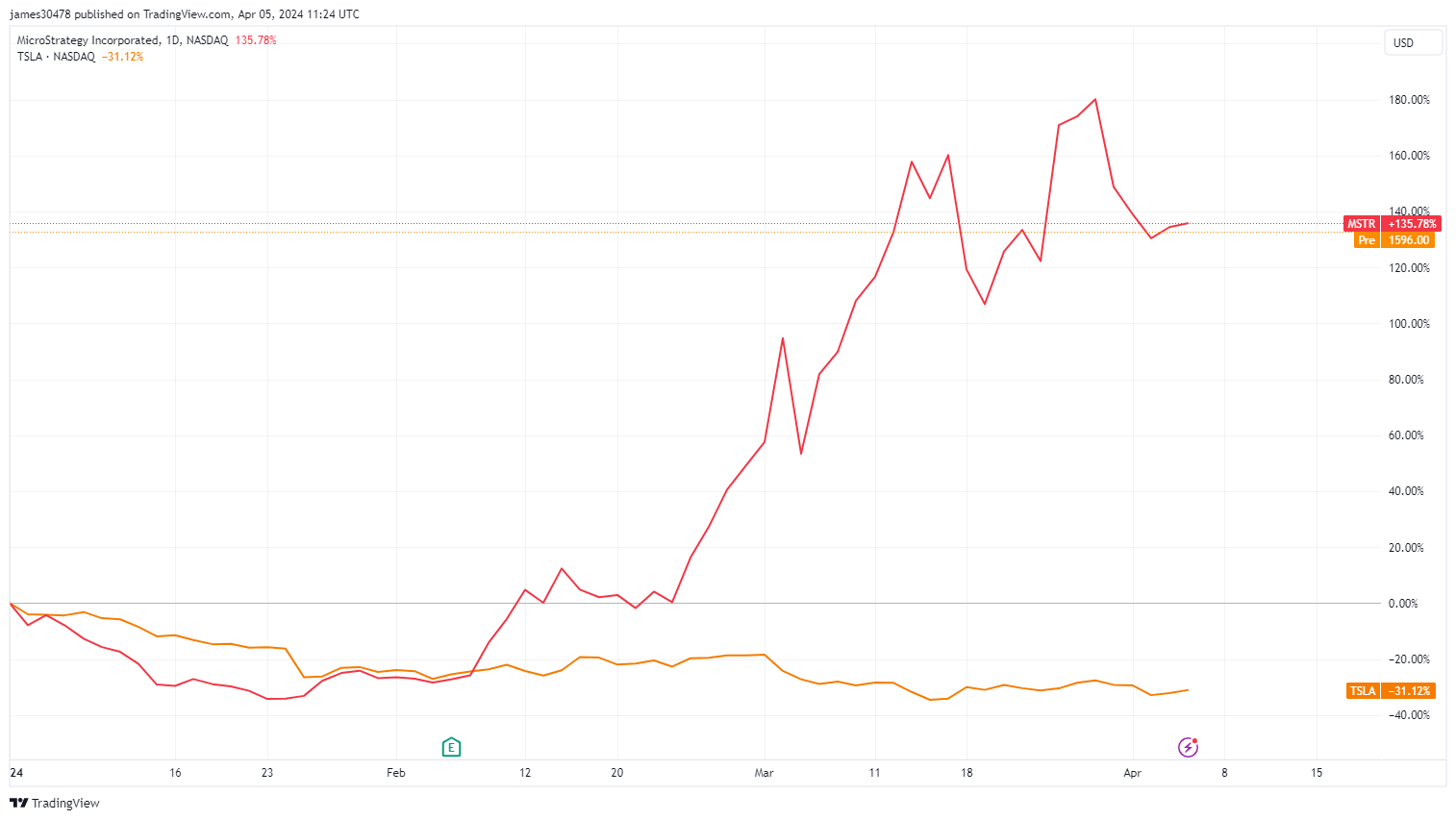

The diverging trajectories of these two companies are reflected in their stock performance. MicroStrategy has seen a remarkable surge of over 1200% since its initial Bitcoin investment, whereas Tesla’s shares have faltered, declining by 31% year-to-date. Consequently, MicroStrategy has ascended the market capitalization leaderboard, while Tesla has descended to the 18th largest asset by market capitalization.

The post MicroStrategy thrives on Bitcoin strategy while Tesla left over $1 billion on table as stock slips appeared first on CryptoSlate.